The Wesleyan Independent Living

The Wesleyan Independent Living is an Independent Living Home in Texas

The Wesleyan Independent Living is an Independent Living Home in Texas

The Wesleyan Independent Living

The Wesleyan Independent Living is an Independent Living Home in Texas

The Wesleyan Independent Living is an Independent Living Home in Texas

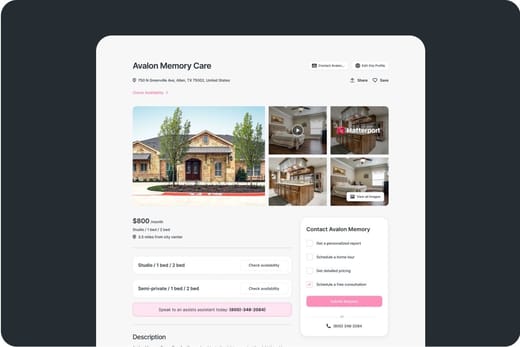

Within the Wesleyan Senior Living Community in Georgetown, TX, The Wesleyan stands as a hallmark of independent living, offering seniors a haven of comfort and convenience. This esteemed facility is designed to cater to the unique needs and desires of its residents, and prides itself on its commitment to fostering independence while ensuring peace of mind, in order to lead fulfilling lives on their terms.

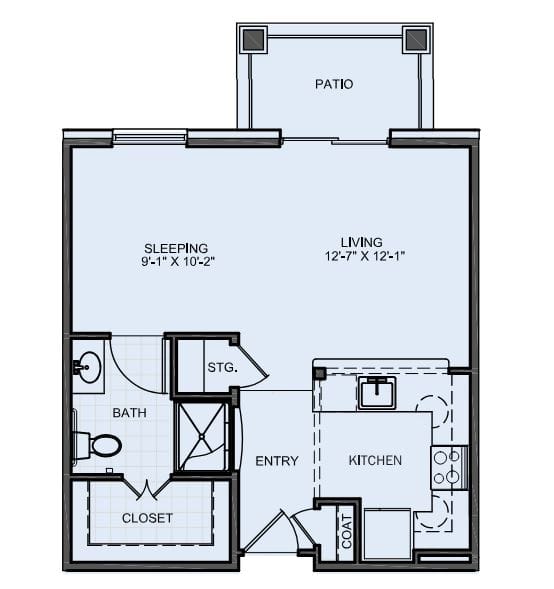

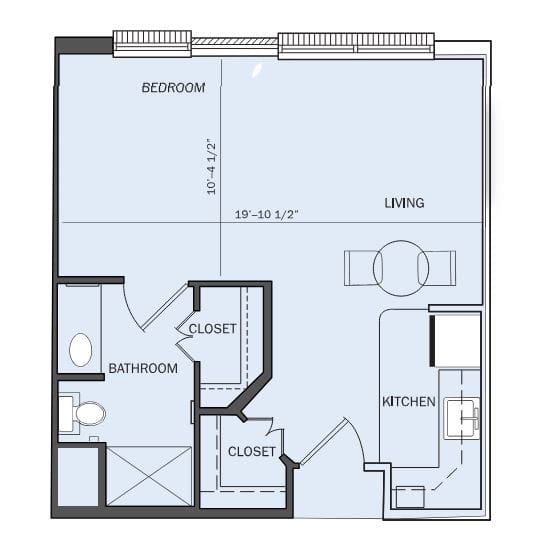

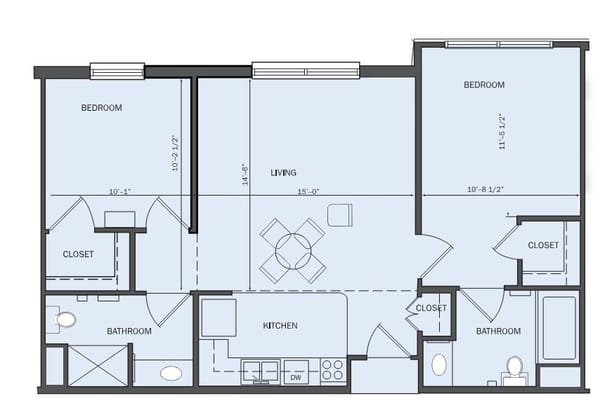

At The Wesleyan, residents enjoy a range of thoughtful amenities tailored to enhance their daily routines. The well-appointed apartments feature full-sized kitchens equipped with modern conveniences such as ovens and dishwashers, empowering residents to prepare meals with ease and indulge in the joy of cooking. Controlled thermostats offer personalized comfort, ensuring an ideal living environment throughout the year. The facility’s emphasis on safety is reflected in the presence of walk-in showers and an advanced emergency call system, providing residents with both convenience and security. With these amenities, The Wesleyan creates a nurturing atmosphere where seniors can embrace their independence, knowing that their well-being is a top priority.

What does this home offer?

Pets Allowed: Yes, Pets Allowed

Room Sizes: 450 - 840 sq. ft

Housing Options: Studio / 1 Bed / 2 Bed / Cottages

Building Type: Two-story

Transportation Services

Fitness and Recreation

Types of Care at The Wesleyan Independent Living

Compare Independent Living around Georgetown

The information below is reported by the Texas Health and Human Services Commission.Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Nursing

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Places of interest near The Wesleyan Independent Living

3.9 miles from city center

210 White Heron Dr, Georgetown, TX 78628

Calculate Travel Distance to The Wesleyan Independent Living

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Financial Aid for Texas Seniors

Get financial aid guidanceContact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

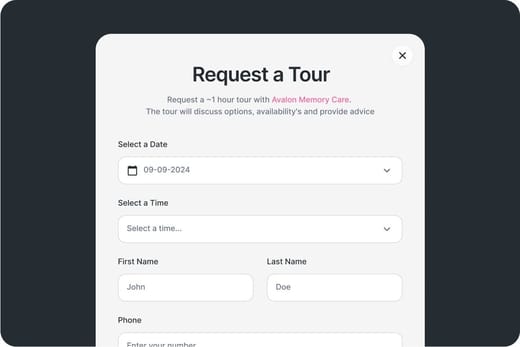

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.