Clayton Oaks Living

Clayton Oaks Living is an Assisted Living Home in Texas

Clayton Oaks Living is an Assisted Living Home in Texas

Clayton Oaks Living

Clayton Oaks Living is an Assisted Living Home in Texas

Clayton Oaks Living is an Assisted Living Home in Texas

Settled in Fort Bend County, Sugar Land, Texas, Clayton Oaks Living is a welcoming senior living community that offers assisted living, short-term respite care, and memory care services. Residents here are well-cared for in the comfort of their snug and spacious accommodations with round-the-clock care provided by a dedicated caregiver. Emergency response call systems are installed in every apartment to keep residents in touch with caregivers at all times for immediate response during needs and emergencies.

At Clayton Oaks Living, every day brings new opportunities to engage in fun and meaningful activities that provide a sense of purpose and fulfillment. Residents are free to participate in a variety of fitness classes, arts and crafts activities, special events, and more. With specialized dining programs, personalized care plans, and a compassionate care team, residents of Clayton Oaks Living feel at ease and well-supported.

Capacity and availability

Medium-capacity home

Offers a balance of services and community atmosphere.

About this community

Additional licensing details

Ownership & operating entity

Clayton Oaks Living is legally operated by CLAYTON OAKS OP, LLC, and administrated by ANN LAYTON.

Type Of Units

Staffing

Key information about the people who lead and staff this community.

Leadership

Care Services

What does this home offer?

Pets Allowed: Yes, Pets Allowed

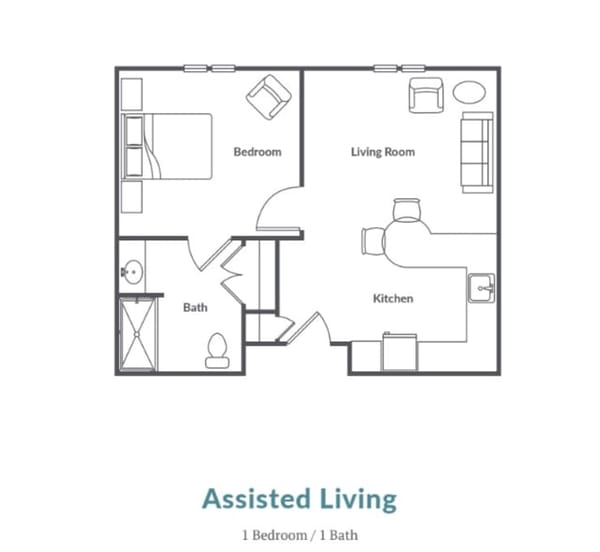

Housing Options: Studio / 1 Bed

Building Type: Two-story

Transportation Services

Fitness and Recreation

Types of Care at Clayton Oaks Living

Inspection History

In Texas, the Health and Human Services Commission (HHSC) is the primary regulatory body that conducts unannounced inspections and publishes quality reports for all long-term care homes.

Results

2 with citations

0 without citations

Texas average: 45 visits/inspections

Texas average: 9 complaint visits

Texas average: 28 inspections

Texas average: 2 inspections with citations

7 citations

Citations indicate regulatory violations. A higher number implies the facility had several areas requiring improvement.

Texas average: 6 citations

Texas average: 2 health citations

Texas average: 6 life safety citations

1 enforcement action

Penalties or interventions imposed by state regulators when facilities do not comply with quality, safety or regulatory standards.

06/05/2023: ADMINISTRATIVE PENALTY

Texas average: 1 enforcement action

Inspection Report Summary for Clayton Oaks Living

Clayton Oaks Living underwent a comprehensive inspection on August 21, 2024, resulting in 7 state standard violations. The facility was cited for 1 Health Code deficiency related to medication supervision, which was corrected by September 21, 2024. The remaining 6 deficiencies were classified under the Life Safety Code and pertained to fire safety and building maintenance issues, including exit door locking devices, sprinkler system inspections, gas pressure testing, and compliance with NFPA 101. These Life Safety Code violations dated back to an inspection on June 3, 2021, and were largely corrected between June 4, 2021, and July 12, 2021. Notably, the facility had previously received an administrative penalty of $3000 on June 5, 2023, for failing to ensure resident protection from abuse, neglect, and exploitation under Texas Administrative Code (TAC) 553.267(a)(3)(E)(ii).

Comparison Chart

The information below is reported by the Texas Health and Human Services Commission.Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

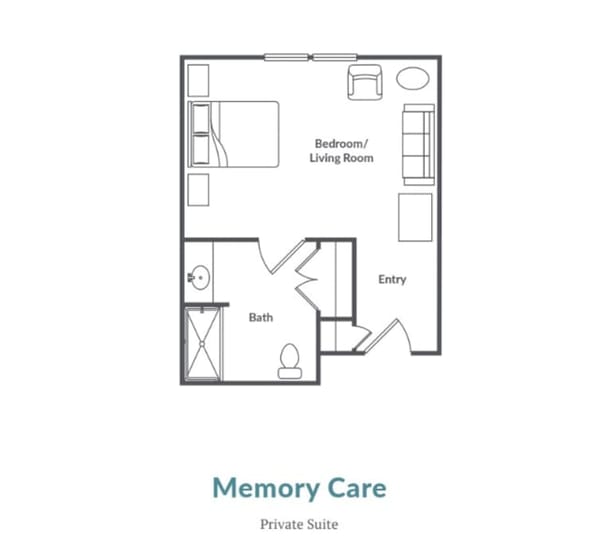

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Nursing Homes 24/7 care needed

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Places of interest near Clayton Oaks Living

4.7 miles from city center

21175 Southwest Fwy, Richmond, TX 77469

Calculate Travel Distance to Clayton Oaks Living

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Claim What’s Yours: Financial Aid for Texas Seniors

- General: Age 65+ or disabled, Texas resident, Medicaid-eligible, care need (not always nursing home level).

- Income Limits (2025): ~$2,829/month (300% FBR, individual).

- Asset Limits: $2,000 (individual), $3,000 (couple).

- TX Specifics: Large state; rural access challenges.

- Services: Personal care (5-7 hours/day), respite (240 hours/year), adult day care (~$60/day), home aides.

- General: Age 60+, Texas resident, at risk of decline.

- Income Limits: ~$2,000/month (individual, varies).

- Asset Limits: $5,000 (individual).

- TX Specifics: Limited funding; high demand in urban areas.

- Services: In-home care (3-5 hours/week), respite (up to 10 days/year), transportation (~5 trips/month).

- General: Age 60+, TX resident; no income/asset limits.

- Income Limits (2025): None; donations encouraged.

- Asset Limits: Not assessed.

- TX Specifics: 28 AAAs; includes Meals on Wheels in some areas.

- Services: Meals (~$5-$7/meal), transportation, homemaker services (~4 hours/week), respite (~5 days/year), legal aid.

- General: Age 65+ or disabled, TX resident, Medicare Part A/B.

- Income Limits (2025): ~$2,510/month (QMB), ~$3,380/month (SLMB), ~$3,598/month (QI)—individual.

- Asset Limits: $9,430 (individual), $14,130 (couple).

- TX Specifics: Includes Extra Help for Part D; no waitlist.

- Services: Covers Part B premiums ($174.70/month), deductibles ($240/year), copays (~20%).

- General: Age 60+ prioritized, TX resident, low-income.

- Income Limits (2025): ~$3,970/month (185% FPL).

- Asset Limits: Not assessed.

- TX Specifics: Priority for elderly/disabled; covers gas, electric, propane.

- Services: Heating/cooling aid ($300-$1,000/season), emergency aid ($500 max).

- General: Caregivers of 60+ needing care or 55+ caregivers of others; TX resident; 2+ ADLs.

- Income Limits (2025): No strict cap; prioritizes low-income (~$24,980/year).

- Asset Limits: Not assessed.

- TX Specifics: High rural demand; includes grandparent caregivers.

- Services: Respite (4-6 hours/week or 5 days/year), adult day care ($60/day), training, supplies (~$500/year).

- General: Age 55+, unemployed, low-income, TX resident.

- Income Limits (2025): ~$1,983/month (125% FPL).

- Asset Limits: Not specified.

- TX Specifics: Priority for veterans, rural residents; AARP partnership.

- Services: Paid training (~20 hours/week at ~$7.25/hour), job placement.

- General: Age 65+ or disabled veteran/spouse, TX resident, wartime service, ADL help (A&A) or homebound.

- Income Limits (2025): Net income < ~$1,984/month (veteran with dependent, A&A); pension offsets income.

- Asset Limits: ~$155,356 (net worth).

- TX Specifics: High veteran population; supports rural/urban needs.

- Services: Cash (~$1,433-$2,642/month veteran, ~$951-$1,318 spouse) for care costs.

- General: Age 65+, TX resident, homeowner (homestead).

- Income Limits (2025): None; tax-based eligibility.

- Asset Limits: Not assessed.

- TX Specifics: $25,000+ exemption; optional freeze in some counties; saves ~$500-$1,000/year.

- Services: Tax exemption or freeze (~$500-$1,000/year savings).

- General: Age 60+, TX resident, low-income.

- Income Limits (2025): ~$2,322/month (185% FPL).

- Asset Limits: Not assessed.

- TX Specifics: Vouchers (~$50/season); serves ~20,000 via 28 AAAs.

- Services: Vouchers (~$50/season) for produce at farmers’ markets.

Contact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.