Bentley Commons at Lynchburg

Bentley Commons at Lynchburg is an Assisted Living Home in Virginia

Bentley Commons at Lynchburg is an Assisted Living Home in Virginia

Bentley Commons at Lynchburg

Bentley Commons at Lynchburg is an Assisted Living Home in Virginia

Bentley Commons at Lynchburg is an Assisted Living Home in Virginia

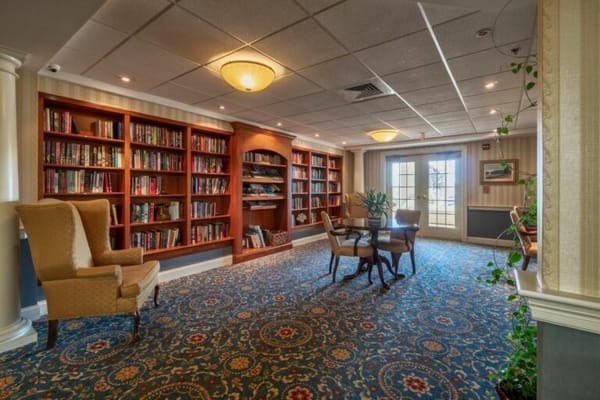

Nestled in the heart of Lynchburg, Virginia, Bentley Commons at Lynchburg is a beacon of luxury in senior living. Offering a spectrum of living options, including independent living, assisted living, and respite care, this community embraces a warm and caring environment, catering to seniors needing assistance with daily living tasks. Uniquely designed to meet the diverse needs and lifestyles of its senior residents, Bentley Commons at Lynchburg embodies the essence of residential senior living. Independence, social interaction, and leisure activities flourish within the community, all delivered with an unwavering commitment to exceptional care and service.

Enriching lives in this vibrant community extends beyond the exquisite surroundings. Situated in a thoughtfully designed neighborhood, Bentley Commons at Lynchburg offers an optimal lifestyle for its residents. The hospitable team, marked by diligence, compassion, and care, ensures that residents thrive in an environment boasting beautiful suites, luxurious common areas, and impeccably manicured grounds. Bentley Commons at Lynchburg opens the door to quality care, social events, and the camaraderie of friendly neighbors. Conveniently located off Graves Mill Road, with quick access to shopping and services, this community operates daily from 8:00 AM to 8:00 PM, inviting residents to experience the epitome of senior living in Lynchburg.

How BBB ratings work

Safety, Compliance & Inspections Overview

-

Citations

Number of deficiencies or violations identified during inspections conducted by Virginia regulators. 41 citations

-

BBB Accreditation

Indicates whether the business meets BBB accreditation standards. Not Accredited No review yet

Not accredited by the BBB, meaning its business practices have not been formally verified through BBB review. -

Total Complaints

Total number of complaints filed against this facility. 17 complaints

Complaints are reports submitted to the state about concerns regarding care, safety, staffing, or facility conditions. -

Total Violations

Total number of regulatory violations on record. 28 violations

Violations are confirmed instances where the facility did not meet regulatory requirements and required correction. -

Inspection Reports

Opens the facility's official licensing and inspection record as maintained by the Virginia transparency or regulatory portal. View Inspection Reports

Facility & Licensing Details

-

Primary Contact

Main representative or administrator responsible for the community, as listed in Virginia licensing records. Mr. Ben Osterkamp, Director of Community Relations

-

Facility Type

Indicates the state-regulated license category used in Virginia (e.g., Residential Care Facility for the Elderly). Assisted Living Facility

-

License Status

Shows whether the facility is currently licensed, closed, or pending renewal in Virginia. Active

-

License Expires

Date when the current license expires and must be renewed. June 19, 2026

-

Administrator

Name of the facility administrator. Ms. Shannon Rudelis

-

Qualifications

Care types and qualifications this facility is certified to provide. Residential and Assisted Living Care , Non-Ambulatory

-

Assigned Inspector

State inspector assigned to this facility. Angela Marie Swink

-

Date Business Started

The date the business reports it began operations. January 1, 2008

-

Business Hours

Facility operating hours for visitors and inquiries. 24 X 7 , Monday - Sunday

What does this home offer?

Pets Allowed: Yes, Pets Allowed

Building Type: 3-story

Transportation Services

Fitness and Recreation

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.

Types of Care at Bentley Commons at Lynchburg

Places of interest near Bentley Commons at Lynchburg

5.8 miles from city center

1604 Graves Mill Rd, Lynchburg, VA 24502

Calculate Travel Distance to Bentley Commons at Lynchburg

Add your location

Comparison Chart

For seniors needing help with daily tasks but not full-time nursing.

Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

For seniors needing help with daily tasks but not full-time nursing.

Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

For seniors needing help with daily tasks but not full-time nursing.

For seniors needing help with daily tasks but not full-time nursing.

For self-sufficient seniors seeking community and minimal assistance.

Respite Care

For seniors needing help with daily tasks but not full-time nursing.

For self-sufficient seniors seeking community and minimal assistance.

Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Guides for Better Senior Living

From costs to care, explore the most important topics to make informed decisions about your future.

Claim What’s Yours: Financial Aid for Virginia Seniors

- General: Age 65+ or disabled, Virginia resident, Medicaid-eligible, nursing home-level care need.

- Income Limits (2025): ~$2,829/month (300% FBR, individual).

- Asset Limits: $2,000 (individual), $3,000 (couple).

- VA Specifics: Managed care model; high demand in urban areas.

- Services: Personal care (5-7 hours/day), respite (240 hours/year), adult day care ($65/day), home modifications ($1,500 avg.).

- General: Caregiver of someone 60+, Virginia resident.

- Income Limits: ~$2,500/month (individual, varies).

- Asset Limits: $40,000 (individual).

- VA Specifics: Limited grants; rural/urban balance.

- Services: In-home respite (up to 30 days/year), adult day care (~$65/day), facility respite (up to 5 days).

- General: Age 60+ (or disabled 18+), VA resident, need significant care (2+ ADLs), not Medicaid-eligible.

- Income Limits (2025): Varies by locality; typically < ~$2,510/month (200% FPL).

- Asset Limits: Limited assets (excludes home, car); varies by DSS.

- VA Specifics: Serves ~5,000 annually; focuses on low-income independence.

- Services: Personal care (4-6 hours/week), adult day care (~$60/day), chore services, assessments, respite (~5 days/year).

- General: Age 65+ (or disabled 18+), VA resident, living in approved ALF/foster care, SSI-eligible or low-income.

- Income Limits (2025): ~$1,041/month (individual, SSI level + $20 disregard); higher with medical deductions.

- Asset Limits: $2,000 (individual).

- VA Specifics: Serves 4,000; personal needs allowance ($90/month).

- Services: Cash (~$1,400-$1,700/month in 2025, varies by region) for ALF/foster care costs; basic care included.

- General: Age 65+ or disabled, VA resident, Medicare Part A/B.

- Income Limits (2025): ~$2,510/month (QMB), ~$3,380/month (SLMB), ~$3,598/month (QI)—individual.

- Asset Limits: $9,430 (individual), $14,130 (couple).

- VA Specifics: Includes Extra Help for Part D; no waitlist.

- Services: Covers Part B premiums ($174.70/month), deductibles ($240/year), copays (~20%).

- General: Age 60+ prioritized, VA resident, low-income household.

- Income Limits (2025): ~$3,970/month (185% FPL).

- Asset Limits: Not assessed.

- VA Specifics: Fuel, Crisis, Cooling components; serves ~100,000 households.

- Services: Heating/cooling aid ($300-$1,000/season), crisis aid ($500 max), equipment repair (~$250).

- General: Age 55+, unemployed, low-income, VA resident.

- Income Limits (2025): ~$1,983/month (125% FPL).

- Asset Limits: Not specified.

- VA Specifics: Priority for veterans, rural residents; AARP/Goodwill partnership.

- Services: Paid training (~20 hours/week at ~$7.25/hour), job placement.

- General: Age 65+ or disabled veteran/spouse, VA resident, wartime service, ADL help (A&A) or homebound.

- Income Limits (2025): Net income < ~$1,984/month (veteran with dependent, A&A); pension offsets income.

- Asset Limits: ~$155,356 (net worth).

- VA Specifics: High veteran population; supports rural/urban needs.

- Services: Cash (~$1,433-$2,642/month veteran, ~$951-$1,318 spouse) for care costs.

- General: Age 65+ or disabled, VA resident, homeowner, income/asset limits vary by locality.

- Income Limits (2025): ~$50,000-$75,000/year (household, e.g., Fairfax: $72,000; Richmond: $50,000).

- Asset Limits: Varies (e.g., Fairfax: $400,000 net worth; Richmond: $100,000).

- VA Specifics: Offered in 90% of localities; saves ~$500-$2,000/year.

- Services: Tax exemption/deferral (~$500-$2,000/year depending on locality).

- General: Age 60+, VA resident, low-income.

- Income Limits (2025): ~$2,322/month (185% FPL).

- Asset Limits: Not assessed.

- VA Specifics: Vouchers (~$50-$75/season); serves ~15,000 via AAAs.

- Services: Vouchers (~$50-$75/season) for produce at farmers’ markets.

What questions do you have about Bentley Commons at Lynchburg?

We’ll help you with pricing, availability, and anything else you need.

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

Homes near Lynchburg, VA