Chapel Hill

Chapel Hill is an Assisted Living Home in Rhode Island

Chapel Hill is an Assisted Living Home in Rhode Island

Chapel Hill

Chapel Hill is an Assisted Living Home in Rhode Island

Chapel Hill is an Assisted Living Home in Rhode Island

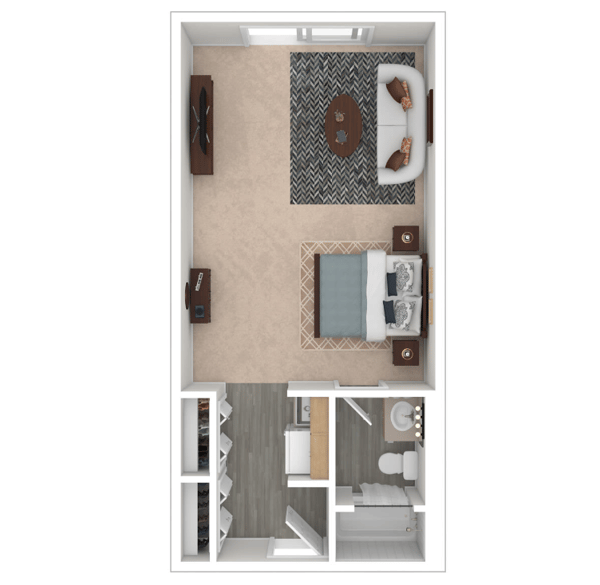

An outstanding senior living community set in the peaceful neighborhood of Old Diamond Hill Road, Cumberland, RI, Chapel Hill Senior Living offers assisted living, memory care, and short-term stays. Enjoy your golden years in comfort and elegance in a wide array of studio, and one-bedroom floor plans. Seniors ease their worries and live their lives to the fullest with exceptional care and support from a team of experienced and highly qualified professionals.

Interact with people with the same interests and cherish personal time with energizing programs and exciting events. Committed to enhancing residents’ well-being, the community serves healthy and tasty meals satisfying nutritional needs and tastes. With its scenic landscapes and fabulous amenities, Chapel Hill Senior Living is a great place for a blissful retirement.

Capacity and availability

Medium-capacity home

Offers a balance of services and community atmosphere.

About this community

Additional licensing details

Ownership & operating entity

Chapel Hill is legally operated by ERIC TERCEIRO, ADMINISTRATOR.

Type Of Units

What does this home offer?

Pets Allowed: Yes, Pets Allowed

Room Sizes: 406 / 477 / 518 / 632 sq. ft

Housing Options: Studio / 1 Bed

Building Type: 3-story

Transportation Services

Fitness and Recreation

Types of Care at Chapel Hill

Comparison Chart

The information below is reported by the Rhode Island Department of Health, Center for Health Facilities Regulation.Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Nursing Home 24/7 care needed

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Places of interest near Chapel Hill

1.9 miles from city center

10 Old Diamond Hill Rd, Cumberland, RI 02864

Calculate Travel Distance to Chapel Hill

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Claim What’s Yours: Financial Aid for Rhode Island Seniors

- General: Age 65+ or disabled, Rhode Island resident, Medicaid-eligible, nursing home-level care need.

- Income Limits (2025): ~$2,829/month (300% FBR, individual).

- Asset Limits: $4,000 (individual, higher than most states).

- RI Specifics: Higher asset limit; small state aids quicker processing.

- Services: Personal care (5-7 hours/day), respite (240 hours/year), adult day care ($65/day), home modifications ($1,500 avg.).

- General: Caregiver of someone 60+ (or with dementia), Rhode Island resident.

- Income Limits: No strict limit; prioritizes low-income.

- Asset Limits: Not applicable.

- RI Specifics: Limited slots; urban focus due to small size.

- Services: In-home respite (4-6 hours/day), adult day care (~$65/day), short-term facility care (up to 5 days).

- General: Age 55+, RI resident (specific counties), NFLOC, safe with PACE support.

- Income Limits (2025): ~$2,829/month (Medicaid-eligible); private pay option available.

- Asset Limits: $4,000 (individual), $6,000 (couple) for Medicaid enrollees.

- RI Specifics: Operated by PACE Organization of Rhode Island; covers 4 counties (Providence, Kent, Washington, Newport).

- Services: Personal care (5-7 hours/day), medical care, meals, transportation, respite, therapies.

- General: Age 65+, RI resident, need help with 1+ ADL/IADL, not Medicaid-eligible.

- Income Limits (2025): ~$1,255-$2,829/month (100%-300% FPL); sliding scale fees.

- Asset Limits: Not strictly assessed; focus on income/need.

- RI Specifics: Administered by Division of Elderly Affairs (DEA); complements Medicaid.

- Services: Personal care (4-6 hours/week), homemaker services, respite (~5 days/year), transportation.

- General: Age 65+ (or disabled), RI resident, SSI-eligible, living in approved AL facility.

- Income Limits (2025): $943/month (SSI federal rate) + state supplement ($332/month).

- Asset Limits: $2,000 (individual), $3,000 (couple).

- RI Specifics: Supplement increases to ~$1,275/month total for AL residents; ~50 facilities participate.

- Services: Financial aid (~$332/month extra) for AL costs (personal care, meals, activities).

- General: Age 65+ or disabled, RI resident, Medicare Part A/B.

- Income Limits (2025): ~$2,510/month (QMB), ~$3,380/month (SLMB), ~$3,598/month (QI)—individual.

- Asset Limits: $9,430 (individual), $14,130 (couple).

- RI Specifics: Three tiers; includes Extra Help for Part D; no waitlist.

- Services: Covers Part B premiums ($174.70/month), deductibles ($240/year), copays (~20%).

- General: Age 60+ prioritized, RI resident, low-income household.

- Income Limits (2025): ~$3,970/month (individual, 185% FPL).

- Asset Limits: Not assessed; income-focused.

- RI Specifics: Covers gas, electric, oil; emergency aid available.

- Services: Heating/cooling aid ($300-$1,000/season), emergency aid ($500 max).

- General: Age 65+ or disabled veteran/spouse, RI resident, wartime service, need for ADL help (A&A) or homebound.

- Income Limits (2025): Net income < ~$1,984/month (veteran with dependent, A&A); pension offsets income.

- Asset Limits: ~$155,356 (net worth limit).

- RI Specifics: High veteran demand; supports rural/urban care needs.

- Services: Cash (~$1,433-$2,642/month veteran, ~$951-$1,318 spouse) for care costs (e.g., in-home, assisted living).

- General: Age 60+, RI resident, low-income.

- Income Limits (2025): ~$2,322/month (individual, 185% FPL).

- Asset Limits: Not assessed.

- RI Specifics: Vouchers (~$50/season); serves ~10,000 annually.

- Services: Vouchers (~$50/season) for fresh produce at approved markets.

- General: Age 65+ (or disabled), RI resident, homeowner/renter, low-income.

- Income Limits (2025): ~$35,000/year (household).

- Asset Limits: Not assessed; income-focused.

- RI Specifics: Credit up to $400; local exemptions vary by municipality.

- Services: Tax credit (~$100-$400/year avg., depending on income).

Contact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.