Garden Estates of Temple

Garden Estates of Temple is an Assisted Living Home in Texas

Garden Estates of Temple is an Assisted Living Home in Texas

Garden Estates of Temple

Garden Estates of Temple is an Assisted Living Home in Texas

Garden Estates of Temple is an Assisted Living Home in Texas

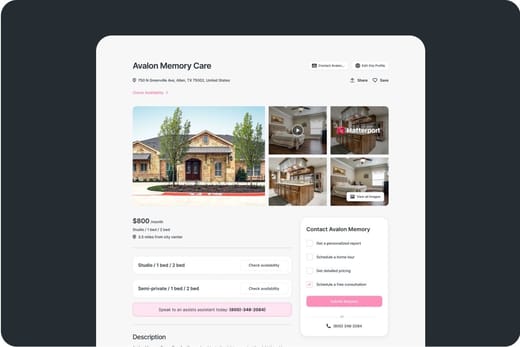

Discover the beauty and warmth of Garden Estates of Temple in Temple, TX, an outstanding destination where vibrant living and exceptional care unite. With a comprehensive range of services, including assisted living and independent living, this community ensures personalized support for every resident. Residents can choose from pet-friendly, cozy accommodations with various floor plans designed for comfort and individuality. Situated near medical facilities, entertainment attractions, and distinguished restaurants, the community offers the perfect balance between serenity and accessibility.

Amenities abound, including a full-service hair salon and barbershop, TV lounge, pub, bistro, library, and more. Residents can engage in diverse activities in these recreational areas. Explore its amazing shared spaces and meet new companions. At Garden Estates of Temple, life is celebrated with joy, comfort, and excellence.

Capacity and availability

Medium-capacity home

Offers a balance of services and community atmosphere.

How BBB ratings work

About this community

Additional licensing details

Ownership & operating entity

Garden Estates of Temple is legally operated by AHR TEMPLE TRS SUB, LLC.

Staffing

Key information about the people who lead and staff this community.

Leadership

Care Services

What does this home offer?

Pets Allowed: Yes, Pets Allowed

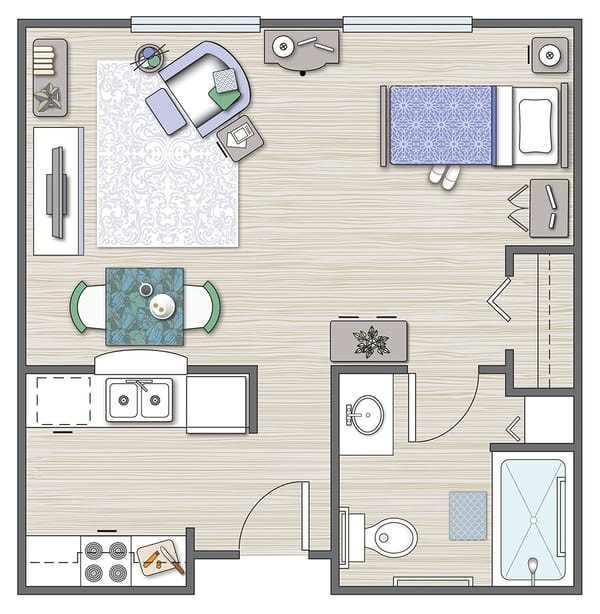

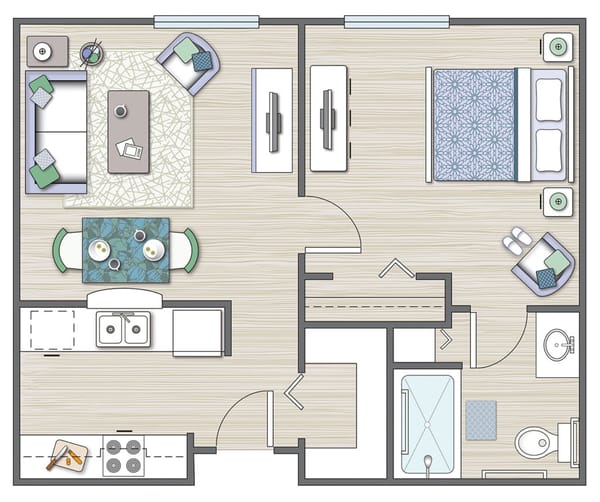

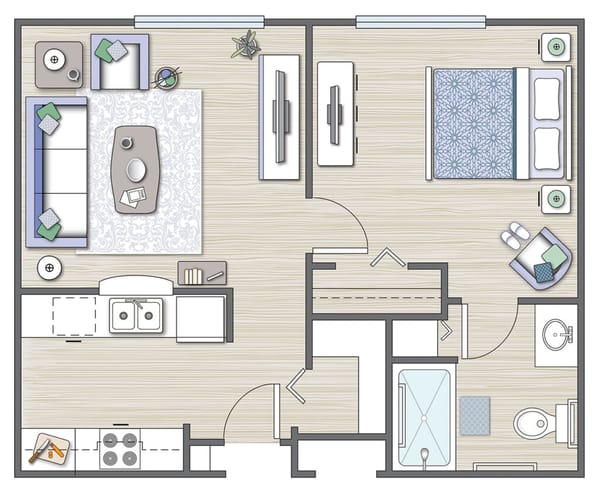

Housing Options: Private / Companion Suites

Building Type: Two-story

Fitness and Recreation

Types of Care at Garden Estates of Temple

Inspection History

In Texas, the Health and Human Services Commission (HHSC) is the primary regulatory body that conducts unannounced inspections and publishes quality reports for all long-term care homes.

Results

2 with citations

0 without citations

Texas average: 1 inspection with citations

8 total citations

Citations indicate regulatory violations. A higher number implies the facility had several areas requiring improvement.

Texas average: 6 citations

Texas average: 2 health citations

Texas average: 6 life safety citations

1 enforcement action

Penalties or interventions imposed by state regulators when facilities do not comply with quality, safety or regulatory standards.

18/01/2023: ADMINISTRATIVE PENALTY

Texas average: 1 enforcement action

Compare Assisted Living around Temple

The information below is reported by the Texas Health and Human Services Commission.Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Nursing Homes 24/7 care needed

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Nursing Homes 24/7 care needed

Places of interest near Garden Estates of Temple

3.7 miles from city center

5320 205 Loop, Temple, TX 76502, USA

Calculate Travel Distance to Garden Estates of Temple

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Financial Aid for Texas Seniors

Get financial aid guidanceContact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

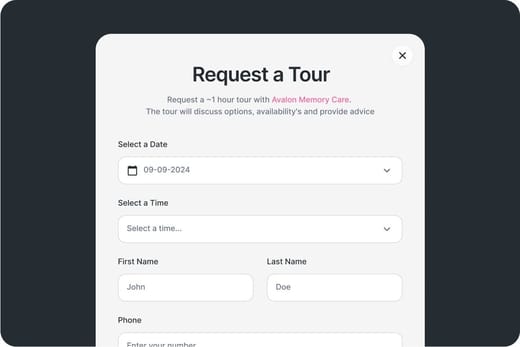

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.