Bridges® by EPOCH at Nashua

Bridges® by EPOCH at Nashua is a Memory Care Home in New Hampshire

Bridges® by EPOCH at… is a Memory Care Home in New Hampshire

Bridges® by EPOCH at Nashua

Bridges® by EPOCH at Nashua is a Memory Care Home in New Hampshire

Bridges® by EPOCH at… is a Memory Care Home in New Hampshire

Bridges by EPOCH at Nashua is a captivating sanctuary thoughtfully designed for individuals with memory impairment. Their unwavering commitment to Alzheimer’s and other dementia-related conditions sets them apart, as they possess a profound understanding of the intricate challenges of memory care. Nestled within the grounds are lush gardens and meandering walking paths, offering a serene escape where nature’s beauty intertwines with residents’ well-being. Compassionate caregivers are well-versed in delivering personalized care, placing the individual at the heart of their attention.

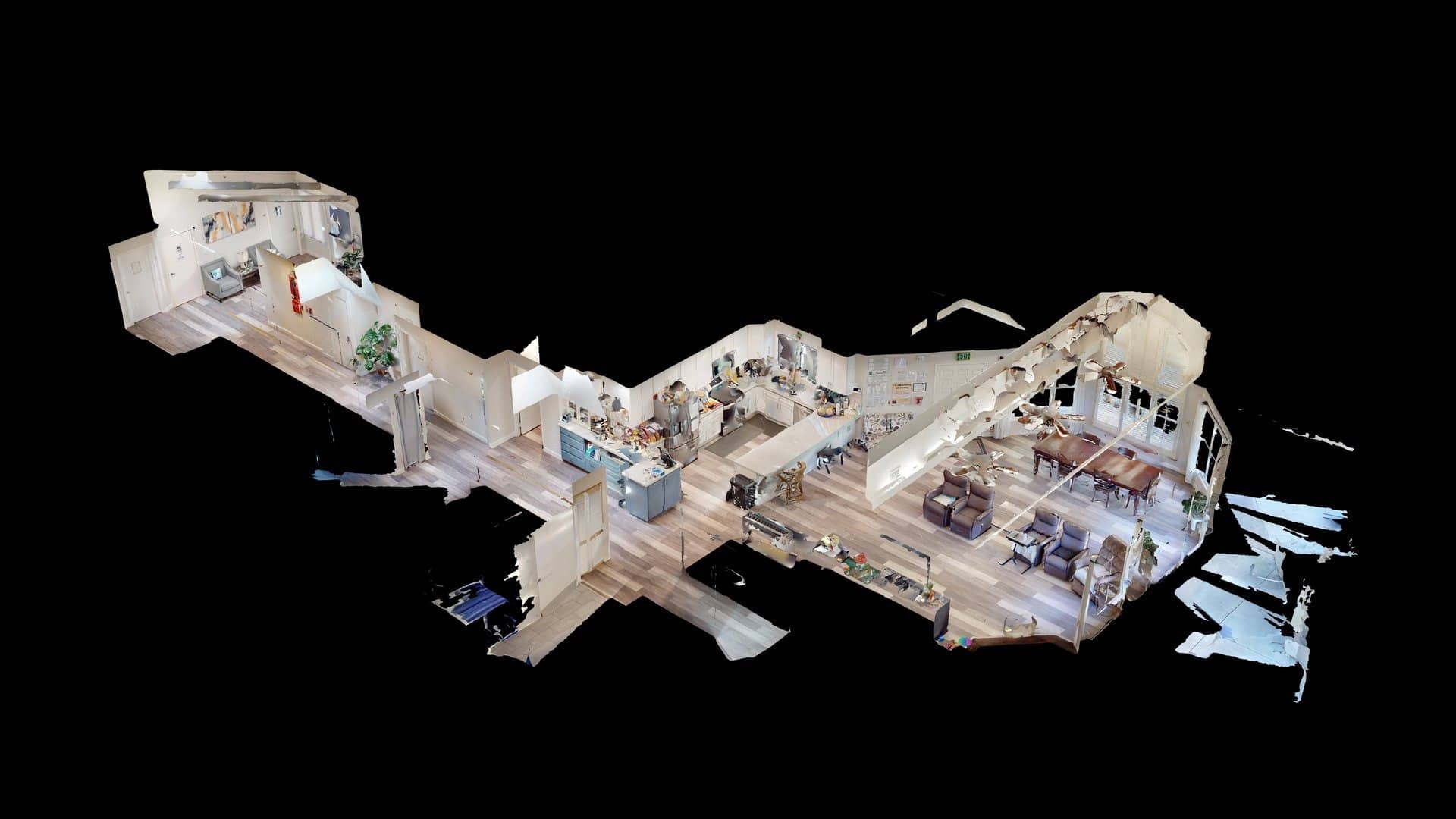

From inviting activity areas that ignite joy to a cozy living room that invites relaxation, every corner emanates warmth and tranquility. A serene library beckons residents to embark on literary journeys, while the charming dining room and country kitchen awaken the senses. The facility boasts full wheelchair accessibility, allowing for seamless mobility. The game room and arts and crafts center serve as hubs of creativity and self-expression, inviting individuals to unleash their imaginations. Modern amenities such as Wi-Fi and high-speed internet keep residents connected to the world, and the community extends its hospitality to furry companions, recognizing their role as beloved members of the family.

Michelle Pelham is the Executive Director at Bridges® by EPOCH at Nashua, bringing extensive leadership experience in assisted living and memory care. She oversees community operations and leads the team to deliver compassionate care, hospitality, and enriching programs. Michelle is dedicated to fostering a positive culture that provides seniors with memory loss a safe, loving, and understanding home.

Capacity and availability

Smaller home

May offer a more intimate, personalized care environment.

About this community

Additional licensing details

Ownership & operating entity

Bridges® by EPOCH at Nashua is administrated by MICHELLE PELHAM.

What does this home offer?

Housing Options: Private / Companion Suite

Building Type: Single-story

Types of Care at Bridges® by EPOCH at Nashua

Comparison Chart

The information below is reported by the New Hampshire Department of Health and Human Services, Health Facilities Administration.Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Respite Care

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Respite Care

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Nursing Homes 24/7 care needed

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Places of interest near Bridges® by EPOCH at Nashua

4.3 miles from city center

575 Amherst St, Nashua, NH 03063

Calculate Travel Distance to Bridges® by EPOCH at Nashua

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Claim What’s Yours: Financial Aid for New Hampshire Seniors

- General: Age 65+ or disabled, New Hampshire resident, Medicaid-eligible, nursing home-level care need.

- Income Limits (2025): ~$2,829/month (300% FBR, individual).

- Asset Limits: $2,000 (individual), $3,000 (couple).

- NH Specifics: Small state; rural access emphasis.

- Services: Personal care (5-7 hours/day), respite (240 hours/year), adult day care (~$65/day), home aides.

- General: Age 60+, New Hampshire resident, or caregiver.

- Income Limits: No strict limit; prioritizes low-income.

- Asset Limits: Not applicable.

- NH Specifics: Primarily referral-based; limited direct funding.

- Services: Care coordination, respite (up to 5 days/year), transportation (~5 trips/month).

- General: Age 65+, NH resident, US citizen/eligible alien, not in public institution.

- Income Limits (2025): ~$1,063/month (individual, net after deductions); varies by living arrangement.

- Asset Limits: $1,500 (individual), $2,000 (couple).

- NH Specifics: Automatic Medicaid eligibility; estate recovery applies.

- Services: Cash (~$50-$200/month) for living costs (e.g., rent, utilities, care support).

- General: Caregivers of 60+ needing care or 55+ caregivers of others; NH resident; functional needs (2+ ADLs).

- Income Limits (2025): Prioritizes ~$24,980/year (individual); no strict cap.

- Asset Limits: Not assessed; need-based.

- NH Specifics: 13 ServiceLink locations; rural/low-income priority.

- Services: Respite (4-6 hours/week or 5 days/year), adult day care ($60/day), training, supplies (~$500/year).

- General: Age 65+ or disabled, NH resident, Medicare Part A/B.

- Income Limits (2025): ~$2,510/month (QMB), ~$3,380/month (SLMB), ~$3,598/month (QI)—individual.

- Asset Limits: $9,430 (individual), $14,130 (couple).

- NH Specifics: Three tiers; no waitlist; includes Extra Help for Part D.

- Services: Covers Part B premiums ($174.70/month), deductibles ($240/year), copays (~20%).

- General: Age 60+ prioritized, NH resident, low-income household.

- Income Limits (2025): ~$33,614/year (1-person), ~$43,958/year (2-person) (150% FPL).

- Asset Limits: Not assessed; income-focused.

- NH Specifics: Administered by 5 CAP agencies; covers oil, gas, electric, wood.

- Services: Heating aid ($300-$1,200/season), weatherization, emergency fuel ($450 max).

- General: Age 55+, unemployed, low-income, NH resident.

- Income Limits (2025): ~$1,983/month (125% FPL).

- Asset Limits: Not specified; income-focused.

- NH Specifics: Priority for veterans, rural residents; AARP partnership.

- Services: Paid training (~20 hours/week at ~$7.25/hour), job placement.

- General: Age 65+ or disabled veteran/spouse, NH resident, wartime service, need for ADL help (A&A) or homebound.

- Income Limits (2025): Net income < ~$1,984/month (veteran with dependent, A&A); pension offsets income.

- Asset Limits: ~$155,356 (net worth limit).

- NH Specifics: High veteran demand in rural/urban areas.

- Services: Cash (~$1,433-$2,642/month veteran, ~$951-$1,318 spouse) for care costs (e.g., in-home, assisted living).

- General: Age 65+ prioritized, NH resident, homeowner, paid property taxes.

- Income Limits (2025): ~$47,000/year (individual), ~$60,000/year (couple).

- Asset Limits: Not assessed; home value cap at $750,000.

- NH Specifics: Refundable relief (~$100-$500/year); annual application.

- Services: Tax relief (~$100-$500/year) to offset housing costs, indirectly aiding care funding.

Contact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

More homes from the same owner

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.