Casa Aldea University City Village

Casa Aldea University City Village is a Retirement Home in California

Casa Aldea University City… is a Retirement Home in California

Casa Aldea University City Village

Casa Aldea University City Village is a Retirement Home in California

Casa Aldea University City… is a Retirement Home in California

Located across San Diego, CA, Casa Aldea is an exceptional senior living community for people aged 55 and above. Offering active adult living and independent living, the community ensures the health and well-being of its residents. Casa Aldea features a wide range of cozy and spacious floor plans from studio apartments to three-plus bedroom apartments. With a skilled and dedicated team of professionals, the community emphasizes the comfort and safety of the seniors.

Casa Aldea ensures that residents gain meaningful connections and conducts engaging activities for its residents. Valuing the importance of pets as companions, the community allows cats and dogs in the residence and the dog park. Amenities include an arts and crafts studio, billiards, a book club, a clubhouse, gardening areas, and a pool and spa.

How BBB ratings work

About this community

Safety & Compliance

Care Services

Additional Policies & Features

Amenities & Lifestyle

Programs & Activities

Pricing & Financial Information

Dining & Nutrition

What does this home offer?

Pets Allowed: Yes, Pets Allowed

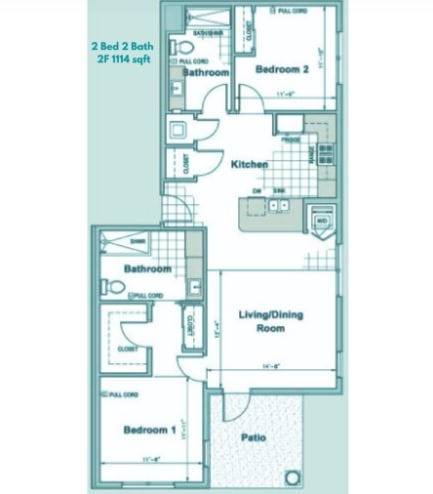

Room Sizes: 623 / 675 - 838 / 845 - 1269 / 1210 sq. ft.

Housing Options: Studio / 1 Bed / 2 Bed / 3+ Bed

Building Type: 1-story / 2-story / 3-story

Fitness and Recreation

Types of Care at Casa Aldea University City Village

Compare Retirement Homes around San Diego

The information below is reported by the California Department of Social Services and Department of Public Health.Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Nursing Homes 24/7 care needed

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Places of interest near Casa Aldea University City Village

11.8 miles from city center — 2.91 miles to nearest hospital (VA Medical Center-San Diego)

6132 Gullstrand St, San Diego, CA 92122

Calculate Travel Distance to Casa Aldea University City Village

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Financial Aid for California Seniors

Get financial aid guidanceContact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.