Heritage Lake Country

Heritage Lake Country

Heritage Lake Country is a Senior Living Home in Wisconsin

Heritage Lake Country is a Senior Living Home in Wisconsin

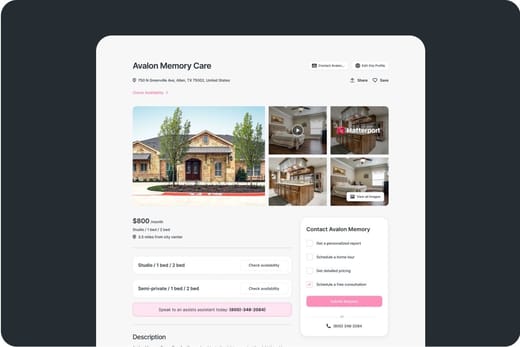

Cherish every moment of your golden years with the esteemed senior living community of Heritage Lake Country in Village Square Drive, Hartland, WI, that offers assisted living, enhanced assisted living, independent living, and memory care. With a selection of cozy and specially designed one-bedroom and two-bedroom residences, seniors experience comfort and convenience like no other. The community prides itself on a team of responsible and highly qualified professionals delivering the highest quality of care and assistance for seniors to thrive and live to their potential.

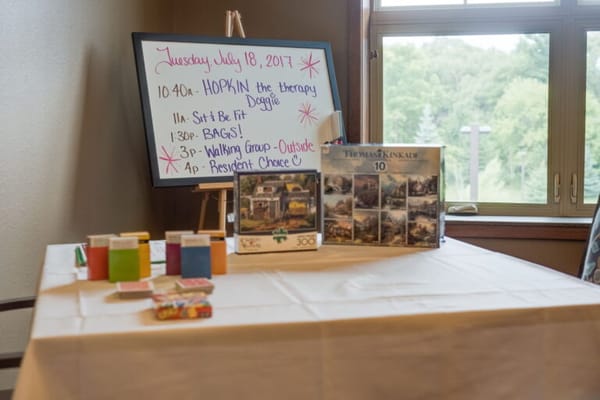

There is always something fun to do with a wide array of enjoyable activities and engaging programs highlighting seniors’ interests and strengths. Delight in healthy and delicious meals that satisfy dietary needs and preferences. Heritage Lake Country is a good place for seniors looking to maximize their independence surrounded by wonderful amenities and innovative approaches.

Capacity and availability

Smaller home

May offer a more intimate, personalized care environment.

Client group served

About this community

Additional licensing details

Ownership & operating entity

Heritage Lake Country is legally operated by MILO PINKERTON, and administrated by HSL 15 LLC.

Safety & Compliance

Staffing

Key information about the people who lead and staff this community.

Leadership

Care Services

All Levels of Care

Additional Policies & Features

Amenities & Lifestyle

Programs & Activities

Pricing & Financial Information

Dining & Nutrition

Rate Information

What does this home offer?

Total Residents: 124

Pets Allowed: Yes, Pets Allowed

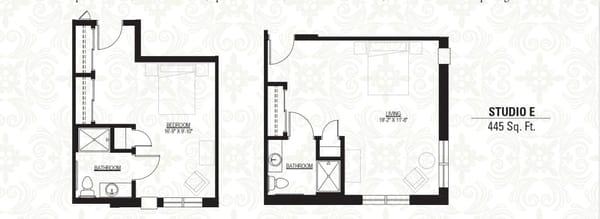

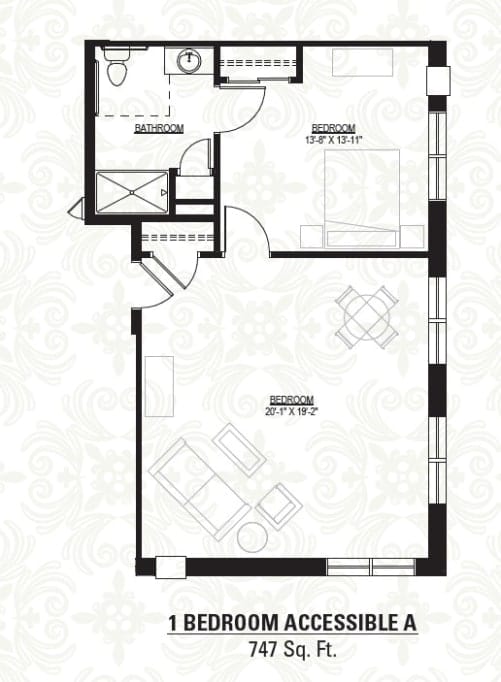

Room Sizes: 299-324 / 344-431 / 445 / 747 sq. ft

Housing Options: Studio / 1 Bed / 2 Bed

Building Type: 3-story

Fitness and Recreation

Types of Care at Heritage Lake Country

Inspection History

In Wisconsin, the Department of Health Services, Division of Quality Assurance performs unannounced onsite surveys to ensure that long-term care facilities meet health and safety laws.

Compare Senior Living around Milwaukee

The information below is reported by the Wisconsin Department of Health Services, Division of Quality Assurance.Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Places of interest near Heritage Lake Country

1.3 miles from city center

2975 Village Square Dr, Hartland, WI 53029

Calculate Travel Distance to Heritage Lake Country

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Financial Aid for Wisconsin Seniors

Get financial aid guidanceContact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

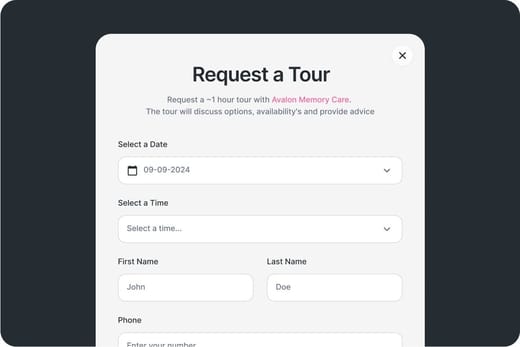

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.