Heritage Park Apartments

Heritage Park Apartments

Heritage Park Apartments is a Senior Living Home in California

Heritage Park Apartments is a Senior Living Home in California

Live the best of your golden years at Heritage Park Apartments, a distinct 55+ community in Oxnard, CA, offering independent living. With beautifully designed and spacious one- and two-bedroom floor plans, residents are guaranteed comfort and safety. The community also promotes a vibrant and welcoming environment, so residents can feel a sense of belonging during their stay.

Residents also enjoy a worry-free lifestyle with on-site management, maintenance, and laundry. The community’s proximity to thriving local amenities and recreation sites, residents have quick access to their necessities and leisure. Pets are also welcome to accompany residents during their stay, ensuring the finest retirement experience.

What does this home offer?

Minimum Age: 55 Years Old

Pets Allowed: Yes, Pets Allowed

Room Sizes: 500 / 700 sq. ft

Housing Options: 1 Bed / 2 Bed

Building Type: 2-story

Parking Available

Types of Care at Heritage Park Apartments

Comparison Chart

The information below is reported by the California Department of Social Services and Department of Public Health.Independent Living For self-sufficient seniors seeking community and minimal assistance.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

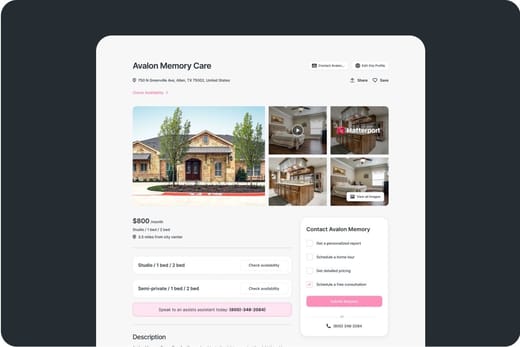

Places of interest near Heritage Park Apartments

0.7 miles from city center

820 S E St Office, Oxnard, CA 93030

Calculate Travel Distance to Heritage Park Apartments

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Claim What’s Yours: Financial Aid for California Seniors

- General: Age 65+, California resident, Medi-Cal eligible, nursing home risk.

- Income Limits (2025): ~$2,829/month (300% FBR, individual).

- Asset Limits: $2,000 (individual), $3,000 (couple).

- CA Specifics: County-managed; waitlists possible.

- Services: In-home support (4-6 hours/day), respite care (14 days/year), meals (~$6/meal), transportation (8 trips/month), care management.

- General: Age 65+, California resident, Medicaid-eligible or low-income.

- Income Limits: ~$1,732/month (individual, Medi-Cal threshold).

- Asset Limits: $2,000 (individual).

- CA Specifics: Can hire family as caregivers.

- Services: Personal care (up to 283 hours/month), homemaker services, respite (varies).

- General: Age 65+, California resident, Medi-Cal-eligible, nursing home-eligible but community-capable.

- Income Limits: ~$2,829/month (300% FBR, individual).

- Asset Limits: $2,000 (individual).

- CA Specifics: Available in 38 counties; waitlists common.

- Services: Case management, respite care (up to 10 days/year), minor home mods (avg. $500), adult day care (~$50/day).

- General: Age 62+, California resident, own and live in home, 40% equity.

- Income Limits (2025): ~$51,500/year (household, adjusted annually).

- Asset Limits: Equity-based; no strict asset cap.

- CA Specifics: Deferred taxes accrue interest (5% as of 2024); repaid upon sale/death.

- Services: Property tax deferral (avg. $1,000-$3,000/year, varies by county).

- General: Age 65+ or disabled, California resident, Medi-Cal-eligible, nursing home-eligible.

- Income Limits: ~$2,829/month (300% FBR, individual).

- Asset Limits: $2,000 (individual).

- CA Specifics: Available in 15 counties (e.g., LA, Sacramento); waitlists common.

- Services: Personal care in ALFs (5-7 hours/day), medication management, social services.

- General: Caregivers of California residents 60+ needing help with 3+ daily activities; no caregiver age limit.

- Income Limits: No strict limit; cost-sharing above ~$2,500/month threshold.

- Asset Limits: Not applicable; need-based.

- CA Specifics: High demand in urban areas; complements IHSS respite.

- Services: Respite care (up to 10 days/year), counseling (4-6 sessions/year), training (2-3 workshops/year), supplies (~$200/year).

- General: Age 60+ priority, California resident, low-income, utility/heating need.

- Income Limits (2025): ~$2,510/month (200% of poverty level, individual).

- Asset Limits: Not applicable; income-focused.

- CA Specifics: High demand in inland/coastal extremes; weatherization capped at $5,000/home.

- Services: Utility payments (avg. $500-$1,000/year), weatherization (e.g., insulation, avg. $1,000-$3,000 savings).

Contact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

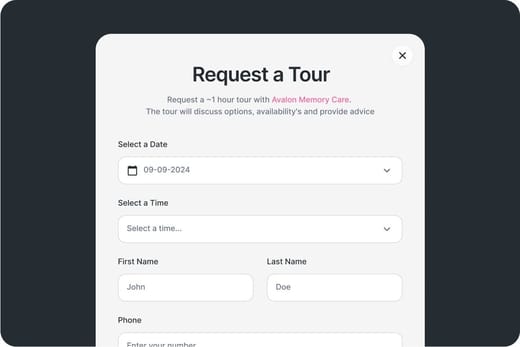

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.