Ciel of Tri-Cities

Ciel of Tri-Cities is a Memory Care Home in Washington

Ciel of Tri-Cities is a Memory Care Home in Washington

Ciel of Tri-Cities

Ciel of Tri-Cities is a Memory Care Home in Washington

Ciel of Tri-Cities is a Memory Care Home in Washington

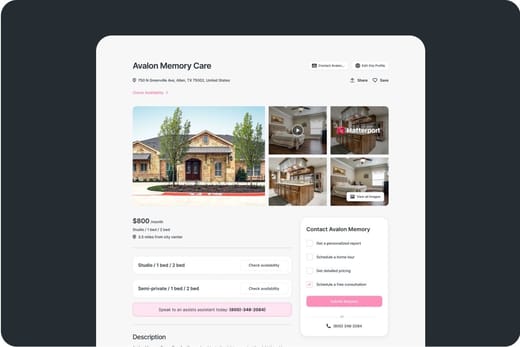

Be inspired to live an enriched life at Ciel of Tri-Cities, a trusted senior living community in Kennewick, WA, offering Independent Living, Assisted Living and Memory Care. Here, residents are offered well-built accommodations, ranging from charming studio, one- and two-bedroom apartments surrounded by Kennewick’s stunning, natural surroundings. With a 24/7 available licensed care team, each resident is guaranteed to receive the care they need when they need it.

Ciel of Tri-Cities takes the hassle out of homeownership, such as yard work and housekeeping to give residents more free time to explore the community and enjoy the amenities and diverse calendar of activities and events. Amenities include spacious game room, art studio and craft room, reading nooks and vibrant yoga and fitness studio for active residents. Residents also enjoy beautiful surroundings and gourmet dining, all while receiving individualized, around-the-clock care.

Capacity and availability

Medium-capacity home

Offers a balance of services and community atmosphere.

About this community

Additional licensing details

Care Services

All Levels of Care

Amenities & Lifestyle

Programs & Activities

Dining & Nutrition

What does this home offer?

Pets Allowed: Yes, Pets Allowed

Housing Options: Studio / 1 Bed

Building Type: Single-story

Transportation Services

Fitness and Recreation

Types of Care at Ciel of Tri-Cities

Access & Eligibility

Ways to qualify for care at this community, including accepted programs and payment options.

This facility is certified for eligible Medicaid services.

Inspection History

In Washington, the Department of Social and Health Services, Residential Care Services conducts unannounced inspections and issues reports on the quality of care in all licensed settings.

Washington average: 8 complaint visits

Washington average: 9 inspections

Compare Memory Care around Washington

The information below is reported by the Washington Department of Social and Health Services, Residential Care Services.Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Nursing Homes 24/7 care needed

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Nursing Homes 24/7 care needed

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Places of interest near Ciel of Tri-Cities

6.9 miles from city center

7255 W Grandridge Blvd, Kennewick, WA 99336, USA

Calculate Travel Distance to Ciel of Tri-Cities

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Financial Aid for Washington Seniors

Get financial aid guidanceYour Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

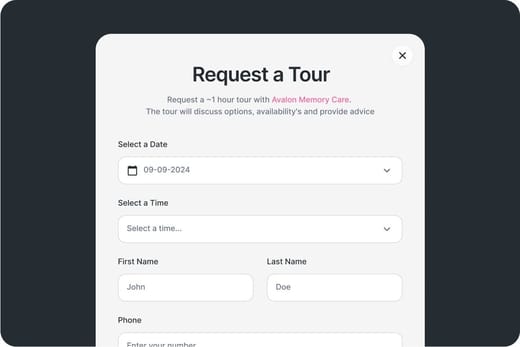

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.