Crestview Manor ALF

Crestview Manor ALF is a Memory Care Home in New York

Crestview Manor ALF is a Memory Care Home in New York

Crestview Manor ALF

Crestview Manor ALF is a Memory Care Home in New York

Crestview Manor ALF is a Memory Care Home in New York

Ideally situated in the harmonious neighborhood of Hawthorne, NY, Crestview Manor Assisted Living is an outstanding community that offers assisted living. A respectful and highly trained team attends to residents’ special needs 24/7, ensuring their comfort and safety. The community is family-owned and operated, promoting a cozy and nurturing environment for residents to feel at ease.

To help ease residents’ financial burdens, the community provides Medicaid-funded programs to meet their needs while catering to their financial capabilities. Fun activities and engaging programs are also conducted for residents to interact with their surroundings and live actively. The community also provides medication management, transportation services, and meals for residents’ convenience. Here, residents age with dignity with the community’s dedicated care and purposely designed amenities.

Capacity and availability

Smaller home

May offer a more intimate, personalized care environment.

About this community

Additional licensing details

Ownership & operating entity

Crestview Manor ALF is legally operated by Azzy Reckess Paula Reckess.

What does this home offer?

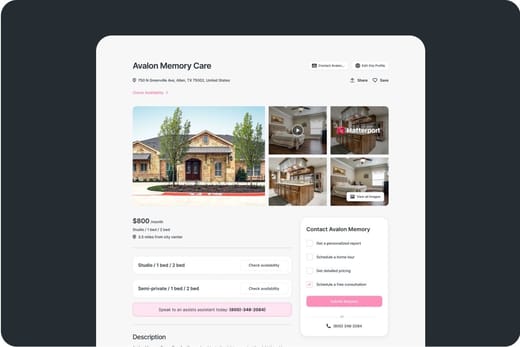

Housing Options: Studio / Semi-Private Rooms

Building Type: Mid-rise

Dining Services

Transportation Services

Housekeeping Services

Recreational Activities

Types of Care at Crestview Manor ALF

Inspection History

In New York, the Department of Health, Office of Aging and Long Term Care performs unannounced onsite inspections to monitor compliance with state and federal healthcare regulations.

5 inspections

2 with violations, 3 without violations

4 complaint-related visits

New York average: 9 inspections, 56 complaint-related visits

11 violations

Violations indicate regulatory issues. A higher number implies the facility had several areas requiring improvement.

New York average: 12 violations

1 enforcement action

Penalties or interventions imposed by state regulators when facilities do not comply with quality, safety or regulatory standards.

December 16, 2021: Stipulation & Order #ACF-21-132

A formal agreement with the state to correct serious or repeated issues.

Compare Memory Care around Westchester County

The information below is reported by the New York State Department of Health.Nursing Home 24/7 care needed

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Hospice Care

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Hospice Care

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Respite Care

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Places of interest near Crestview Manor ALF

2 miles from city center

150 Old Saw Mill River Rd, Hawthorne, NY 10532

Calculate Travel Distance to Crestview Manor ALF

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Financial Aid for New York Seniors

Get financial aid guidanceContact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

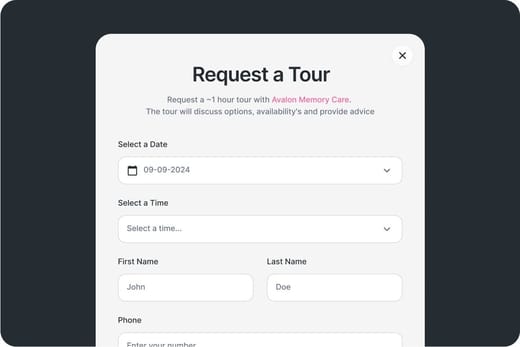

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.