Watermark Laguna Niguel

Watermark Laguna Niguel is an Assisted Living Home in California

Watermark Laguna Niguel is an Assisted Living Home in California

Watermark Laguna Niguel

Watermark Laguna Niguel is an Assisted Living Home in California

Watermark Laguna Niguel is an Assisted Living Home in California

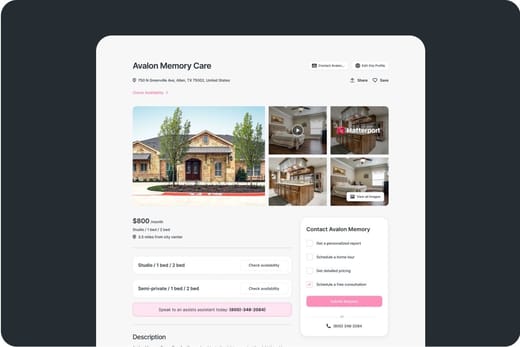

Watermark Laguna Niguel offers a resort-style experience for seniors in the heart of Orange County. This exceptional senior living community introduces a unique blend of Assisted Living and Memory Care services to a city that’s cherished by its senior residents.

At Watermark Laguna Niguel, residents can savor the luxury of resort-style living. while receiving exceptional care, allowing them to embrace the life they’ve always wanted. The dedicated team at Watermark Laguna Niguel is committed to serving the seniors of this remarkable area. Nestled in a city known for its scenic parks, inviting trails, and vibrant community events, residents here revel in the good life all year round.

Capacity and availability

Medium-capacity home

Offers a balance of services and community atmosphere.

This home usually has availability

Lower occupancy suggests more openings may be available.

About this community

California average: 72%

Additional licensing details

Ownership & operating entity

Watermark Laguna Niguel is legally operated by US ALLIANCE HOLDEN OF FORBES TENANT LLC; WATERMARK.

Inspection History

In California, the Department of Social Services (for assisted living facilities) and the Department of Public Health (for nursing homes) conduct inspections to ensure resident safety and regulatory compliance.

3 visits

California average: 14 visits

Breakdown by visit type

1 total complaint visit

2 other visits

California average

12 total complaint visits

7 other visits

1 complaint investigation

Investigations can have many visits.

California average: 10 complaint investigations

2 official inspections

California average: 4 official inspections

1 total citation

Citations indicate regulatory violations. A higher number implies the facility had several areas requiring improvement.

California average: 9 citations

0 serious citations

A violation that poses an immediate risk to resident health or safety, or represents a substantial failure to comply with licensing requirements.

California average: 3 serious citations

1 moderate citation

A violation that does not pose an immediate risk to resident health or safety but requires correction to remain in compliance.

California average: 4 moderate citations

Inspection Report Summary for Watermark Laguna Niguel

Watermark Laguna Niguel, a 135‑bed Residential Care Facility for the Elderly, has demonstrated continuous compliance across several inspections. The first visit on 26 July 2023 was a COMP II interview in which Administrator Christopher Tharp confirmed his knowledge of Title 22 regulations, admission policies, staffing requirements, and emergency procedures. The facility was noted to have zero residents in census at that time, and the interview set the stage for its forthcoming licensing process.

A pre‑licensing inspection on 9 August 2023 confirmed that the building’s physical plant—three stories with 78 assisted‑living and 38 memory‑care rooms—met all statutory standards. Observations highlighted secured medicine rooms, locked toxin storage, functioning fire suppression systems, and fully stocked emergency supplies. The inspector also verified that the fire clearance had been granted by the Orange County Fire Authority and that all plumbing and electrical systems were operational. No deficiencies were cited, and the report noted that the final application approval would be issued by the Centralized Applications Bureau.

Annual required inspections in 2024 (12 August) and 2025 (25 August) were unannounced and, again, found no deficiencies. Inspectors Joseph Alejandre, Ruth Martinez, and Garlli Tat documented that the memory‑care unit’s delayed egress remained functional, all stairways carried evacuation chairs, and that residents’ rooms had required furnishings. Medication storage remained locked, staff training records were complete, and food and water supplies met emergency standards. The 2025 report also confirmed a hospice waiver for 25 residents and noted the change in leadership to Director James Howland.

Across all visits, Watermark Laguna Niguel consistently met California’s health‑and‑human‑services standards, with no cited violations and a clear record of safe, well‑managed resident care.

Comparison Chart

The information below is reported by the California Department of Social Services and Department of Public Health.Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Nursing Homes 24/7 care needed

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Home Care

Hospice Care

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Places of interest near Watermark Laguna Niguel

3.3 miles from city center

27762 Forbes Rd, Laguna Niguel, CA 92677

Calculate Travel Distance to Watermark Laguna Niguel

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Claim What’s Yours: Financial Aid for California Seniors

- General: Age 65+, California resident, Medi-Cal eligible, nursing home risk.

- Income Limits (2025): ~$2,829/month (300% FBR, individual).

- Asset Limits: $2,000 (individual), $3,000 (couple).

- CA Specifics: County-managed; waitlists possible.

- Services: In-home support (4-6 hours/day), respite care (14 days/year), meals (~$6/meal), transportation (8 trips/month), care management.

- General: Age 65+, California resident, Medicaid-eligible or low-income.

- Income Limits: ~$1,732/month (individual, Medi-Cal threshold).

- Asset Limits: $2,000 (individual).

- CA Specifics: Can hire family as caregivers.

- Services: Personal care (up to 283 hours/month), homemaker services, respite (varies).

- General: Age 65+, California resident, Medi-Cal-eligible, nursing home-eligible but community-capable.

- Income Limits: ~$2,829/month (300% FBR, individual).

- Asset Limits: $2,000 (individual).

- CA Specifics: Available in 38 counties; waitlists common.

- Services: Case management, respite care (up to 10 days/year), minor home mods (avg. $500), adult day care (~$50/day).

- General: Age 62+, California resident, own and live in home, 40% equity.

- Income Limits (2025): ~$51,500/year (household, adjusted annually).

- Asset Limits: Equity-based; no strict asset cap.

- CA Specifics: Deferred taxes accrue interest (5% as of 2024); repaid upon sale/death.

- Services: Property tax deferral (avg. $1,000-$3,000/year, varies by county).

- General: Age 65+ or disabled, California resident, Medi-Cal-eligible, nursing home-eligible.

- Income Limits: ~$2,829/month (300% FBR, individual).

- Asset Limits: $2,000 (individual).

- CA Specifics: Available in 15 counties (e.g., LA, Sacramento); waitlists common.

- Services: Personal care in ALFs (5-7 hours/day), medication management, social services.

- General: Caregivers of California residents 60+ needing help with 3+ daily activities; no caregiver age limit.

- Income Limits: No strict limit; cost-sharing above ~$2,500/month threshold.

- Asset Limits: Not applicable; need-based.

- CA Specifics: High demand in urban areas; complements IHSS respite.

- Services: Respite care (up to 10 days/year), counseling (4-6 sessions/year), training (2-3 workshops/year), supplies (~$200/year).

- General: Age 60+ priority, California resident, low-income, utility/heating need.

- Income Limits (2025): ~$2,510/month (200% of poverty level, individual).

- Asset Limits: Not applicable; income-focused.

- CA Specifics: High demand in inland/coastal extremes; weatherization capped at $5,000/home.

- Services: Utility payments (avg. $500-$1,000/year), weatherization (e.g., insulation, avg. $1,000-$3,000 savings).

Contact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

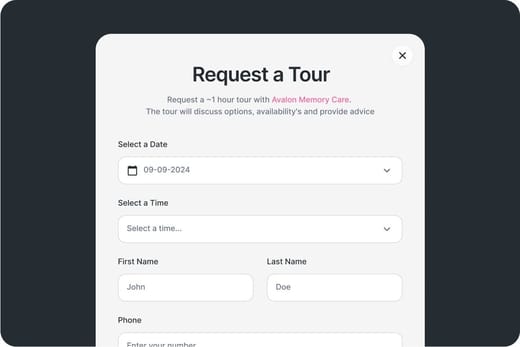

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.