Canton Christian Home

Canton Christian Home is an Independent Living Home in Ohio

Canton Christian Home is an Independent Living Home in Ohio

Canton Christian Home

Canton Christian Home is an Independent Living Home in Ohio

Canton Christian Home is an Independent Living Home in Ohio

Serving seniors with pride for over 40 years, Canton Christian Home is a faith-based, non-profit continuing care retirement community in Canton, Ohio. Canton Christian Home provides a range of senior living choices, such as skilled nursing care, assisted living, and independent living. With over 25 floor plans, the community ensures that residents find a living space that matches their needs and tastes.

A friendly, Christ-centered community, Canton Christian Home supports residents’ dynamic, active lifestyles through its extensive services. Promoting residents’ health and social life, the community provides dining options where residents, family, and friends can come together and enjoy a creative, nutritious, delicious meal from scratch. Other amenities include cozy meeting rooms, salon services, gift shops, and access to physical, occupational, and speech therapies.

-

Occupancy trails most facilities in the state, suggesting excess open capacity. Bed capacity aligns with the typical community size in the state, allowing steady admissions. Residents tend to stay here longer than similar facilities across the state.

-

Home revenue sits below most peers, indicating modest billing throughput. Payroll outlays align with state averages, keeping staffing resources on par with peers. Total income trails most communities, suggesting tighter operating margins.

-

Medicare nights track the statewide midpoint, keeping volumes steady. Medicaid nights fall below most peers, pointing to lighter Medicaid reliance. Private pay nights hover around the statewide average, supporting a diversified mix.

Percentage of home revenue spent on payroll costs.

Percentage of home revenue spent on payroll costs.

CMS 5-star rating based on health inspections, staffing, and quality measures.

CMS 5-star rating based on health inspections, staffing, and quality measures.

Rating based on deficiencies found during state health inspections.

Rating based on deficiencies found during state health inspections.

Rating based on nurse staffing hours per resident per day.

Rating based on nurse staffing hours per resident per day.

Quality Measures rating based on clinical outcomes for residents.

Quality Measures rating based on clinical outcomes for residents.

Total nurse staffing hours per resident per day.

Total nurse staffing hours per resident per day.

Number of resident nights paid by Medicare for short-term or rehab care.

Number of resident nights paid by Medicare for short-term or rehab care.

Resident nights covered by Medicaid for long-term care or support services.

Resident nights covered by Medicaid for long-term care or support services.

Nights paid privately by residents or families, without Medicare/Medicaid coverage.

Nights paid privately by residents or families, without Medicare/Medicaid coverage.

How BBB ratings work

About this community

Additional licensing details

Ownership & operating entity

Canton Christian Home is administrated by JOANN KONTUR.

Policies

Staffing

Key information about the people who lead and staff this community.

Leadership

Contact Information

What does this home offer?

Pets Allowed: Yes, Pets Allowed

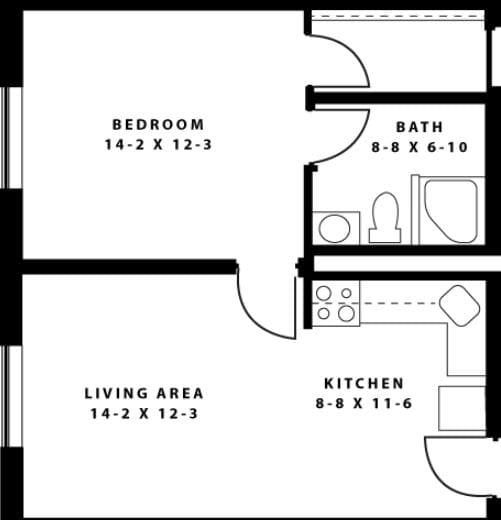

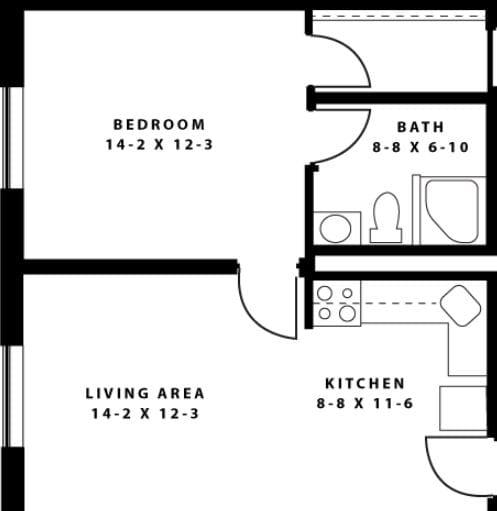

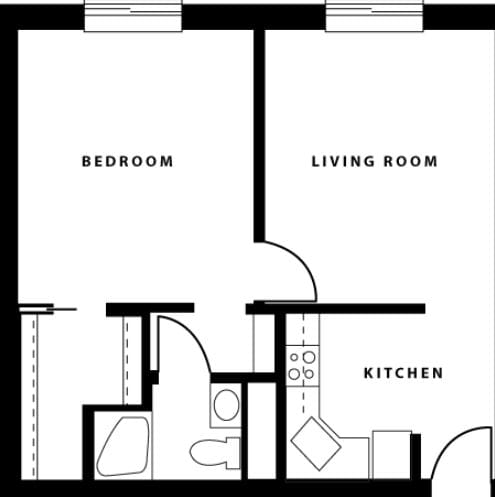

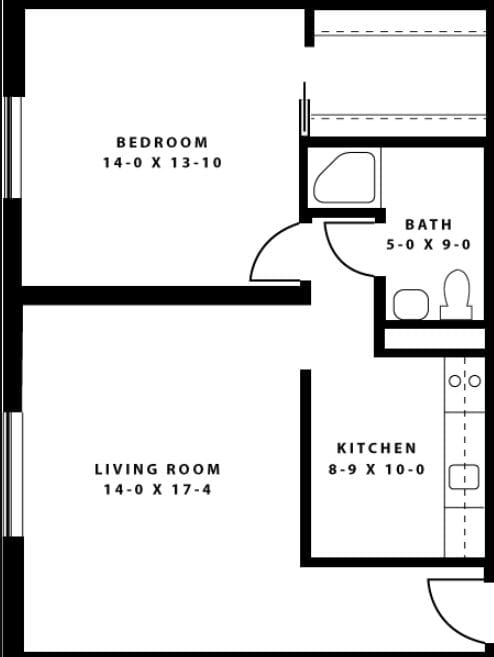

Housing Options: Studio / 1 Bed

Building Type: Mid-rise

Transportation Services

Fitness and Recreation

Types of Care at Canton Christian Home

Access & Eligibility

Ways to qualify for care at this community, including accepted programs and payment options.

Inspection History

In Ohio, the Department of Health, Bureau of Survey and Certification conducts unannounced onsite inspections to evaluate the quality of care and environment in all licensed facilities.

Latest inspection

Inspection oversight

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.

Places of interest near Canton Christian Home

2.3 miles from city center

2550 Cleveland Ave NW, Canton, OH 44709

Calculate Travel Distance to Canton Christian Home

Add your location

Comparison Chart

The information below is reported by the Ohio Department of Health, Bureau of Survey and Certification.For seniors needing help with daily tasks but not full-time nursing.

For self-sufficient seniors seeking community and minimal assistance.

Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

24/7 care needed

For seniors needing help with daily tasks but not full-time nursing.

For seniors needing help with daily tasks but not full-time nursing.

For seniors needing help with daily tasks but not full-time nursing.

For self-sufficient seniors seeking community and minimal assistance.

Staffing Data

Source: CMS Payroll-Based Journal (Q2 2025)

Nursing Staff Breakdown

| Role ⓘ | Count ⓘ | Avg Shift (hrs) ⓘ | Uses Contractors? ⓘ |

|---|---|---|---|

| Registered Nurse | 7 | 10 | Yes |

| Licensed Practical Nurse | 46 | 9.5 | Yes |

| Certified Nursing Assistant | 118 | 7.5 | Yes |

Staff by Category

Contractor Analysis

| Role ⓘ | Employees ⓘ | Contractors ⓘ | Total Staff ⓘ | Total Hours ⓘ | Days Worked ⓘ | % of Days ⓘ | Avg Shift (hrs) ⓘ |

|---|---|---|---|---|---|---|---|

| Certified Nursing Assistant | 38 | 80 | 118 | 12,329 | 91 | 100% | 7.5 |

| Licensed Practical Nurse | 9 | 37 | 46 | 4,438 | 91 | 100% | 9.5 |

| Registered Nurse | 4 | 3 | 7 | 1,257 | 88 | 97% | 10 |

| Speech Language Pathologist | 0 | 5 | 5 | 1,022 | 80 | 88% | 5.3 |

| Administrator | 2 | 0 | 2 | 976 | 64 | 70% | 8 |

| Other Dietary Services Staff | 4 | 0 | 4 | 811 | 89 | 98% | 7.1 |

| Clinical Nurse Specialist | 2 | 0 | 2 | 806 | 64 | 70% | 9.1 |

| Physical Therapy Aide | 0 | 2 | 2 | 642 | 74 | 81% | 5.4 |

| Dietitian | 1 | 0 | 1 | 510 | 63 | 69% | 8.1 |

| Nurse Practitioner | 1 | 0 | 1 | 504 | 63 | 69% | 8 |

| Mental Health Service Worker | 1 | 0 | 1 | 504 | 63 | 69% | 8 |

| Physical Therapy Assistant | 0 | 2 | 2 | 323 | 60 | 66% | 5.4 |

| Respiratory Therapy Technician | 0 | 3 | 3 | 312 | 64 | 70% | 4.9 |

| Qualified Social Worker | 0 | 1 | 1 | 274 | 62 | 68% | 4.4 |

| Occupational Therapy Aide | 0 | 1 | 1 | 239 | 46 | 51% | 5.2 |

| Medical Director | 0 | 1 | 1 | 56 | 13 | 14% | 4.3 |

| Occupational Therapy Assistant | 0 | 2 | 2 | 21 | 9 | 10% | 2.3 |

Health Inspection History

Source: CMS Health Citations (Dec 2018 – Feb 2025)

Citation Severity Distribution

Top Deficiency Categories

Citation Sources

State Comparison (OH)

Recent Citations (Last 3 Years)

| Date | Severity ? | Category | Tag | Status |

|---|---|---|---|---|

| Feb 14, 2025 | G | Quality of Care | F0689 | Corrected |

| May 28, 2024 | G | Quality of Care | F0689 | Corrected |

| Mar 23, 2023 | D | Abuse/Neglect | F0609 | Corrected |

| Mar 23, 2023 | D | Abuse/Neglect | F0610 | Corrected |

| Mar 23, 2023 | D | Administration | F0773 | Corrected |

| Mar 23, 2023 | D | Infection Control | F0881 | Corrected |

| Mar 23, 2023 | F | Infection Control | F0885 | Corrected |

| Mar 23, 2023 | D | Nutrition | F0800 | Corrected |

| Mar 23, 2023 | D | Pharmacy | F0758 | Corrected |

| Mar 23, 2023 | D | Quality of Care | F0686 | Corrected |

| Mar 23, 2023 | D | Quality of Care | F0688 | Corrected |

| Mar 23, 2023 | D | Quality of Care | F0689 | Corrected |

| Mar 23, 2023 | D | Quality of Care | F0791 | Corrected |

| Mar 23, 2023 | D | Care Planning | F0635 | Corrected |

| Mar 23, 2023 | D | Care Planning | F0658 | Corrected |

| Mar 23, 2023 | D | Resident Rights | F0550 | Corrected |

| Mar 23, 2023 | D | Resident Rights | F0622 | Corrected |

| Mar 23, 2023 | D | Resident Rights | F0623 | Corrected |

| Feb 20, 2020 | D | Infection Control | F0881 | Corrected |

| Dec 19, 2018 | K | Abuse/Neglect | F0600 | Corrected |

| Dec 19, 2018 | K | Abuse/Neglect | F0607 | Corrected |

| Dec 19, 2018 | K | Abuse/Neglect | F0610 | Corrected |

| Dec 19, 2018 | E | Administration | F0835 | Corrected |

| Dec 19, 2018 | E | Administration | F0867 | Corrected |

| Dec 19, 2018 | F | Nutrition | F0812 | Corrected |

| Dec 19, 2018 | D | Pharmacy | F0757 | Corrected |

| Dec 19, 2018 | D | Quality of Care | F0689 | Corrected |

| Dec 19, 2018 | D | Quality of Care | F0698 | Corrected |

| Dec 19, 2018 | D | Care Planning | F0657 | Corrected |

| Dec 19, 2018 | D | Resident Rights | F0550 | Corrected |

| Dec 19, 2018 | D | Resident Rights | F0580 | Corrected |

Facility Characteristics

Source: CMS Long-Term Care Facility Characteristics (Data as of Jan 2026)

Resident Census by Payment Source

Programs & Services

Family Engagement

Active councils help families stay involved in care decisions and facility operations.

Guides for Better Senior Living

From costs to care, explore the most important topics to make informed decisions about your future.

Claim What’s Yours: Financial Aid for Ohio Seniors

- General: Age 60+, Ohio resident, Medicaid-eligible, nursing home-level care need.

- Income Limits (2025): ~$2,829/month (300% FBR, individual).

- Asset Limits: $2,000 (individual), $3,000 (couple).

- OH Specifics: Administered through regional agencies; waitlists possible.

- Services: Personal care (5-7 hours/day), respite (240 hours/year), adult day care ($65/day), home modifications ($1,500 avg.).

- General: Age 60+, Ohio resident, at risk of decline.

- Income Limits: ~$2,000/month (individual, varies).

- Asset Limits: $5,000 (individual).

- OH Specifics: Limited funding; regional variation.

- Services: In-home care (3-5 hours/week), respite (up to 10 days/year), transportation (~5 trips/month).

- General: Age 21+ (65+ prioritized), OH resident, Medicaid-eligible, NFLOC.

- Income Limits (2025): ~$2,829/month (individual); QIT required.

- Asset Limits: $2,000 (individual), $3,000 (couple).

- OH Specifics: Covers ~300 facilities; room/board not included (separate cost).

- Services: Personal care, meals, medication management, transportation (~$3,000-$4,000/month value).

- General: Age 55+, OH resident (specific counties), NFLOC, safe with PACE support.

- Income Limits (2025): ~$2,829/month (Medicaid-eligible); private pay option available.

- Asset Limits: $2,000 (individual), $3,000 (couple) for Medicaid enrollees.

- OH Specifics: Available in 9 counties (e.g., Cuyahoga, Franklin); expanding via Healthy Aging Grants.

- Services: Personal care (5-7 hours/day), medical care, meals, transportation, respite, therapies.

- General: Age 65+ or disabled, OH resident, Medicare Part A/B.

- Income Limits (2025): ~$2,510/month (QMB), ~$3,380/month (SLMB), ~$3,598/month (QI)—individual.

- Asset Limits: $9,430 (individual), $14,130 (couple).

- OH Specifics: Three tiers; includes Extra Help for Part D; no waitlist.

- Services: Covers Part B premiums ($174.70/month), deductibles ($240/year), copays (~20%).

- General: Age 60+ prioritized, OH resident, low-income household.

- Income Limits (2025): ~$3,970/month (individual, 185% FPL).

- Asset Limits: Not assessed; income-focused.

- OH Specifics: Covers gas, electric, oil; emergency aid via Winter/Summer Crisis Programs.

- Services: Heating/cooling aid ($300-$1,000/season), emergency aid ($500 max).

- General: Caregivers of 60+ needing care or 55+ caregivers of others; OH resident; functional needs (2+ ADLs).

- Income Limits (2025): Prioritizes ~$24,980/year (individual); no strict cap.

- Asset Limits: Not assessed; need-based.

- OH Specifics: 12 AAAs; rural/low-income priority; volunteer respite option.

- Services: Respite (4-6 hours/week or 5 days/year), adult day care ($60/day), training, supplies (~$500/year).

- General: Age 55+, unemployed, low-income, OH resident.

- Income Limits (2025): ~$1,983/month (125% FPL).

- Asset Limits: Not specified; income-focused.

- OH Specifics: Priority for veterans, rural residents; AARP partnership.

- Services: Paid training (~20 hours/week at ~$7.25/hour), job placement.

- General: Age 65+ or disabled veteran/spouse, OH resident, wartime service, need for ADL help (A&A) or homebound.

- Income Limits (2025): Net income < ~$1,984/month (veteran with dependent, A&A); pension offsets income.

- Asset Limits: ~$155,356 (net worth limit).

- OH Specifics: High veteran demand; supports care in multiple settings.

- Services: Cash (~$1,433-$2,642/month veteran, ~$951-$1,318 spouse) for care costs (e.g., in-home, assisted living).

- General: Age 65+ (or disabled), OH resident, homeowner, low-income.

- Income Limits (2025): ~$38,500/year (individual, adjusted annually).

- Asset Limits: Not assessed; home ownership required.

- OH Specifics: Reduces taxable value by $25,000; applies to primary residence.

- Services: Tax reduction (~$400-$800/year avg., varies by county).

- General: Age 60+ prioritized, OH resident, homeowner, hardship post-Jan 21, 2020.

- Income Limits (2025): ~$147,600/year (family of 4, 150% AMI; varies by county).

- Asset Limits: Not assessed; hardship-focused.

- OH Specifics: Covers delinquent mortgages, utilities, taxes; max $25,000 mortgage aid.

- Services: Mortgage aid ($25,000 max), utility/property tax aid ($5,000 avg.).

Contact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today