The Landing of Brighton – Rochester

The Landing of Brighton – Rochester is a Memory Care Home in New York

The Landing of Brighton… is a Memory Care Home in New York

The Landing of Brighton – Rochester

The Landing of Brighton – Rochester is a Memory Care Home in New York

The Landing of Brighton… is a Memory Care Home in New York

A proud member of Bridge Senior Living, The Landing of Brighton offers assisted and memory care living. The upscale senior living home boasts a home-like ambiance that steeps a beautiful experience for the next home for you or your loved one– making sure residents feel like they belong. They encourage independence in their residents, which is why they provide a lifestyle based on your terms. Residents can expect an environment that leads to a vibrant and enriching lifestyle created to fit their holistic needs.

The Landing offers its fully equipped amenities to help with the resident’s mental and physical stimulation to remain active– an art studio, library, music room, walking paths, and courtyards, to name a few of the community’s offerings. The well-trained staff on duty tend to your needs– on top of the services they offer: housekeeping and maintenance, cleaning, and transportation, among others.

Inspection Report Summary for The Landing of Brighton – Rochester

A total of 9 inspections were conducted from August 1, 2021 through July 31, 2025, resulting in 18 violations. Four inspections reported no violations.

The inspection with the highest number of violations was the Relicensure, Complaint Survey issued on 'Report Issued: November 22, 2024', which documented 'Violations: 8'. The cited deficiencies spanned several regulatory areas: operating certificates (485.5 (f)), general provisions (488.3 (b)), food service (488.8 (b) (7)), environmental standards (488.11 (d) (1) and 488.11 (f) (1)), disaster and emergency procedures (488.12 (b)), resident services (1001.10 (i) (5-8)), and medication management (1001.10 (l)(1)).

Zero‑violation surveys were issued on 'Report Issued: April 9, 2025'; 'Report Issued: January 9, 2025'; 'Report Issued: April 30, 2024'; and 'Report Issued: October 29, 2021', each recording 'Violations: 0'. Enforcement actions during the period include a Stipulation & Order issued on 'Report Issued: September 23, 2021' (ACF‑21‑087).

This is the number of people who can stay here (Facility Capacity).

This is the number of people who can stay here (Facility Capacity).

Community Stability & Environment

-

Walk Score

Walk Score in senior living communities measures how easy it is for residents to access essential services and amenities—like grocery stores, parks, pharmacies, and transit—without needing a car. 8

Very Car-DependentAlmost all errands require a car. Very few walkable amenities. Minimal sidewalk infrastructure. Walking is practical only for recreation, not errands.

Safety, Compliance & Inspections Overview

-

Complaint Visits

Inspections triggered by official complaints filed with the state. 5 complaints

-

Other Visits

Administrative or follow-up visits not related to complaints or inspections. 4 visits

-

Total Violations

Total number of regulatory violations on record. 18 violations

-

Total Inspections

Total number of state inspections conducted. 9 inspections

-

Inspections with Violations

Number of inspections that found violations. 5 inspections

-

Inspections without Violations

Number of inspections with no violations found. 4 inspections

-

Operating Certificate

Facility operating certificate number. 370-S-197

-

Enforcement Actions

Details of enforcement actions taken against this facility. September 23, 2021 — Stipulation & Order #: ACF-21-087

Facility & Licensing Details

-

County

County in New York where the facility is located. Monroe

-

Facility Type

Indicates the state-regulated license category used in New York (e.g., Residential Care Facility for the Elderly). Enriched Housing Program

-

Licensee / Operator

Entity or organization legally responsible for managing this facility under New York regulations. Brighton Senior Care, LLC

-

Regional Office

State regional office responsible for overseeing this facility. Western Regional Office - Buffalo

What does this home offer?

Pets Allowed: Yes, Pets Allowed

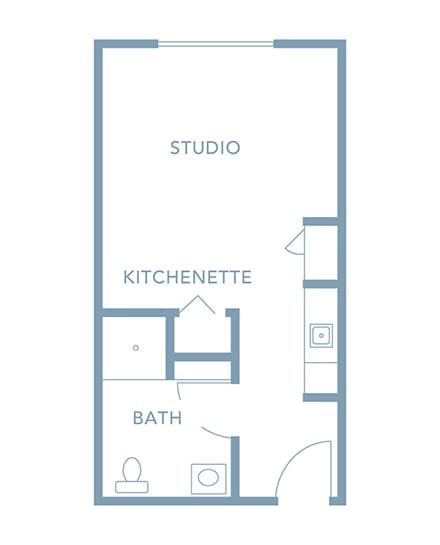

Housing Options: Studio / 1 Bed / 2 Bed

Building Type: Two-story

Transportation Services

Fitness and Recreation

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.

Types of Care at The Landing of Brighton – Rochester

Places of interest near The Landing of Brighton – Rochester

4.1 miles from city center

1350 Westfall Rd, Rochester, NY 14618

Calculate Travel Distance to The Landing of Brighton – Rochester

Add your location

Join Our Online

Senior Community!

Connect, laugh, and explore — all from the comfort of your home.

Guides for Better Senior Living

From costs to care, explore the most important topics to make informed decisions about your future.

Comparison Chart

For seniors needing help with daily tasks but not full-time nursing.

For self-sufficient seniors seeking community and minimal assistance.

Specialized care for those with Memory Loss, Alzheimer’s, or dementia, ensuring safety and support.

24/7 care needed

For seniors needing help with daily tasks but not full-time nursing.

Specialized care for those with Memory Loss, Alzheimer’s, or dementia, ensuring safety and support.

For seniors needing help with daily tasks but not full-time nursing.

Specialized care for those with Memory Loss, Alzheimer’s, or dementia, ensuring safety and support.

Respite Care

For seniors needing help with daily tasks but not full-time nursing.

Specialized care for those with Memory Loss, Alzheimer’s, or dementia, ensuring safety and support.

Specialized care for those with Memory Loss, Alzheimer’s, or dementia, ensuring safety and support.

Claim What’s Yours: Financial Aid for New York Seniors

- General: Age 65+ or disabled, New York resident, Medicaid- eligible, care need (not necessarily nursing home level).

- Income Limits (2025): ~$2,829/month (300% FBR, individual).

- Asset Limits: $30,182 (individual, higher due to NY Medicaid expansion).

- NY Specifics: Higher asset limit; urban density increases demand.

- Services: Personal care (5-7 hours/day), respite care (240 hours/year), home modifications ($1,500 avg.), assistive technology ($500 avg.).

- General: Age 60+, New York resident, at risk of decline but not nursing home level.

- Income Limits: ~$2,500/month (individual, varies).

- Asset Limits: $15,000 (individual).

- NY Specifics: Cost-sharing required above certain income; urban/rural balance.

- Services: In-home care (3-5 hours/week), respite (up to 10 days/year), case management, transportation (~5 trips/month).

- General: Age 62+, NYC resident, live in rent-controlled/stabilized apartment, spend >1/3 of income on rent.

- Income Limits (2025): $50,000/year (household).

- Asset Limits: No strict asset cap, but income-focused eligibility.

- NY Specifics: Limited to NYC’s rent-regulated units; high demand in urban areas.

- Services: Rent freeze (e.g., covers increases of $50-$200+/month); tax credit for landlord.

- General: Age 65+, NYC resident, own and live in a 1-3 family home, co-op, or condo.

- Income Limits (2025): $58,399/year (household).

- Asset Limits: No strict asset cap, income-driven eligibility.

- NY Specifics: Applies only in NYC; excludes large apartment buildings.

- Services: Property tax reduction (5-50%, e.g., $500-$5,000/year based on income and property value).

- General: One participant must be 60+ (host or guest), NYC resident, able to share living space.

- Income Limits: No strict limit, but targets those needing cost relief.

- Asset Limits: Not applicable; focus on housing need.

- NY Specifics: Primarily NYC-focused; limited slots due to demand.

- Services: Shared housing (reduces rent/living costs by 30-50%, e.g., $500-$1,000/month savings); optional light assistance between housemates.

Contact Us

Beds shows the number of beds currently filled in each community agianst the total number of beds. Higher occupied beds usually indicates strong demand and reputation, while lower occupancy may suggest more availability for new residents.

What questions do you have about The Landing of Brighton – Rochester?

We’ll help you with pricing, availability, and anything else you need.

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today