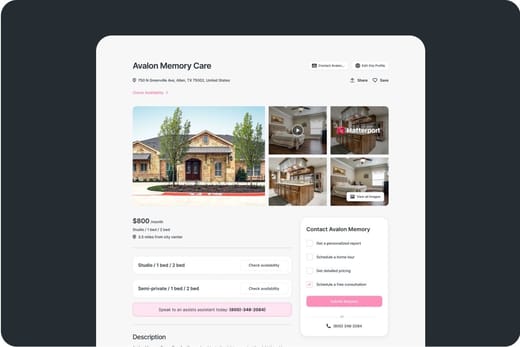

The Oaks at Lebanon

The Oaks at Lebanon is an Assisted Living Home in Oregon

The Oaks at Lebanon is an Assisted Living Home in Oregon

The Oaks at Lebanon

The Oaks at Lebanon is an Assisted Living Home in Oregon

The Oaks at Lebanon is an Assisted Living Home in Oregon

Nestled between Eugene and Portland, Oregon, The Oaks at Lebanon’s vision is to create a vibrant community where seniors thrive independently or with assistance through a culture of respect and compassion. They provide award-winning programs and personalized services that enhance residents’ physical, emotional, and spiritual well-being. Upholding integrity, inclusivity, and innovation values, they aim to foster a sense of purpose and belonging among residents.

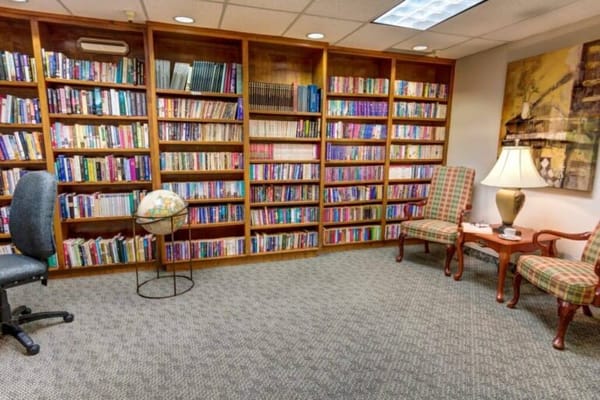

Experience a wealth of amenities and services at The Oaks at Lebanon, including a beauty salon, fitness center, and cable services. Weekly housekeeping, laundry, and in-unit kitchenettes ensure convenience and comfort for residents. Engage in a variety of events such as art therapy, baking classes, and car shows, fostering a vibrant and social atmosphere where every day offers new opportunities for enrichment and enjoyment. Every day at The Oaks is one to create new friendships and memories.

Capacity and availability

Smaller home

May offer a more intimate, personalized care environment.

About this community

Additional licensing details

Ownership & operating entity

The Oaks at Lebanon is legally operated by 621 West Oak OR OpCo, LLC, and administrated by ANGELIC KUTSCH.

Staffing

Key information about the people who lead and staff this community.

Leadership

Care Services

Contact Information

Additional Policies & Features

What does this home offer?

Housing Options: Studio / 1 Bed / 2 Bed

Building Type: 2-story

Dining Services

Beauty Services

Transportation Services

Housekeeping Services

Recreational Activities

Exercise Programs

Types of Care at The Oaks at Lebanon

Access & Eligibility

Ways to qualify for care at this community, including accepted programs and payment options.

This facility is certified for eligible Medicaid services.

Inspection History

In Oregon, the Department of Human Services, Aging and People with Disabilities performs unannounced surveys and regular inspections to ensure resident safety in all care settings.

4 visits/inspections

Latest inspection

11 licensing violations

Violations of state licensing requirements identified during facility inspections.

7 deficiencies

Deficiencies indicate regulatory issues. A higher number implies the facility had several areas requiring improvement.

Comparison Chart

The information below is reported by the Oregon Department of Human Services, Aging and People with Disabilities.Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Places of interest near The Oaks at Lebanon

0.5 miles from city center

621 W Oak St, Lebanon, OR 97355, USA

Calculate Travel Distance to The Oaks at Lebanon

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Claim What’s Yours: Financial Aid for Oregon Seniors

- General: Age 60+, Oregon resident, at risk of nursing home but not Medicaid-eligible.

- Income Limits: ~$2,000/month (individual, varies).

- Asset Limits: $5,000 (individual).

- OR Specifics: Cost-sharing required; rural/urban balance.

- Services: In-home care (3-5 hours/week), respite (up to 10 days/year), adult day care (~$70/day), transportation (~5 trips/month).

- General: Age 65+ or disabled, Oregon resident, Medicaid-eligible, nursing home-level care need.

- Income Limits (2025): ~$2,829/month (300% FBR, individual).

- Asset Limits: $2,000 (individual), $3,000 (couple).

- OR Specifics: High demand in urban areas (e.g., Portland).

- Services: Personal care (5-7 hours/day), respite (240 hours/year), adult day care ($70/day), home modifications ($1,500 avg.).

- General: Age 55+, OR resident (specific counties), NFLOC, safe with PACE support.

- Income Limits (2025): ~$2,829/month (Medicaid-eligible); private pay option available.

- Asset Limits: $2,000 (individual), $3,000 (couple) for Medicaid enrollees.

- OR Specifics: Available in 11 counties (e.g., Multnomah, Washington); Providence ElderPlace dominant provider.

- Services: Personal care (5-7 hours/day), medical care, meals, transportation, respite, therapies.

- General: Age 65+ or disabled, OR resident, Medicare Part A/B.

- Income Limits (2025): ~$2,510/month (QMB), ~$3,380/month (SLMB), ~$3,598/month (QI)—individual.

- Asset Limits: $9,430 (individual), $14,130 (couple).

- OR Specifics: Three tiers; includes Extra Help for Part D; no waitlist.

- Services: Covers Part B premiums ($174.70/month), deductibles ($240/year), copays (~20%).

- General: Age 60+ prioritized, OR resident, low-income household.

- Income Limits (2025): ~$3,970/month (individual, 185% FPL).

- Asset Limits: Not assessed; income-focused.

- OR Specifics: Covers gas, electric, oil; emergency aid via Oregon Energy Fund (OEF).

- Services: Heating/cooling aid ($300-$1,000/season), emergency aid ($500 max via OEF).

- General: Caregivers of 60+ needing care or 55+ caregivers of others; OR resident; functional needs (2+ ADLs).

- Income Limits (2025): No strict cap; prioritizes low-income (~$24,980/year).

- Asset Limits: Not assessed; need-based.

- OR Specifics: 15 regions; rural priority; includes grandparent caregivers.

- Services: Respite (4-6 hours/week or 5 days/year), adult day care ($60/day), training, supplies (~$500/year).

- General: Age 55+, unemployed, low-income, OR resident.

- Income Limits (2025): ~$1,983/month (125% FPL).

- Asset Limits: Not specified; income-focused.

- OR Specifics: Priority for veterans, rural residents; Easterseals/AARP partnership.

- Services: Paid training (~20 hours/week at ~$7.25/hour), job placement.

- General: Age 65+ or disabled veteran/spouse, OR resident, wartime service, need for ADL help (A&A) or homebound.

- Income Limits (2025): Net income < ~$1,984/month (veteran with dependent, A&A); pension offsets income.

- Asset Limits: ~$155,356 (net worth limit).

- OR Specifics: High veteran demand; Oregon Veterans’ Homes option.

- Services: Cash (~$1,433-$2,642/month veteran, ~$951-$1,318 spouse) for care costs (e.g., in-home, assisted living).

- General: Age 62+, OR resident, homeowner 5+ years, low-income.

- Income Limits (2025): ~$58,000/year (household, adjusted annually).

- Asset Limits: Home value < county median; equity > 15%.

- OR Specifics: Deferred taxes accrue 6% interest; repaid upon sale/death.

- Services: Tax deferral (~$1,000-$3,000/year avg., varies by county).

- General: Age 60+, OR resident (or spouse of any age); no income limit.

- Income Limits (2025): None; donations encouraged.

- Asset Limits: Not assessed.

- OR Specifics: Includes Meals on Wheels; prioritizes homebound/low-income.

- Services: Home-delivered or congregate meals (~$5-$7/meal value, 5 meals/week avg.).

Contact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

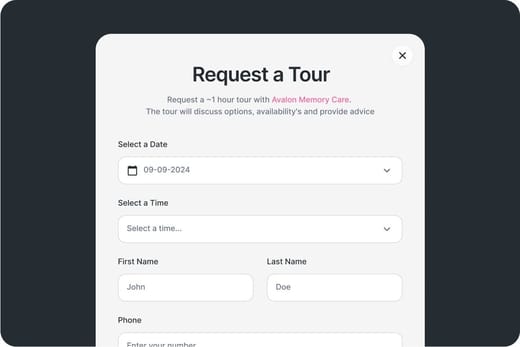

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.