Parsons House Austin

Parsons House Austin is an Assisted Living Home in Texas

Parsons House Austin is an Assisted Living Home in Texas

Parsons House Austin

Parsons House Austin is an Assisted Living Home in Texas

Parsons House Austin is an Assisted Living Home in Texas

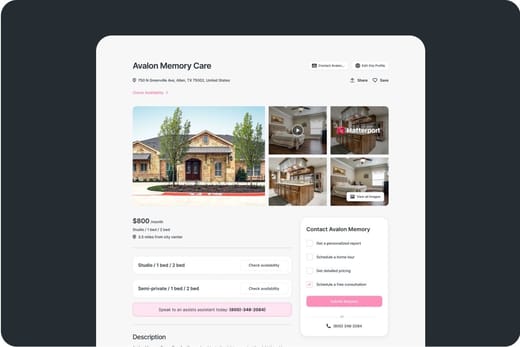

Parsons House Austin is an independent living, assisted living, and memory care facility that promotes a sense of freedom for each senior– regardless of living situation. The senior living community emphasizes the importance of each individual, which is why they make it a priority that residents are able to grow as individuals while being able to do what they want in a community that gives them a generous amount of feasibility and exceptional care found in their personalized care.

The lifestyle at Parsons is person-centered– with every corner and room in the building being given seamless access to– indoor and outdoor common areas, arts and crafts room, fitness center, game room, and hair service salon are among the few amenities that residents are eligible to use.

Kellie serves as the Executive Director at Parsons House Austin, fostering a supportive environment and a shared commitment to seniors. She values the company’s focus on advancement and continuous improvement, leading the community with dedication and care.

Capacity and availability

Medium-capacity home

Offers a balance of services and community atmosphere.

About this community

Additional licensing details

Ownership & operating entity

Parsons House Austin is legally operated by PARSONS HOUSE R.E. AUSTIN, LLC, and administrated by SARAH IRWIN.

Staffing

Key information about the people who lead and staff this community.

Leadership

Care Services

Types of Care at Parsons House Austin

What does this home offer?

Minimum Age: 55 Years Old

Housing Options: 1 Bed / 2 Bed

Building Type: Two Stories

Fitness and Recreation

Inspection History

In Texas, the Health and Human Services Commission (HHSC) is the primary regulatory body that conducts unannounced inspections and publishes quality reports for all long-term care homes.

Results

2 with citations

0 without citations

Texas average: 45 visits/inspections

Texas average: 9 complaint visits

Texas average: 28 inspections

Texas average: 2 inspections with citations

5 total citations

Citations indicate regulatory violations. A higher number implies the facility had several areas requiring improvement.

Texas average: 6 citations

Texas average: 2 health citations

Texas average: 6 life safety citations

0 enforcement actions

Penalties or interventions imposed by state regulators when facilities do not comply with quality, safety or regulatory standards.

Texas average: 1 enforcement action

Inspection Report Summary for Parsons House Austin

The most recent comprehensive inspection of PARSONS HOUSE AUSTIN occurred on March 01, 2022, and resulted in a total of 5 violations of state standards. Upon reviewing the inspection findings, it is evident that all 5 deficiencies were related to Life Safety Code requirements, with no Health Code violations cited. The Life Safety Code issues included failures to ensure compliance with applicable chapters of NFPA 101, proper functioning of the fire alarm and smoke detection system, adequate janitor closets, and prevention of cross-contamination in the kitchen and laundry areas. These deficiencies were identified during a previous inspection on October 2, 2019, and corrected between November 4, 2019, and October 29, 2019. No enforcement actions were found to be associated with these inspections or the most recent one on March 01, 2022.

Comparison Chart

The information below is reported by the Texas Health and Human Services Commission.Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Places of interest near Parsons House Austin

5.8 miles from city center

1130 Camino La Costa, Austin, TX 78752

Calculate Travel Distance to Parsons House Austin

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Claim What’s Yours: Financial Aid for Texas Seniors

- General: Age 65+ or disabled, Texas resident, Medicaid-eligible, care need (not always nursing home level).

- Income Limits (2025): ~$2,829/month (300% FBR, individual).

- Asset Limits: $2,000 (individual), $3,000 (couple).

- TX Specifics: Large state; rural access challenges.

- Services: Personal care (5-7 hours/day), respite (240 hours/year), adult day care (~$60/day), home aides.

- General: Age 60+, Texas resident, at risk of decline.

- Income Limits: ~$2,000/month (individual, varies).

- Asset Limits: $5,000 (individual).

- TX Specifics: Limited funding; high demand in urban areas.

- Services: In-home care (3-5 hours/week), respite (up to 10 days/year), transportation (~5 trips/month).

- General: Age 60+, TX resident; no income/asset limits.

- Income Limits (2025): None; donations encouraged.

- Asset Limits: Not assessed.

- TX Specifics: 28 AAAs; includes Meals on Wheels in some areas.

- Services: Meals (~$5-$7/meal), transportation, homemaker services (~4 hours/week), respite (~5 days/year), legal aid.

- General: Age 65+ or disabled, TX resident, Medicare Part A/B.

- Income Limits (2025): ~$2,510/month (QMB), ~$3,380/month (SLMB), ~$3,598/month (QI)—individual.

- Asset Limits: $9,430 (individual), $14,130 (couple).

- TX Specifics: Includes Extra Help for Part D; no waitlist.

- Services: Covers Part B premiums ($174.70/month), deductibles ($240/year), copays (~20%).

- General: Age 60+ prioritized, TX resident, low-income.

- Income Limits (2025): ~$3,970/month (185% FPL).

- Asset Limits: Not assessed.

- TX Specifics: Priority for elderly/disabled; covers gas, electric, propane.

- Services: Heating/cooling aid ($300-$1,000/season), emergency aid ($500 max).

- General: Caregivers of 60+ needing care or 55+ caregivers of others; TX resident; 2+ ADLs.

- Income Limits (2025): No strict cap; prioritizes low-income (~$24,980/year).

- Asset Limits: Not assessed.

- TX Specifics: High rural demand; includes grandparent caregivers.

- Services: Respite (4-6 hours/week or 5 days/year), adult day care ($60/day), training, supplies (~$500/year).

- General: Age 55+, unemployed, low-income, TX resident.

- Income Limits (2025): ~$1,983/month (125% FPL).

- Asset Limits: Not specified.

- TX Specifics: Priority for veterans, rural residents; AARP partnership.

- Services: Paid training (~20 hours/week at ~$7.25/hour), job placement.

- General: Age 65+ or disabled veteran/spouse, TX resident, wartime service, ADL help (A&A) or homebound.

- Income Limits (2025): Net income < ~$1,984/month (veteran with dependent, A&A); pension offsets income.

- Asset Limits: ~$155,356 (net worth).

- TX Specifics: High veteran population; supports rural/urban needs.

- Services: Cash (~$1,433-$2,642/month veteran, ~$951-$1,318 spouse) for care costs.

- General: Age 65+, TX resident, homeowner (homestead).

- Income Limits (2025): None; tax-based eligibility.

- Asset Limits: Not assessed.

- TX Specifics: $25,000+ exemption; optional freeze in some counties; saves ~$500-$1,000/year.

- Services: Tax exemption or freeze (~$500-$1,000/year savings).

- General: Age 60+, TX resident, low-income.

- Income Limits (2025): ~$2,322/month (185% FPL).

- Asset Limits: Not assessed.

- TX Specifics: Vouchers (~$50/season); serves ~20,000 via 28 AAAs.

- Services: Vouchers (~$50/season) for produce at farmers’ markets.

Contact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

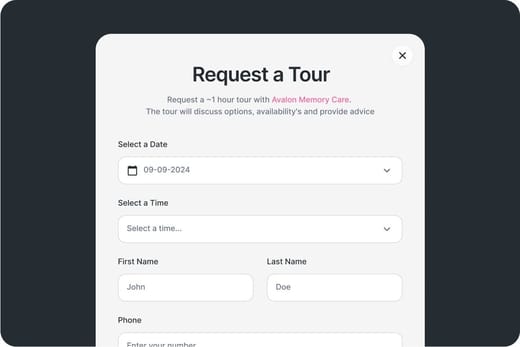

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.