Oklahoma Palliative & Hospice Care

Oklahoma Palliative & Hospice Care

Oklahoma Palliative & Hospice Care is a hospice and palliative care provider that believes that every person deserves to live with dignity and comfort. It is a community-based organization founded on Christian principles, and it serves patients of all faiths and backgrounds in Oklahoma. They specialize in home-based care, so patients can stay in the familiar surroundings of their own homes, surrounded by loved ones. It also provides most equipment and supplies related to the hospice diagnosis at no charge, to ease the financial burden.

Their professional care team includes doctors, nurses, social workers, chaplains, and volunteers, who work together to provide patients with expert pain management and comprehensive support for their physical, emotional, and spiritual well-being. Oklahoma Palliative & Hospice Care is a family of compassionate caregivers who are dedicated to making every moment meaningful for patients and their loved ones. They’re here to help senior residents cope with life’s most challenging moments, and to bring them comfort and peace.

Types of Care at Oklahoma Palliative & Hospice Care

Compare Senior Communities around Oklahoma

The information below is reported by the Oklahoma State Department of Health, Protective Health Services.Places of interest near Oklahoma Palliative & Hospice Care

11.2 miles from city center — 1.97 miles to nearest hospital (Variety Care Straka Terrace)

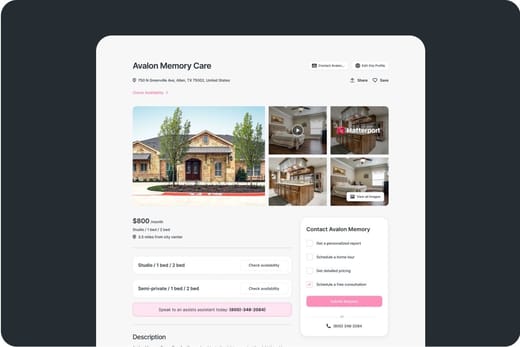

908 SW 107th St. Oklahoma City, OK 73170

Calculate Travel Distance to Oklahoma Palliative & Hospice Care

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Financial Aid for Oklahoma Seniors

Get financial aid guidanceContact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

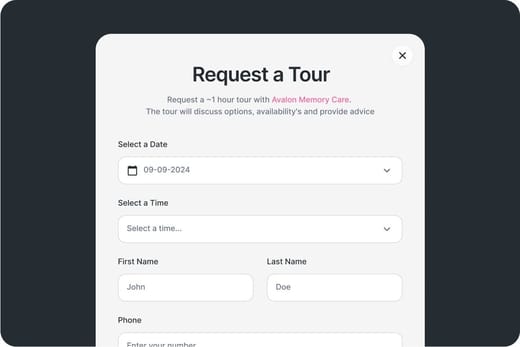

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.