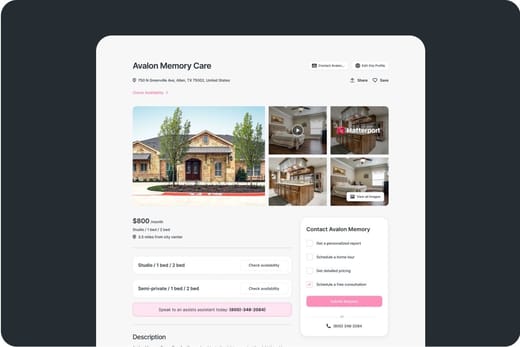

Atlantic Shores Retirement Community

Atlantic Shores Retirement Community

The Atlantic Shores Retirement Community, situated in Virginia, offers a serene and picturesque environment for seniors to retreat to. Its strategic location in close proximity to vibrant cities such as Norfolk and Virginia Beach makes it an ideal choice for retirees. Moreover, the stunning coastal view of the Atlantic Ocean from the community is awe-inspiring and fills the heart with wonder. Atlantic Shores provides exceptional senior living options for assisted living, memory care, and post-acute care, such as skilled nursing and rehabilitation, all conveniently located in one place.

Their concierge services are available from 8AM to 8PM, providing assistance with dinner reservations, transportation, registering for activities and excursions, postal services, and more. They also have technology staff on-site to help with computer and media device set up and operation, as well as classes on using new technologies and popular apps. Hearing loops for hearing aids and other assistive devices are also available. In addition, Atlantic Shores has community gardens for residents to grow their own flowers and vegetables. The lakeside park is a perfect spot for gathering with friends and family, and the screened-in gazebo overlooking Lake Redwing is a beautiful spot for bird-watching. Guest suites are available for overnight visitors, and they offer housekeeping, Wi-Fi, TV, fresh linens, and toiletries.

Facility Overview

-

License Details

License information registered with the Better Business Bureau.

- State Corporation Commission - Virginia (#04444550)

-

Primary Contact

Primary contact person for this business. Mrs. Jenny Maugeri, Executive Director

Inspection & Compliance

-

BBB Rating

BBB ratings (A+ to F) reflect how reliably a business handles customer interactions and complaints. They're based on complaint history, transparency, licensing, and time in business — not on customer reviews. NR (No Rating) means the BBB doesn't have enough information yet or the business is under review. Rated A+

Places of interest near Atlantic Shores Retirement Community

1200 Atlantic Shores Dr, Virginia Beach, VA 23454

1200 Atlantic Shores Dr, Virginia Beach, VA 23454

[email protected]

+1 757-716-2000

[email protected]

+1 757-716-2000

Calculate Travel Distance to Atlantic Shores Retirement Community

Add your location

Join Our Online

Senior Community!

Connect, laugh, and explore — all from the comfort of your home.

Guides for Better Senior Living

From costs to care, explore the most important topics to make informed decisions about your future.

Comparison Chart

For seniors needing help with daily tasks but not full-time nursing.

Specialized care for those with Memory Loss, Alzheimer’s, or dementia, ensuring safety and support.

For seniors needing help with daily tasks but not full-time nursing.

Specialized care for those with Memory Loss, Alzheimer’s, or dementia, ensuring safety and support.

For seniors needing help with daily tasks but not full-time nursing.

For self-sufficient seniors seeking community and minimal assistance.

Specialized care for those with Memory Loss, Alzheimer’s, or dementia, ensuring safety and support.

24/7 care needed

For seniors needing help with daily tasks but not full-time nursing.

Claim What’s Yours: Financial Aid for Virginia Seniors

- General: Age 65+ or disabled, Virginia resident, Medicaid-eligible, nursing home-level care need.

- Income Limits (2025): ~$2,829/month (300% FBR, individual).

- Asset Limits: $2,000 (individual), $3,000 (couple).

- VA Specifics: Managed care model; high demand in urban areas.

- Services: Personal care (5-7 hours/day), respite (240 hours/year), adult day care ($65/day), home modifications ($1,500 avg.).

- General: Caregiver of someone 60+, Virginia resident.

- Income Limits: ~$2,500/month (individual, varies).

- Asset Limits: $40,000 (individual).

- VA Specifics: Limited grants; rural/urban balance.

- Services: In-home respite (up to 30 days/year), adult day care (~$65/day), facility respite (up to 5 days).

- General: Age 60+ (or disabled 18+), VA resident, need significant care (2+ ADLs), not Medicaid-eligible.

- Income Limits (2025): Varies by locality; typically < ~$2,510/month (200% FPL).

- Asset Limits: Limited assets (excludes home, car); varies by DSS.

- VA Specifics: Serves ~5,000 annually; focuses on low-income independence.

- Services: Personal care (4-6 hours/week), adult day care (~$60/day), chore services, assessments, respite (~5 days/year).

- General: Age 65+ (or disabled 18+), VA resident, living in approved ALF/foster care, SSI-eligible or low-income.

- Income Limits (2025): ~$1,041/month (individual, SSI level + $20 disregard); higher with medical deductions.

- Asset Limits: $2,000 (individual).

- VA Specifics: Serves 4,000; personal needs allowance ($90/month).

- Services: Cash (~$1,400-$1,700/month in 2025, varies by region) for ALF/foster care costs; basic care included.

- General: Age 65+ or disabled, VA resident, Medicare Part A/B.

- Income Limits (2025): ~$2,510/month (QMB), ~$3,380/month (SLMB), ~$3,598/month (QI)—individual.

- Asset Limits: $9,430 (individual), $14,130 (couple).

- VA Specifics: Includes Extra Help for Part D; no waitlist.

- Services: Covers Part B premiums ($174.70/month), deductibles ($240/year), copays (~20%).

- General: Age 60+ prioritized, VA resident, low-income household.

- Income Limits (2025): ~$3,970/month (185% FPL).

- Asset Limits: Not assessed.

- VA Specifics: Fuel, Crisis, Cooling components; serves ~100,000 households.

- Services: Heating/cooling aid ($300-$1,000/season), crisis aid ($500 max), equipment repair (~$250).

- General: Age 55+, unemployed, low-income, VA resident.

- Income Limits (2025): ~$1,983/month (125% FPL).

- Asset Limits: Not specified.

- VA Specifics: Priority for veterans, rural residents; AARP/Goodwill partnership.

- Services: Paid training (~20 hours/week at ~$7.25/hour), job placement.

- General: Age 65+ or disabled veteran/spouse, VA resident, wartime service, ADL help (A&A) or homebound.

- Income Limits (2025): Net income < ~$1,984/month (veteran with dependent, A&A); pension offsets income.

- Asset Limits: ~$155,356 (net worth).

- VA Specifics: High veteran population; supports rural/urban needs.

- Services: Cash (~$1,433-$2,642/month veteran, ~$951-$1,318 spouse) for care costs.

- General: Age 65+ or disabled, VA resident, homeowner, income/asset limits vary by locality.

- Income Limits (2025): ~$50,000-$75,000/year (household, e.g., Fairfax: $72,000; Richmond: $50,000).

- Asset Limits: Varies (e.g., Fairfax: $400,000 net worth; Richmond: $100,000).

- VA Specifics: Offered in 90% of localities; saves ~$500-$2,000/year.

- Services: Tax exemption/deferral (~$500-$2,000/year depending on locality).

- General: Age 60+, VA resident, low-income.

- Income Limits (2025): ~$2,322/month (185% FPL).

- Asset Limits: Not assessed.

- VA Specifics: Vouchers (~$50-$75/season); serves ~15,000 via AAAs.

- Services: Vouchers (~$50-$75/season) for produce at farmers’ markets.

Beds shows the number of beds currently filled in each community agianst the total number of beds. Higher occupied beds usually indicates strong demand and reputation, while lower occupancy may suggest more availability for new residents.

What questions do you have about Atlantic Shores Retirement Community?

We’ll help you with pricing, availability, and anything else you need.

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

Homes near Virginia Beach, VA