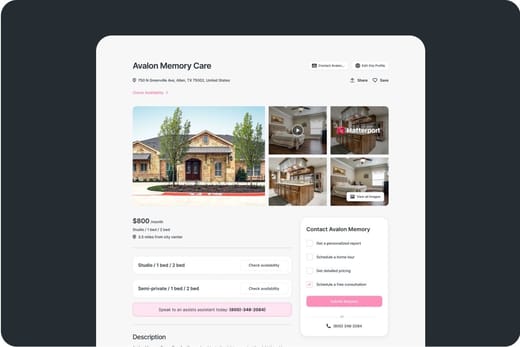

Mustang Creek Estates of Flower Mound

Mustang Creek Estates of Flower Mound is an Assisted Living Home in Texas

Mustang Creek Estates of… is an Assisted Living Home in Texas

Mustang Creek Estates of Flower Mound

Mustang Creek Estates of Flower Mound is an Assisted Living Home in Texas

Mustang Creek Estates of… is an Assisted Living Home in Texas

Treat yourself to a worry-free lifestyle with the trusted senior living community of Mustang Creek Estates of Flower Mound in College Parkway, Flower Mound, TX, providing assisted living, assisted living plus, and memory care. With its dedication to seniors’ well-being, the community provides top-tier care and assistance around the clock. Helping residents with their daily activities and maintenance, Mustang Creek Estates Flower Mound goes above and beyond to ensure they are comfortable and well-cared for.

Explore new interests and rekindle passions through a variety of engaging activities and enjoyable programs that cater to your interests and strengths. Have a delightful dining experience with delicious and nutritious meals that satisfy dietary needs and tastes. Surrounded by a calming environment and rich nature, Mustang Creek Estates Flower Mound is ideal for seniors seeking a peaceful retirement while receiving the utmost support for their special needs.

Capacity and availability

Smaller home

May offer a more intimate, personalized care environment.

About this community

Additional licensing details

Ownership & operating entity

Mustang Creek Estates of Flower Mound is legally operated by MCE V OP CO, LLC, and administrated by GUY GAGE.

Type Of Units

Staffing

Key information about the people who lead and staff this community.

Leadership

Care Services

What does this home offer?

Pets Allowed: Yes, Pets Allowed

Housing Options: Private Rooms / Shared Rooms

Building Type: Single-story

Transportation Services

Social Activities

24-Hour Caring Staff

Types of Care at Mustang Creek Estates of Flower Mound

Inspection History

In Texas, the Health and Human Services Commission (HHSC) is the primary regulatory body that conducts unannounced inspections and publishes quality reports for all long-term care homes.

0 enforcement actions

Penalties or interventions imposed by state regulators when facilities do not comply with quality, safety or regulatory standards.

Texas average: 1 enforcement action

Compare Assisted Living around Flower Mound

The information below is reported by the Texas Health and Human Services Commission.Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Home Care

Hospice Care

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Respite Care

Places of interest near Mustang Creek Estates of Flower Mound

5 miles from city center

2500 College Pkwy, Flower Mound, TX 75028

Calculate Travel Distance to Mustang Creek Estates of Flower Mound

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Financial Aid for Texas Seniors

Get financial aid guidanceContact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

More homes from the same owner

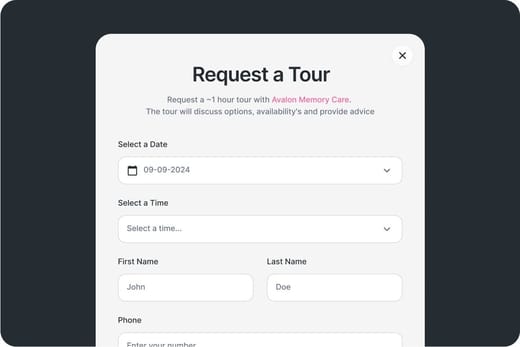

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.