The Courtyard at Oshkosh

The Courtyard at Oshkosh is an Assisted Living Home in Wisconsin

The Courtyard at Oshkosh is an Assisted Living Home in Wisconsin

The Courtyard at Oshkosh

The Courtyard at Oshkosh is an Assisted Living Home in Wisconsin

The Courtyard at Oshkosh is an Assisted Living Home in Wisconsin

The Courtyard at Oshkosh is a senior living community located in Oshkosh, WI, offering a warm and supportive environment, and specializing in assisted living, respite care, and specialized memory care services. Residents of The Courtyard benefit from its unwavering commitment to residents’ well-being, offering 24/7 availability of assistance, diet-approved meal provision, and specialized care including diabetic care, incontinence care, and medication management.

The Courtyard at Oshkosh also provides a rich array of activities and amenities. Grooming services, along with dedicated housekeeping and laundry services, enable residents to maintain their dignity and focus on the activities they enjoy. Residents can also engage in physical activities designed to promote fitness, as well as participate in regular social events.

This is the number of people who can stay here (Facility Capacity).

This is the number of people who can stay here (Facility Capacity).

Community Stability & Environment

-

Licensed Since

Date when the facility's license was first issued by Wisconsin April 8, 2020

-

Walk Score

Walk Score in senior living communities measures how easy it is for residents to access essential services and amenities—like grocery stores, parks, pharmacies, and transit—without needing a car. 2 / 100 Very Car-Dependent

Almost all errands require a car. Very few walkable amenities. Minimal sidewalk infrastructure. Walking is practical only for recreation, not errands.

Facility & Licensing Details

-

County

County in Wisconsin where the facility is located. WINNEBAGO

-

Facility Type

Indicates the state-regulated license category used in Wisconsin (e.g., Residential Care Facility for the Elderly). CLASS CNA (NONAMBULATORY)

-

Licensee / Operator

Entity or organization legally responsible for managing this facility under Wisconsin regulations. THOMAS OSTROM

-

Administrator

Name of the facility administrator. OSHKOSH ASSISTED LIVING LLC

-

Regional Office

State regional office responsible for overseeing this facility. NORTHEASTERN REGION

Operations & Staffing

-

Contact Name

Primary contact person at this facility. JESS BETTS-NELSON

-

Gender Served

Gender of residents served at this facility. Both

-

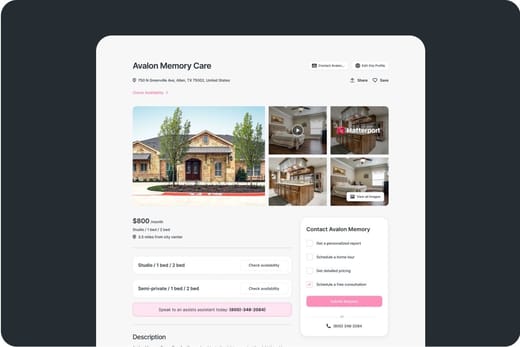

Rate Range

Monthly rate range for accommodations at this facility. $3,000 - $9,000

-

Waiver Certified

Indicates if the facility is certified for waiver programs (e.g., CBRF waiver). No

-

Client Group Served

Types of client groups served at this facility. Terminally Ill, Physically Disabled, Irreversible Dementia Alzeimers, Advanced Aged, HCBS Compliant

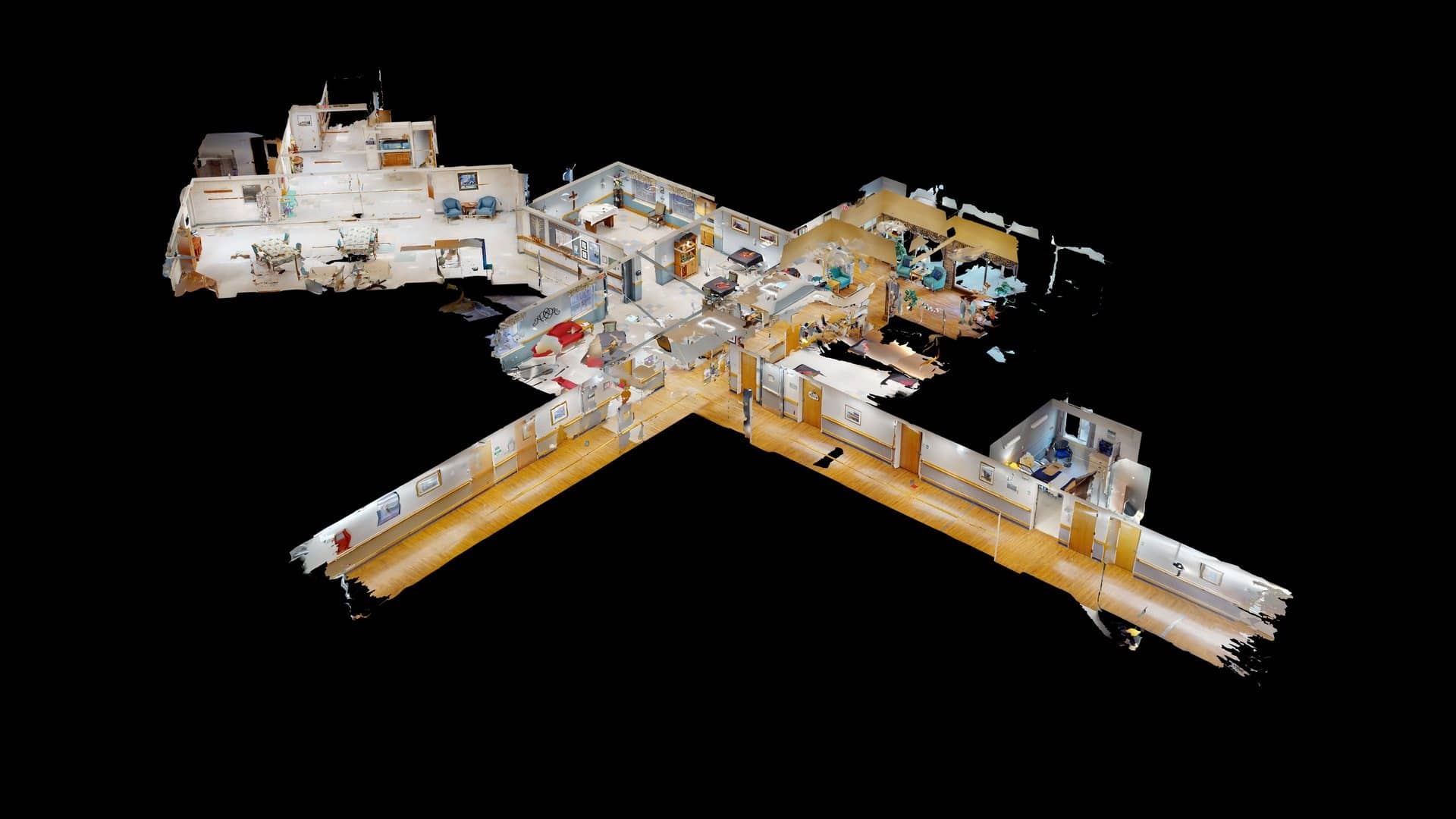

What does this home offer?

Pets Allowed: Yes, Pets Allowed

Building Type: Single-story

Transportation Services

Fitness and Recreation

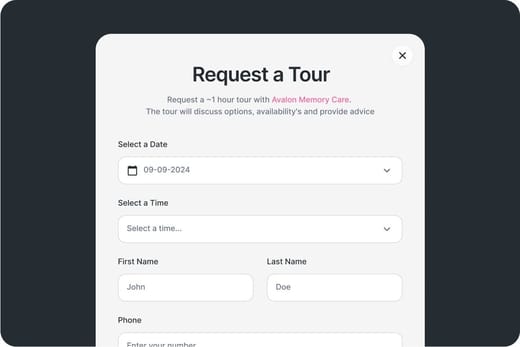

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.

Types of Care at The Courtyard at Oshkosh

The Courtyard at Oshkosh Reviews

Places of interest near The Courtyard at Oshkosh

3.2 miles from city center

3851 Jackson St, Oshkosh, WI 54901

[email protected]

920-385-7600

Calculate Travel Distance to The Courtyard at Oshkosh

Add your location

Join Our Online

Senior Community!

Connect, laugh, and explore — all from the comfort of your home.

Guides for Better Senior Living

From costs to care, explore the most important topics to make informed decisions about your future.

Comparison Chart

For seniors needing help with daily tasks but not full-time nursing.

For self-sufficient seniors seeking community and minimal assistance.

Specialized care for those with Memory Loss, Alzheimer’s, or dementia, ensuring safety and support.

For seniors needing help with daily tasks but not full-time nursing.

Specialized care for those with Memory Loss, Alzheimer’s, or dementia, ensuring safety and support.

For seniors needing help with daily tasks but not full-time nursing.

For seniors needing help with daily tasks but not full-time nursing.

Specialized care for those with Memory Loss, Alzheimer’s, or dementia, ensuring safety and support.

For seniors needing help with daily tasks but not full-time nursing.

Claim What’s Yours: Financial Aid for Wisconsin Seniors

- General: Age 65+ or disabled, Wisconsin resident, Medicaid-eligible, long-term care need.

- Income Limits (2025): ~$2,829/month (300% FBR, individual).

- Asset Limits: $2,000 (individual), $3,000 (couple).

- WI Specifics: Managed care model; rural/urban balance.

- Services: Personal care (5-7 hours/day), respite (240 hours/year), adult day care ($65/day), home modifications ($1,500 avg.).

- General: Caregiver of someone 60+ (or with dementia), Wisconsin resident.

- Income Limits: No strict limit; prioritizes low-income.

- Asset Limits: Not applicable.

- WI Specifics: High rural demand; ADRC coordination.

- Services: In-home respite (4-6 hours/day), adult day care (~$65/day), short-term facility care (up to 5 days).

- General: Age 65+ (or disabled 18+), WI resident, Medicaid-eligible, NFLOC.

- Income Limits (2025): ~$2,829/month; QIT optional.

- Asset Limits: $2,000 (individual), $3,000 (couple).

- WI Specifics: Flexible budget; serves ~20,000; participant hires caregivers.

- Services: Personal care (custom hours), respite, home mods, equipment, transportation, support services.

- General: Age 65+, WI resident, US citizen/qualified immigrant, not on full Medicaid.

- Income Limits (2025): ~$24,980-$34,980/year (Level 1-2B, individual); varies by level.

- Asset Limits: None.

- WI Specifics: Four benefit levels; serves ~50,000 annually.

- Services: $5 generic/$15 brand copays (Level 1); deductibles ($500-$850) for higher levels; covers most Rx drugs.

- General: Age 65+ or disabled, WI resident, Medicare Part A/B.

- Income Limits (2025): ~$2,510/month (QMB), ~$3,380/month (SLMB), ~$3,598/month (QI)—individual.

- Asset Limits: $9,430 (individual), $14,130 (couple).

- WI Specifics: Includes Extra Help for Part D; no waitlist.

- Services: Covers Part B premiums ($174.70/month), deductibles ($240/year), copays (~20%).

- General: Age 60+ prioritized, WI resident, low-income household.

- Income Limits (2025): ~$3,970/month (185% FPL).

- Asset Limits: Not assessed.

- WI Specifics: Covers gas, electric, wood; crisis aid available.

- Services: Heating/electric aid ($300-$1,000/season), crisis aid ($500 max), weatherization.

- General: Age 55+, unemployed, low-income, WI resident.

- Income Limits (2025): ~$1,983/month (125% FPL).

- Asset Limits: Not specified.

- WI Specifics: Priority for veterans, rural residents; Goodwill/AARP partnership.

- Services: Paid training (~20 hours/week at ~$7.25/hour), job placement.

- General: Age 65+ or disabled veteran/spouse, WI resident, wartime service, ADL help (A&A) or homebound.

- Income Limits (2025): Net income < ~$1,984/month (veteran with dependent, A&A); pension offsets income.

- Asset Limits: ~$155,356 (net worth).

- WI Specifics: High rural veteran use; supports care costs.

- Services: Cash (~$1,433-$2,642/month veteran, ~$951-$1,318 spouse) for care costs.

- General: Age 65+, WI resident, homeowner, live in home 6+ months/year.

- Income Limits (2025): ~$24,980/year (household).

- Asset Limits: Home equity < $500,000; limited other assets.

- WI Specifics: Saves ~$500-$1,500/year; interest ~2%-3%.

- Services: Deferred tax payment (~$500-$1,500/year avg.).

- General: Age 60+, WI resident, low-income.

- Income Limits (2025): ~$2,322/month (185% FPL).

- Asset Limits: Not assessed.

- WI Specifics: Vouchers (~$45/season); serves ~15,000 annually.

- Services: Vouchers (~$45/season) for produce at farmers’ markets.

Contact Us

What questions do you have about The Courtyard at Oshkosh?

We’ll help you with pricing, availability, and anything else you need.

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

Homes near Oshkosh, WI