Trusted Choice Homecare

Trusted Choice Homecare

Trusted Choice Homecare is a Home Care Agency in New York

Trusted Choice Homecare is a Home Care Agency in New York

Found amidst the hustle and bustle of Buffalo, New York, Trusted Choice Homecare has been serving New York Families alongside CDPAP. This Medicaid program allows chronically ill or physically disabled clients to hire their home care assistants or skilled nurses to help with everyday activities. Trusted Choice provides an in-depth assessment that enables New York Families to engage in their care choice.

Since 2016, they have provided families with the peace of mind of caring for their loved ones and getting paid simultaneously. These caregivers provide a range of care, including bathing, feeding, and dressing. This comforts their clients, knowing they can trust who cares for them because they are family.

Compare Home Care around Buffalo

The information below is reported by the New York State Department of Health.Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

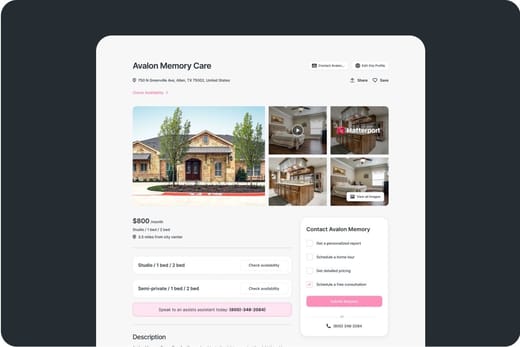

Places of interest near Trusted Choice Homecare

1.3 miles from city center

500 Seneca St, Buffalo, NY 14204

Calculate Travel Distance to Trusted Choice Homecare

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Financial Aid for New York Seniors

Get financial aid guidanceContact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

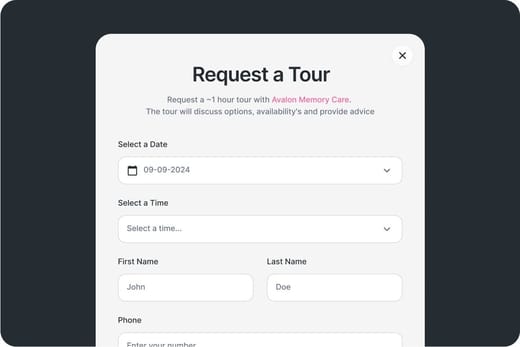

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.