Lidia‘s Blessed Home

Lidia‘s Blessed Home is a Memory Care Home in California

Lidia‘s Blessed Home is a Memory Care Home in California

Lidia‘s Blessed Home

Lidia‘s Blessed Home is a Memory Care Home in California

Lidia‘s Blessed Home is a Memory Care Home in California

Lidia’s Blessed Home is a residential care facility for the elderly, located in Modesto, CA, providing memory care services to their residents. They offer studio, private, and semi-private accommodations where residents can receive personalized care tailored to meet their individual needs. As part of their care services, residents receive non-ambulatory care, and assistance with daily living activities.

Meals provided in Lidia’s Blessed Home can be customized depending on the dietary needs and restrictions of the residents. Their facility also employs a wander guard, as an added security for individuals who tend to wander, like their residents living with Alzheimer’s and other forms of dementia.

Capacity and availability

Smaller home

May offer a more intimate, personalized care environment.

This home usually has availability

Lower occupancy suggests more openings may be available.

About this community

California average: 73%

Additional licensing details

Ownership & operating entity

Lidia‘s Blessed Home is legally operated by HIRISCAU, LIDIA.

Inspection History

In California, the Department of Social Services (for assisted living facilities) and the Department of Public Health (for nursing homes) conduct inspections to ensure resident safety and regulatory compliance.

2 visits

California average: 16 visits

Breakdown by visit type

1 total complaint visit

1 other visit

California average

12 total complaint visits

7 other visits

1 complaint investigation

Investigations can have many visits.

California average: 10 complaint investigations

5 official inspections

California average: 4 official inspections

3 total citations

Citations indicate regulatory violations. A higher number implies the facility had several areas requiring improvement.

California average: 10 citations

1 serious citation

A violation that poses an immediate risk to resident health or safety, or represents a substantial failure to comply with licensing requirements.

California average: 3 serious citations

2 moderate citations

A violation that does not pose an immediate risk to resident health or safety but requires correction to remain in compliance.

California average: 4 moderate citations

Latest inspection

3 deficiencies

Deficiencies indicate regulatory issues. A higher number implies the facility had several areas requiring improvement.

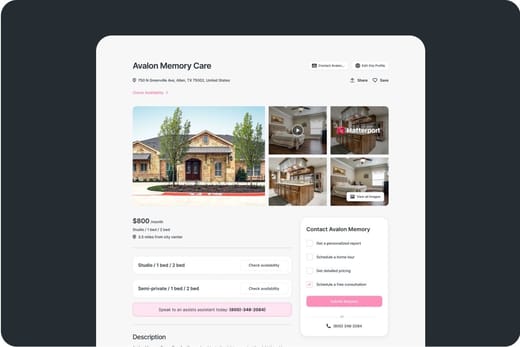

Compare Memory Care around Modesto

The information below is reported by the California Department of Social Services and Department of Public Health.Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Nursing Homes 24/7 care needed

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Places of interest near Lidia‘s Blessed Home

5.0 miles from city center — 0.37 miles to nearest hospital (Darroch Brain and Spine Institute)

3209 Hummingbird Ln, Modesto, CA 95356

Calculate Travel Distance to Lidia‘s Blessed Home

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Financial Aid for California Seniors

Get financial aid guidanceContact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

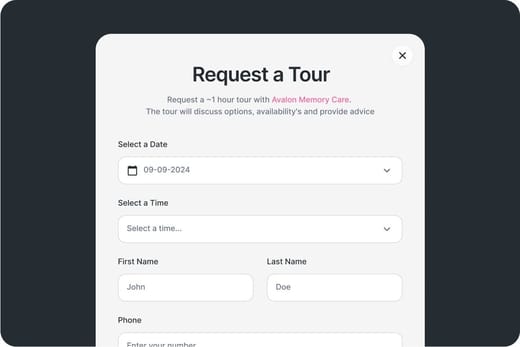

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.