Landmark Villa

Landmark Villa is an Assisted Living Home in California

Landmark Villa is an Assisted Living Home in California

Landmark Villa

Landmark Villa is an Assisted Living Home in California

Landmark Villa is an Assisted Living Home in California

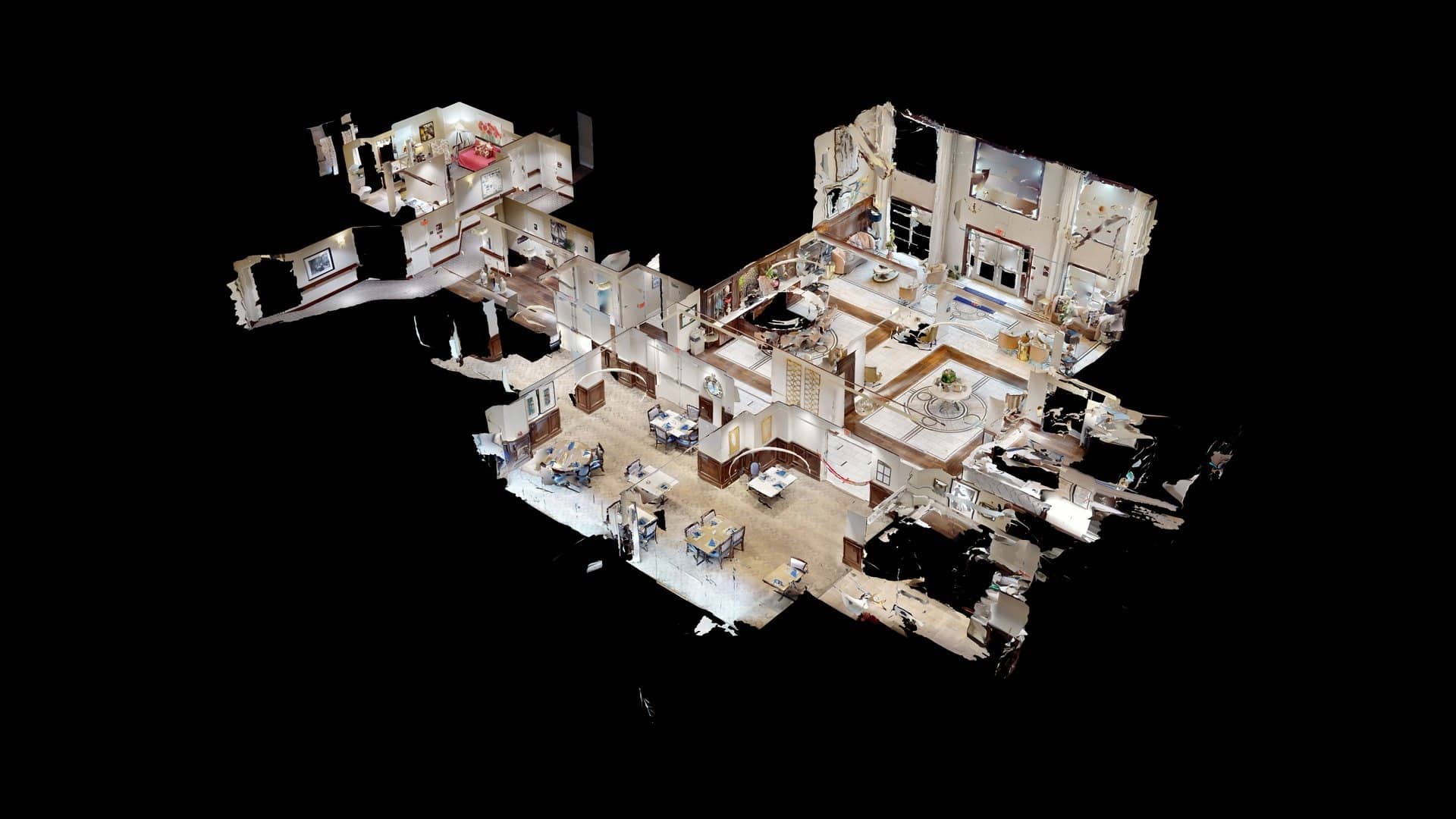

Beautifully located in the quiet residential area of Hayward, CA, Landmark Villa is an idyllic retreat that offers assisted living and independent living. The community is dedicated to enhancing residents’ living experiences, providing the highest quality of care and assistance tailored to their special needs. Here, residents are guaranteed a maintenance-free lifestyle with the community handling the housekeeping, laundry, and daily living activities.

Enriching activities and engaging programs are also conducted for residents to gain meaningful experiences and meet new friends. Indulge in healthy and delightful meals that cater to dietary needs and tastes. With personalized care plans and specially designed amenities, residents will surely have the finest retirement experience while staying on a budget.

About this community

Landmark Villa is legally operated by HCRC, INC, and is overseen by Regional Office 15.

What does this home offer?

Room Sizes: 432 / 470 / 563 sq. ft

Housing Options: Studio / 1 Bed / Shared Rooms

Building Type: 2-story

Dining Services

Beauty Services

Transportation Services

Recreational Activities

Exercise Programs

Parking Available

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.

Types of Care at Landmark Villa

Inspection History

Inspection Report Summary for Landmark Villa

The California Department of Social Services’ Community Care Licensing Division conducted several unannounced inspections of Landmark Villa (Facility Number 015601501) in Hayward, California, between September 2021 and June 2022. The September 22 2021 visit focused on infection‑control compliance during the COVID‑19 pandemic and found no deficiencies. Staff and residents adhered to masking, temperature checks, and hand‑washing protocols, and the facility maintained an up‑to‑date mitigation plan, vaccination records, emergency food supplies, and functional fire‑safety equipment. The evaluator noted that a written emergency/disaster plan was posted and that the facility had achieved 95 % vaccination coverage among residents and staff.

In contrast, subsequent case‑management visits uncovered recurring documentation and care‑planning deficiencies, particularly for residents with dementia. The October 13 2021 investigation revealed that resident R1, who has dementia, had no medical assessments in 2018 or 2019 and that Landmark Villa had neither a dementia care plan nor an updated plan of operation as required by Title 22, Section 87705. These omissions posed potential health and safety risks, and the evaluator issued a plan of correction with a due date of October 27 2021. A similar lapse was found in the June 1 2022 visit, where the facility had not updated R1’s appraisal/needs and services plan after a fall in November 2019, had lost centrally stored medication and destruction records, and had not maintained accurate medication delivery logs. These violations were cited under Title 22, Section 87463, with a correction deadline of June 15 2022.

Other inspections, such as the February 7 2022 health‑check visit, found no deficiencies, though the evaluator noted missing hand‑washing posters in kitchenettes and the absence of a pedal‑operated trash bin outside an isolation room. Across all reports, Landmark Villa demonstrated strong compliance with COVID‑19 protocols but struggled to maintain the documentation and individualized care requirements mandated for residents with dementia. The facility has been required to submit updated plans, medical assessments, and supporting documentation to CCL by the specified deadlines, with the potential for civil penalties if deficiencies remain uncorrected.

Places of interest near Landmark Villa

1.7 miles from city center

21000 Mission Blvd, Hayward, CA 94541

[email protected]

+1 510-276-2872

Calculate Travel Distance to Landmark Villa

Add your location

Guides for Better Senior Living

From costs to care, explore the most important topics to make informed decisions about your future.

Comparison Chart

For seniors needing help with daily tasks but not full-time nursing.

For seniors needing help with daily tasks but not full-time nursing.

For seniors needing help with daily tasks but not full-time nursing.

Respite Care

For seniors needing help with daily tasks but not full-time nursing.

For seniors needing help with daily tasks but not full-time nursing.

Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Respite Care

Claim What’s Yours: Financial Aid for California Seniors

- General: Age 65+, California resident, Medi-Cal eligible, nursing home risk.

- Income Limits (2025): ~$2,829/month (300% FBR, individual).

- Asset Limits: $2,000 (individual), $3,000 (couple).

- CA Specifics: County-managed; waitlists possible.

- Services: In-home support (4-6 hours/day), respite care (14 days/year), meals (~$6/meal), transportation (8 trips/month), care management.

- General: Age 65+, California resident, Medicaid-eligible or low-income.

- Income Limits: ~$1,732/month (individual, Medi-Cal threshold).

- Asset Limits: $2,000 (individual).

- CA Specifics: Can hire family as caregivers.

- Services: Personal care (up to 283 hours/month), homemaker services, respite (varies).

- General: Age 65+, California resident, Medi-Cal-eligible, nursing home-eligible but community-capable.

- Income Limits: ~$2,829/month (300% FBR, individual).

- Asset Limits: $2,000 (individual).

- CA Specifics: Available in 38 counties; waitlists common.

- Services: Case management, respite care (up to 10 days/year), minor home mods (avg. $500), adult day care (~$50/day).

- General: Age 62+, California resident, own and live in home, 40% equity.

- Income Limits (2025): ~$51,500/year (household, adjusted annually).

- Asset Limits: Equity-based; no strict asset cap.

- CA Specifics: Deferred taxes accrue interest (5% as of 2024); repaid upon sale/death.

- Services: Property tax deferral (avg. $1,000-$3,000/year, varies by county).

- General: Age 65+ or disabled, California resident, Medi-Cal-eligible, nursing home-eligible.

- Income Limits: ~$2,829/month (300% FBR, individual).

- Asset Limits: $2,000 (individual).

- CA Specifics: Available in 15 counties (e.g., LA, Sacramento); waitlists common.

- Services: Personal care in ALFs (5-7 hours/day), medication management, social services.

- General: Caregivers of California residents 60+ needing help with 3+ daily activities; no caregiver age limit.

- Income Limits: No strict limit; cost-sharing above ~$2,500/month threshold.

- Asset Limits: Not applicable; need-based.

- CA Specifics: High demand in urban areas; complements IHSS respite.

- Services: Respite care (up to 10 days/year), counseling (4-6 sessions/year), training (2-3 workshops/year), supplies (~$200/year).

- General: Age 60+ priority, California resident, low-income, utility/heating need.

- Income Limits (2025): ~$2,510/month (200% of poverty level, individual).

- Asset Limits: Not applicable; income-focused.

- CA Specifics: High demand in inland/coastal extremes; weatherization capped at $5,000/home.

- Services: Utility payments (avg. $500-$1,000/year), weatherization (e.g., insulation, avg. $1,000-$3,000 savings).

Contact Us

What questions do you have about Landmark Villa?

We’ll help you with pricing, availability, and anything else you need.

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

Homes near Hayward, CA