Trinity Oaks of Pearland

Trinity Oaks of Pearland is an Independent Living Home in Texas

Trinity Oaks of Pearland is an Independent Living Home in Texas

Trinity Oaks of Pearland

Trinity Oaks of Pearland is an Independent Living Home in Texas

Trinity Oaks of Pearland is an Independent Living Home in Texas

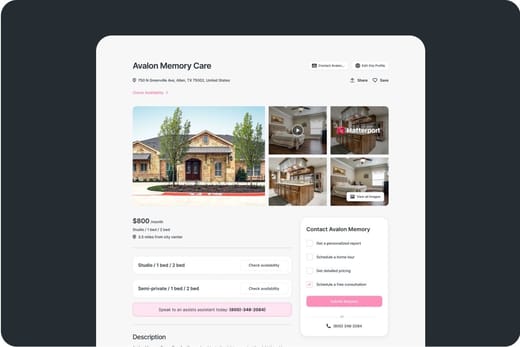

Residing in the harmonious Pearland Parkway, Pearland, TX, is the outstanding senior living community of Trinity Oaks of Pearland providing assisted living and independent living. With a wide range of cozy and sophisticated one-bedroom and two-bedroom residences, seniors enjoy unmatched comfort and security. The community strives to provide accessible and quality care and assistance for seniors to thrive and make the most out of their best years.

Achieve your aspirations and create meaningful experiences with engaging activities and enjoyable events. In Trinity Oaks of Pearland, residents enjoy restaurant-style dining with healthy and tasty meals approved by licensed dietitians to meet dietary restrictions and preferences. Moreover, the community is placed near wonderful amenities and stunning attractions ensuring seniors’ needs and desires are easily accessible.

Capacity and availability

Medium-capacity home

Offers a balance of services and community atmosphere.

About this community

Additional licensing details

Ownership & operating entity

Trinity Oaks of Pearland is legally operated by CHG SENIOR LIVING OF PEARLAND LLC, and administrated by MICHELLE QUINTANILLA.

Staffing

Key information about the people who lead and staff this community.

Leadership

Care Services

What does this home offer?

Room Sizes: 360 - 795 / 665 - 980 sq. ft.

Housing Options: Studio / 1 Bed / 2 Bed

Building Type: Single-story

Transportation Services

Fitness and Recreation

Types of Care at Trinity Oaks of Pearland

Inspection History

In Texas, the Health and Human Services Commission (HHSC) is the primary regulatory body that conducts unannounced inspections and publishes quality reports for all long-term care homes.

Results

2 with citations

0 without citations

Texas average: 1 inspection with citations

6 total citations

Citations indicate regulatory violations. A higher number implies the facility had several areas requiring improvement.

Texas average: 6 citations

Texas average: 2 health citations

Texas average: 6 life safety citations

0 enforcement actions

Penalties or interventions imposed by state regulators when facilities do not comply with quality, safety or regulatory standards.

Texas average: 1 enforcement action

Compare Independent Living around Brazoria County

The information below is reported by the Texas Health and Human Services Commission.Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Respite Care

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Places of interest near Trinity Oaks of Pearland

33.8 miles from city center

3033 Pearland Pkwy, Pearland, TX 77581

Calculate Travel Distance to Trinity Oaks of Pearland

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Financial Aid for Texas Seniors

Get financial aid guidanceContact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

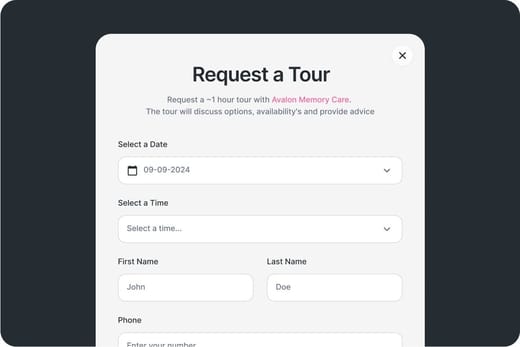

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.