Pleasant Point Senior Living

Pleasant Point Senior Living is an Assisted Living Home in Wisconsin

Pleasant Point Senior Living is an Assisted Living Home in Wisconsin

Pleasant Point Senior Living

Pleasant Point Senior Living is an Assisted Living Home in Wisconsin

Pleasant Point Senior Living is an Assisted Living Home in Wisconsin

Pleasant Point Senior Living, located in Mount Pleasant, Wisconsin, is highly regarded for its compassionate care, akin to a close-knit family. This community not only offers residential assisted living but also embraces independent living retirement communities, providing a comprehensive range of services that go above and beyond. They also extend their support to short-term respite care, ensuring residents enjoy a comfortable and worry-free lifestyle.

Amidst the spacious and convenient setting at Pleasant Point Senior Living, residents benefit from the presence of on-call nurses 24/7 and an inviting interior design palette that soothes the senses. The amenities include fine dining, housekeeping, and laundry services, all complemented by a diverse calendar of events and activities that infuse vibrancy into the community. For added convenience, there’s even an on-site beauty salon and barbershop. The strategic location offers easy access to local conveniences, making this Wisconsin home a standout choice for seniors.

Capacity and availability

Smaller home

May offer a more intimate, personalized care environment.

Client group served

About this community

Additional licensing details

Ownership & operating entity

Pleasant Point Senior Living is legally operated by ANDREW RIDER, and administrated by RACINE SENIOR LIVING INC.

Staffing

Key information about the people who lead and staff this community.

Leadership

Rate Information

Inspection History

In Wisconsin, the Department of Health Services, Division of Quality Assurance performs unannounced onsite surveys to ensure that long-term care facilities meet health and safety laws.

Compare Assisted Living around Racine

The information below is reported by the Wisconsin Department of Health Services, Division of Quality Assurance.Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Places of interest near Pleasant Point Senior Living

5.4 miles from city center

8500 Corporate Dr, Racine, WI 53406

Calculate Travel Distance to Pleasant Point Senior Living

Add your location

Guides for Better Senior Living

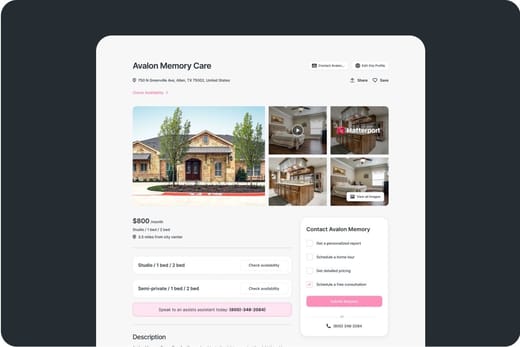

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Financial Aid for Wisconsin Seniors

Get financial aid guidanceContact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

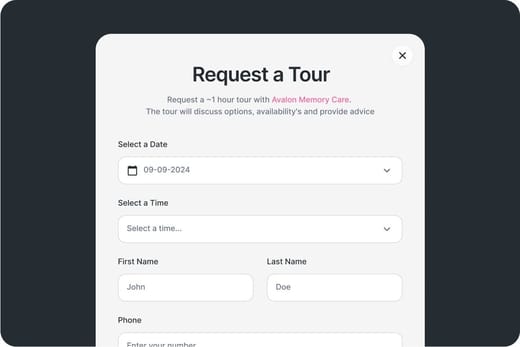

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.