Alliance Homecare – New York

Alliance Homecare, set in New York, New York, is the premier option for in-home care, adhering to its philosophy of caring for clients as if they’re family. For over 15 years, they have provided New York Families with exceptional care through their services. They understand the need of families to have their loved ones cared for in the comfort of their homes, and Alliance Homecare ensures their needs are gracefully and ethically met.

Featured in Assisted Living Magazine, they have selected only the best home health aides to care for their clients and have maintained a standard of trust among them. These caregivers joyfully make the lives of their clients more convenient by providing the attention and support they need and deserve. From helping with daily living to bathing and feeding, families can trust that their loved ones are in capable hands. Moreover, they provide specialized support for older adults experiencing Dementia and Alzheimer’s or those going through Parkinson’s. Rest assured that your loved one is safe in the company of compassionate experts.

Guides for Better Senior Living

From costs to care, explore the most important topics to make informed decisions about your future.

Where will you be?

2 W 45th St 7th Floor, New York, NY 10036

2 W 45th St 7th Floor, New York, NY 10036

Calculate Travel Distance to Alliance Homecare – New York

Add your location

Curious about the neighborhood? Explore Street View

Step Inside – Explore Our Community in 3D

Claim What’s Yours: Financial Aid for New York Seniors

- General: Age 65+ or disabled, New York resident, Medicaid- eligible, care need (not necessarily nursing home level).

- Income Limits (2025): ~$2,829/month (300% FBR, individual).

- Asset Limits: $30,182 (individual, higher due to NY Medicaid expansion).

- NY Specifics: Higher asset limit; urban density increases demand.

- Services: Personal care (5-7 hours/day), respite care (240 hours/year), home modifications ($1,500 avg.), assistive technology ($500 avg.).

- General: Age 60+, New York resident, at risk of decline but not nursing home level.

- Income Limits: ~$2,500/month (individual, varies).

- Asset Limits: $15,000 (individual).

- NY Specifics: Cost-sharing required above certain income; urban/rural balance.

- Services: In-home care (3-5 hours/week), respite (up to 10 days/year), case management, transportation (~5 trips/month).

- General: Age 62+, NYC resident, live in rent-controlled/stabilized apartment, spend >1/3 of income on rent.

- Income Limits (2025): $50,000/year (household).

- Asset Limits: No strict asset cap, but income-focused eligibility.

- NY Specifics: Limited to NYC’s rent-regulated units; high demand in urban areas.

- Services: Rent freeze (e.g., covers increases of $50-$200+/month); tax credit for landlord.

- General: Age 65+, NYC resident, own and live in a 1-3 family home, co-op, or condo.

- Income Limits (2025): $58,399/year (household).

- Asset Limits: No strict asset cap, income-driven eligibility.

- NY Specifics: Applies only in NYC; excludes large apartment buildings.

- Services: Property tax reduction (5-50%, e.g., $500-$5,000/year based on income and property value).

- General: One participant must be 60+ (host or guest), NYC resident, able to share living space.

- Income Limits: No strict limit, but targets those needing cost relief.

- Asset Limits: Not applicable; focus on housing need.

- NY Specifics: Primarily NYC-focused; limited slots due to demand.

- Services: Shared housing (reduces rent/living costs by 30-50%, e.g., $500-$1,000/month savings); optional light assistance between housemates.

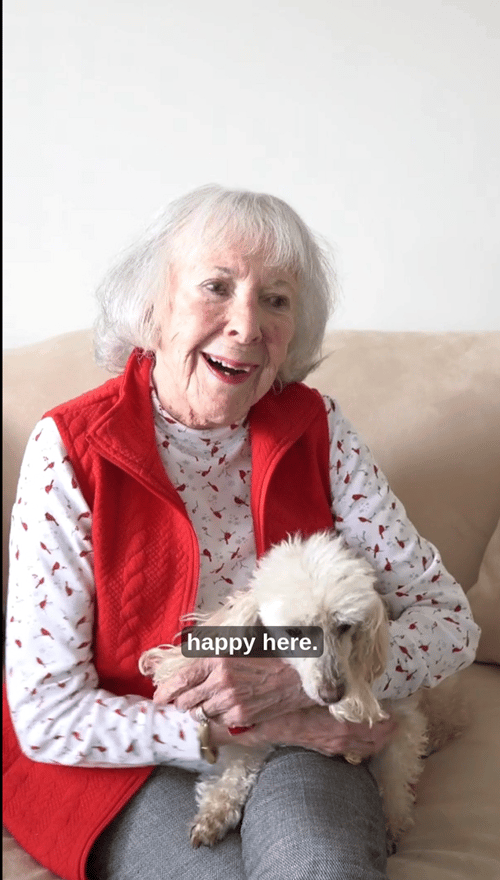

Meet the Neighbors

Hear real stories from seniors who already live in our communities. Discover what life is like straight from their own voices.

Let’s Play Bingo!

Join our live online bingo from the comfort of your home.

Meet friends, have fun, and win big – the game never stops!

Let’s Play – Live Bingo Awaits!

Games starting all day long!

Contact Us

Please Select Time

Beds shows the number of beds currently filled in each community agianst the total number of beds. Higher occupied beds usually indicates strong demand and reputation, while lower occupancy may suggest more availability for new residents.

Community |

City |

Occupancy |

Beds |

Medicaid Nights |

Medicare Nights |

Free Market Nights |

Home Revenue |

Payroll Costs |

Home Costs |

Owner |

CCN |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 150 RIVERSIDE OP LLC | NEW YORK CITY | 93.9% | 520 | 36276 | 121761 | 16184 | $116,000,000.00 | $24,236,374.00 | $58,054,161.00 | 150 RIVERSIDE MANAGEMENT GROUP LLC | 335334 |

| AMSTERDAM NURSING HOME CORP. | NEW YORK CITY | 96.9% | 409 | 30501 | 83248 | 31401 | $76,008,552.00 | $20,103,570.00 | $43,417,788.00 | FENSTER, JUDITH | 335570 |

| FORT TRYON REHAB AND HC FACILITY | NEW YORK CITY | 96.2% | 205 | 5423 | 63873 | 3473 | $28,644,028.00 | $8,648,640.00 | $24,229,082.00 | NAKDIMEN, SHELLY | 335257 |

| GOUVERNEUR HEALTHCARE CENTER | NEW YORK CITY | 97.0% | 295 | 8944 | 50802 | 43345 | $98,322,328.00 | $28,670,015.00 | $49,686,626.00 | 335461 | |

| HARLEM CENTER FO NURSING & REHAB | NEW YORK CITY | 97.6% | 200 | 16996 | 42655 | 10160 | $42,808,139.00 | $11,260,010.00 | $25,197,640.00 | LANDAU, JOEL | 335522 |

| ISABELLA GERIATRIC CENTER | NEW YORK CITY | 96.9% | 705 | 17680 | 135196 | 75627 | $89,598,303.00 | $38,035,001.00 | $71,418,334.00 | BALKO, ALEXANDER | 335100 |

| MARY MANNING WALSH NURSING HOME | NEW YORK CITY | 94.1% | 360 | 38991 | 52447 | 29416 | $130,000,000.00 | $21,096,522.00 | $46,451,039.00 | CATHOLIC HEALTHCARE SYSTEMS | 335050 |

| NEW EASTSIDE NURSING HOME | NEW YORK CITY | 95.5% | 58 | 3209 | 13996 | 2590 | $10,183,234.00 | $4,164,893.00 | $3,495,847.00 | KNOLL, DEVORA | 335517 |

| NORTHERN MANHATTAN NURSING HOME | NEW YORK CITY | 96.2% | 320 | 11976 | 76456 | 25063 | $59,360,273.00 | $15,076,362.00 | $27,366,157.00 | HURWITZ, BARBARA | 335792 |

| ST. MARYS CENTER INC. | NEW YORK CITY | 77.5% | OKWODU, JOHN | 335762 |

Want to See More Data?

Access the full set of official government statistics on nursing homes by using the link below.

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

Frequently Asked Questions

Several government programs offer financial assistance for senior housing in various countries, focusing on the United States for a broad overview:

- Medicaid: Medicaid is a state and federally funded program that can cover the costs of nursing home care for those who meet eligibility criteria, including income and asset limits. Some states also offer Medicaid waivers that help pay for home and community-based services to prevent or delay nursing home placement.

- Medicare: Medicare, primarily a health insurance program for people aged 65 and over, does not cover long-term housing costs. However, it can cover short-term stays in a skilled nursing facility under specific conditions following a hospital stay.

- Section 202 Supportive Housing for the Elderly Program: This program provides housing for low-income seniors. It offers rental assistance and access to supportive services, such as cleaning, cooking, and transportation.

- Low-Income Housing Tax Credit (LIHTC) Properties: While not a direct subsidy, LIHTC encourages developers to create affordable housing. Seniors with low incomes can find reduced-rent apartments through this program.

- State and Local Programs: Many states, counties, and cities offer their own programs to assist seniors with housing costs. These can include property tax relief programs, rental assistance programs, and programs that offer affordable senior housing options.

- Veterans Affairs (VA): The VA offers several programs for veterans, including the Aid and Attendance benefit, which provides monthly payments to veterans who require the aid of another person, or are housebound, to help cover the cost of care in homes, nursing homes, and assisted living facilities.

- Social Security: While Social Security primarily provides retirement income, for many seniors, these benefits are a crucial part of their budget, including housing costs.

Before recommending homes, we conduct a thorough evaluation on crucial factors that define a senior home such as the quality of care they provide, the reputation of the organization, and a comprehensive review of community testimonials as well. Every detail is assessed to assure that seniors are offered not just senior care options, but trustworthy homes where they can experience the care that they deserve.

Yes. Assisting families who need Medicaid is important to us as it plays a crucial role in offering financial support to seniors confronting economic challenges. We would like to keep essential healthcare services accessible to all community members, irrespective of one’s financial circumstances.

We extend our services at no cost, ensuring that families and seniors can benefit from tailored assistance in their search for care and home options. Our ability to offer personalized guidance without charge to families and seniors is made possible through the support and funding from the communities with which we team up.

- Finding and ranking the best assisted living facilities

- Finding and ranking the best nursing homes

- Finding and ranking the best memory care facilities

- Our concierge service helps seniors move into the perfect home for them

- Helping seniors use medicare, medicaid, and other government programs to pay for their homes

- Helping seniors avoid senior homes that have bad service or fraud

- Helping seniors avoid senior homes that have bad service or fraud

- Autobiography & Family History Writing + Research

- Senior-focused concierge medicine

- Senior-focused nutritionist

- Senior-focused personal training

- Memory care specialists

- Custom wheelchairs at all price points.

- Custom hearing aids

- Cosmetic skincare + dermatology

- Companionship: We offer in-person and virtual companionship services. Someone engaging to hang out with or talk to on video chat.

- Senior housing concierge. Our service finds the best senior living options based on your needs, income, and personality.

Check out our resident interviews

Check out our cost guide.