Independence Hill

Independence Hill is a Retirement Home in Texas

Independence Hill is a Retirement Home in Texas

Independence Hill

Independence Hill is a Retirement Home in Texas

Independence Hill is a Retirement Home in Texas

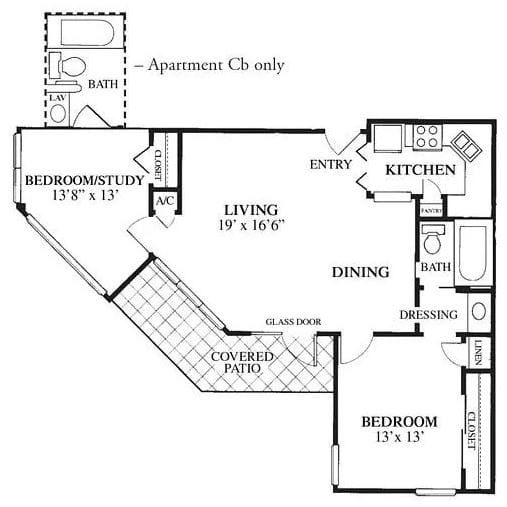

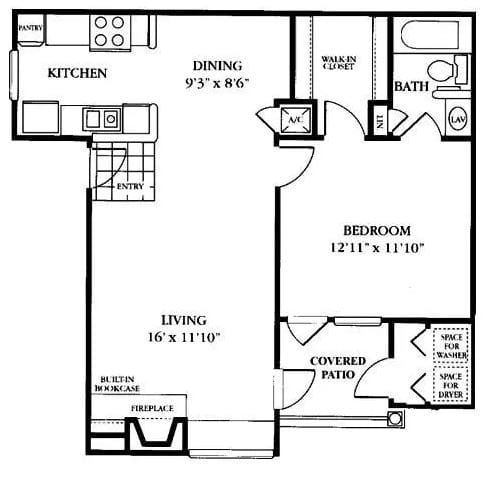

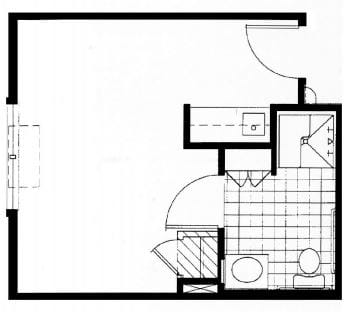

Located at the heart of Huebner Road, San Antonio, TX, Independence Hill Retirement Community at Stone Oak is a peaceful senior living community that provides assisted living, independent living, and independence village. Featuring a wide array of floor plans for different living options including one-bedroom to two-bedroom cottages for independent living residents, one-bedroom and studio for residents under assisted living, and one-bedroom to two-bedroom for seniors under independence village. Independence Hill focuses on the needs of its residents, delivering care tailored to their preferences and needs.

With a kind, compassionate, and professional team of caregivers, the community ensures the welfare of the seniors. Independence Hill orchestrates activities and programs that highlight the physical, social, emotional, intellectual, and spiritual wellness of its residents. Here, seniors also get to satisfy their cravings with restaurant-style meals served three times daily. Residents may also opt to eat dinner in their room. Independence Hill provides a peaceful and worry-free life within its grounds with a scenic view of nature.

Capacity and availability

Medium-capacity home

Offers a balance of services and community atmosphere.

How BBB ratings work

About this community

Additional licensing details

Ownership & operating entity

Independence Hill is administrated by ROBERT GOSSETT.

Staffing

Key information about the people who lead and staff this community.

Leadership

Care Services

What does this home offer?

Pets Allowed: Yes, Pets Allowed

Housing Options: Studio / 1 Bed / 2 Bed / Cottage

Building Type: Mid-rise

Transportation Services

Fitness and Recreation

Types of Care at Independence Hill

Compare Retirement Homes around San Antonio

The information below is reported by the Texas Health and Human Services Commission.Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Retirement Homes

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Places of interest near Independence Hill

18.8 miles from city center — 1.19 miles to nearest hospital (Methodist Hospital Stone Oak)

20450 Huebner Rd, San Antonio, TX 78258

Calculate Travel Distance to Independence Hill

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Financial Aid for Texas Seniors

Get financial aid guidanceContact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.