Holiday Maple Downs

Holiday Maple Downs is an Independent Living Home in New York

Holiday Maple Downs is an Independent Living Home in New York

Holiday Maple Downs

Holiday Maple Downs is an Independent Living Home in New York

Holiday Maple Downs is an Independent Living Home in New York

Holiday Maple Downs is an idyllic residence nestled in Fayetteville, New York. Enveloped by the serenity of mature trees and situated in a tranquil residential neighborhood, this community exudes a sense of peacefulness that fosters an enriching lifestyle. Set against the backdrop of suburban Syracuse, residents are presented with the perfect environment for senior independent living, where they can lead lives that are vibrant, active, and deeply connected.

Amidst the leafy surroundings, Holiday Maple Downs offers a pet-friendly haven, embracing companionship and warmth. As a place that values comfort and convenience, the community extends the courtesy of rest by the stays and provides complimentary transportation, ensuring residents’ ease of movement. The community brims with a wealth of amenities, from a well-equipped fitness center to a game room and an arts and crafts center, allowing residents to indulge in their passions and interests. The inclusion of housekeeping services adds to the convenience, ensuring a worry-free lifestyle that embraces both relaxation and engagement. At Holiday Maple Downs, life takes on a new dimension—where every day is an opportunity to embrace serenity.

Staffing

Key information about the people who lead and staff this community.

Leadership

What does this home offer?

Pets Allowed: Yes, Pets Allowed

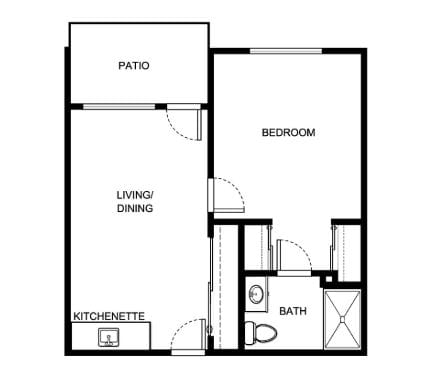

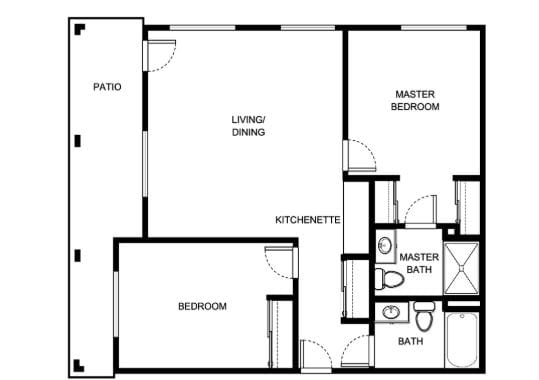

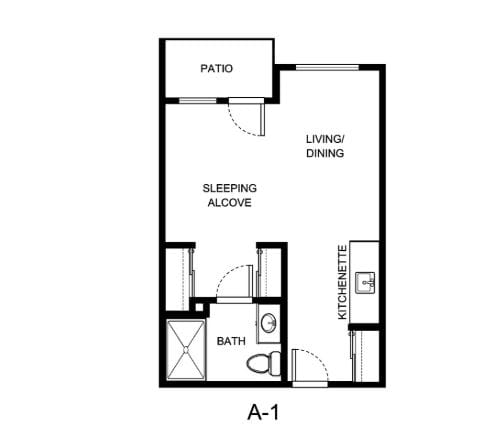

Room Sizes: 335 - 563 / 542 - 698 / 967 - 1,095 sq. ft

Housing Options: Studio / 1 Bed / 2 Bed

Building Type: Two-story

Transportation Services

Fitness and Recreation

Types of Care at Holiday Maple Downs

Type of Rooms Available

Compare Independent Living around Fayetteville

The information below is reported by the New York State Department of Health.Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Places of interest near Holiday Maple Downs

8.9 miles from city center

7220 E Genesee St, Fayetteville, NY 13066

Calculate Travel Distance to Holiday Maple Downs

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Financial Aid for New York Seniors

Get financial aid guidanceContact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.