Last Health inspection on Sep 2024

Covenant Living at Inverness

Covenant Living at Inverness

Covenant Living at Inverness is a Senior Living Home in Oklahoma

Covenant Living at Inverness is a Senior Living Home in Oklahoma

The Covenant Living at Inverness is a senior living community that mainly provides service for residential living, assisted living, and skilled nursing seniors. The senior living community is dedicated to empowering all residents to be given the opportunity to live life on their own terms. The atmosphere of the senior living community boasts a friendly yet professional ambiance. The resort-like community boasts a relaxing and calming experience for their residents because they provide them with the opportunity to freely choose a lifestyle that matches their needs. The Covenant Living at Inverness is the premier community in Tulsa that promotes a lifestyle of growth and fulfillment in the lives of every resident.

The Covenant senior living is all about convenience and individuality. A lot of their amenities and services are designed to ensure that a resident’s needs are met and satisfied. Assisted living residents are offered the SAIDO learning program that focuses on the enhancement of cognitive ability for residents with dementia. To name a few of their community amenities include a library, wellness center, courtyard and garden, and an arts and crafts studio; while services include housekeeping and laundry, and transportation.

Jacob Will is the Executive Director at Covenant Living at Inverness, bringing over 15 years of senior living experience. He began his career as a healthcare administrator and has held various leadership roles, including director of assisted living and vice president of health services. Jacob is actively involved with the Alzheimer’s Association and holds degrees in business administration and gerontology from Kansas State University.

Capacity and availability

Smaller home

May offer a more intimate, personalized care environment.

This home usually has availability

Lower occupancy suggests more openings may be available.

Finances and operations

The portion of the home's budget spent on staff, including nurses, caregivers, and other employees who support care and operations.

The portion of the home's budget spent on staff, including nurses, caregivers, and other employees who support care and operations.

All remaining costs needed to run the home, such as food, utilities, building maintenance, supplies and administrative expenses.

All remaining costs needed to run the home, such as food, utilities, building maintenance, supplies and administrative expenses.

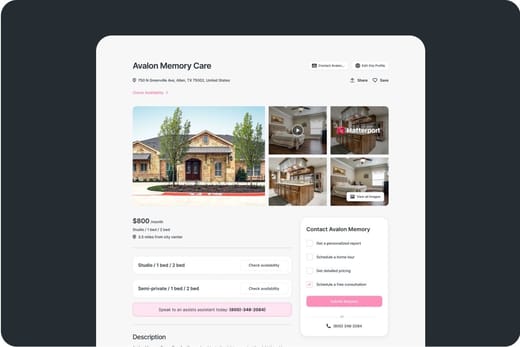

About this community

Additional licensing details

Ownership & operating entity

Covenant Living at Inverness is administrated by JACOB WILL.

Inspection History

In Oklahoma, the State Department of Health, Protective Health Services is the regulatory body responsible for conducting unannounced inspections and reporting on facility compliance.

Compare Senior Living around Tulsa

The information below is reported by the Oklahoma State Department of Health, Protective Health Services.Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Senior Living

Nursing Home 24/7 care needed

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Senior Living

Nursing Home 24/7 care needed

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Senior Living

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Senior Living

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Senior Living

Places of interest near Covenant Living at Inverness

7.1 miles from city center

3800 West 71st St S, Tulsa, OK 74132

Calculate Travel Distance to Covenant Living at Inverness

Add your location

Staffing Data

Source: CMS Payroll-Based Journal (Q2 2025)

Nursing Staff Breakdown

| Role ⓘ | Count ⓘ | Avg Shift (hrs) ⓘ | Uses Contractors? ⓘ |

|---|---|---|---|

| Registered Nurse | 6 | 9.7 | Yes |

| Licensed Practical Nurse | 19 | 8.9 | Yes |

| Certified Nursing Assistant | 58 | 8 | Yes |

Staff by Category

Contractor Analysis

| Role ⓘ | Employees ⓘ | Contractors ⓘ | Total Staff ⓘ | Total Hours ⓘ | Days Worked ⓘ | % of Days ⓘ | Avg Shift (hrs) ⓘ |

|---|---|---|---|---|---|---|---|

| Certified Nursing Assistant | 24 | 34 | 58 | 6,858 | 91 | 100% | 8 |

| Medication Aide/Technician | 11 | 14 | 25 | 3,008 | 91 | 100% | 7.4 |

| Licensed Practical Nurse | 6 | 13 | 19 | 2,802 | 91 | 100% | 8.9 |

| Registered Nurse | 2 | 4 | 6 | 895 | 90 | 99% | 9.7 |

| Physical Therapy Aide | 0 | 5 | 5 | 679 | 67 | 74% | 5.2 |

| Administrator | 2 | 0 | 2 | 488 | 61 | 67% | 8 |

| Nurse Practitioner | 1 | 0 | 1 | 472 | 60 | 66% | 7.9 |

| Speech Language Pathologist | 0 | 6 | 6 | 461 | 71 | 78% | 3.6 |

| Clinical Nurse Specialist | 1 | 0 | 1 | 460 | 60 | 66% | 7.7 |

| RN Director of Nursing | 2 | 0 | 2 | 456 | 58 | 64% | 7.6 |

| Dental Services Staff | 1 | 0 | 1 | 453 | 58 | 64% | 7.8 |

| Qualified Social Worker | 0 | 3 | 3 | 225 | 54 | 59% | 4.1 |

| Physical Therapy Assistant | 0 | 7 | 7 | 208 | 64 | 70% | 2.9 |

| Respiratory Therapy Technician | 0 | 3 | 3 | 204 | 66 | 73% | 2.8 |

| Medical Director | 0 | 1 | 1 | 29 | 16 | 18% | 1.8 |

| Occupational Therapy Assistant | 0 | 1 | 1 | 23 | 3 | 3% | 7.7 |

Health Inspection History

2 citations per inspection (avg)

Citations can result from standard inspections or complaint-based investigations.

Breakdown of citations

Citations history (last 3 years)

Facility Characteristics

Source: CMS Long-Term Care Facility Characteristics (Data as of Jan 2026)

Resident Census by Payment Source

Programs & Services

Family Engagement

Active councils help families stay involved in care decisions and facility operations.

Quality of care over time

These measures show how residents usually do over time at this home, based on health outcomes and preventive care.

Long-Stay Resident Measures

Daily care & independence

Safety & clinical stability

Emotional & behavioral wellbeing

Preventive care

Nutrition & physical health

Short-stay resident measures

Financial Trends

Historical financial and operational data for Covenant Living at Inverness based on CMS SNF Cost Reports.

Loading trend charts...

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Financial Aid for Oklahoma Seniors

Get financial aid guidanceContact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

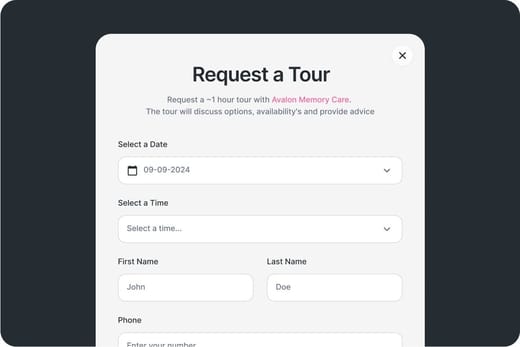

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.