TreeOak Courtyard Assisted Living At Cristwood

TreeOak Courtyard Assisted Living At Cristwood is a Memory Care Home in Washington

TreeOak Courtyard Assisted Living… is a Memory Care Home in Washington

TreeOak Courtyard Assisted Living At Cristwood

TreeOak Courtyard Assisted Living At Cristwood is a Memory Care Home in Washington

TreeOak Courtyard Assisted Living… is a Memory Care Home in Washington

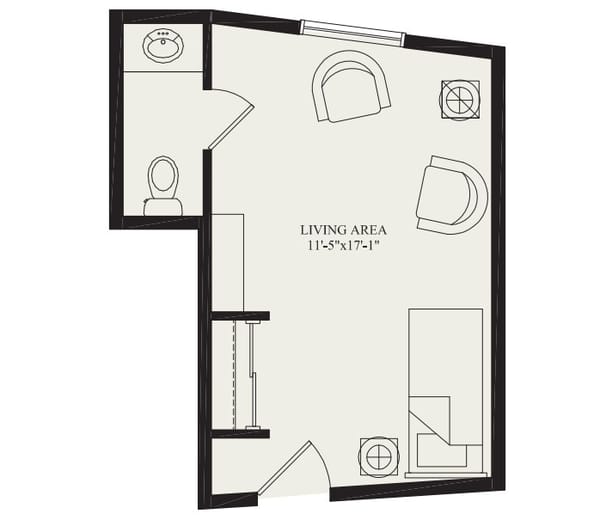

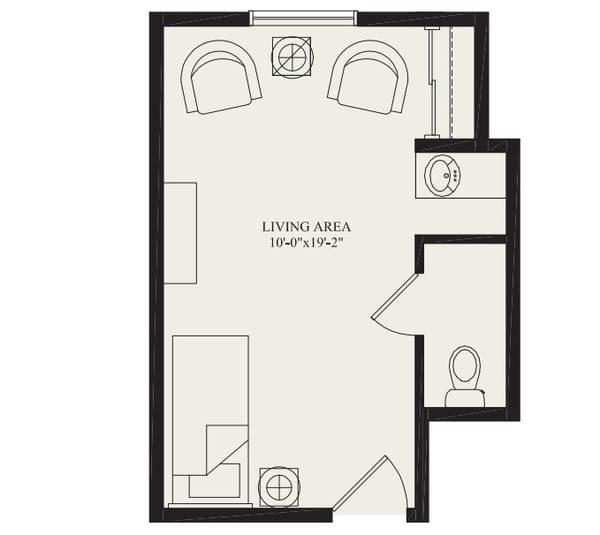

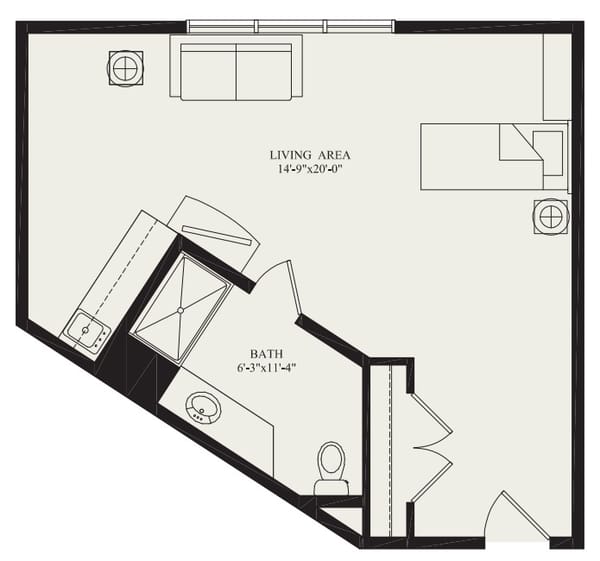

Set on a beautiful 55-acre campus in King County, Shoreline, WA, Treeoak Courtyard Assisted Living at Cristwood, is a bustling senior living community that offers independent living, assisted living, and memory care. Designed with residents’ welfare in mind, each apartment within the community is easily accessible and comes in a variety of studio, one-bedroom, and two-bedroom floor plans to accommodate various preferences and needs. An on-site team of licensed nurses and caregivers are available to provide compassionate assisted care and appropriate levels of medical care.

Residents are encouraged to participate in an array of meaningful activities, spiritual growth, and transformational relationships. Enjoy a delicious meal and engage in vibrant fitness and wellness programs for an optimized well-being. Lifelong learning is fostered through a variety of educational activities, including writing classes & workshops, genealogy classes, and technology classes. With 24-hour access to nutritionally balanced meals, housekeeping, and transportation services, residents are sure to live a convenient and worry-free life.

What does this home offer?

Housing Options: Studio

Building Type: Two-story

Transportation Services

Types of Care at TreeOak Courtyard Assisted Living At Cristwood

Compare Memory Care around King County

The information below is reported by the Washington Department of Social and Health Services, Residential Care Services.Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Nursing Homes 24/7 care needed

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Places of interest near TreeOak Courtyard Assisted Living At Cristwood

1.2 miles from city center

19327 Kings Garden Dr N, Shoreline, WA 98133

Calculate Travel Distance to TreeOak Courtyard Assisted Living At Cristwood

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Financial Aid for Washington Seniors

Get financial aid guidanceContact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.