The Village at Mill Landing

The Village at Mill Landing is an Assisted Living Home in New York State

The Village at Mill… is an Assisted Living Home in New York State

The Village at Mill Landing

The Village at Mill Landing is an Assisted Living Home in New York State

The Village at Mill… is an Assisted Living Home in New York State

Situated in Monroe County, Rochester, NY, The Village at Mill Landing is an exceptional senior living community that offers assisted living and memory care services. Residents are provided with the comfort of knowing that a team of certified caregivers and 24-hour team members are available to offer them care and assistance whenever they need it. With access to occupational and physical therapy and a health and wellness director available, residents are able to maintain their strength, mobility, skills, and well-being.

Residents are provided with plenty of opportunities to stay active and make new connections with a robust calendar of activities, including travel opportunities, horticulture therapy, and volunteer programs. Services like housekeeping and maintenance are offered to give residents plenty of free time to enjoy the community amenities. These include an activity & games room, arts and crafts studio, a bistro, theater, salon, a chapel and beautiful outdoor areas for outdoor activities and relaxation.

Capacity and availability

Medium-capacity home

Offers a balance of services and community atmosphere.

About this community

Additional licensing details

Ownership & operating entity

The Village at Mill Landing is legally operated by WRP Operating Greece LLC.

What does this home offer?

Pets Allowed: Yes, Pets Allowed

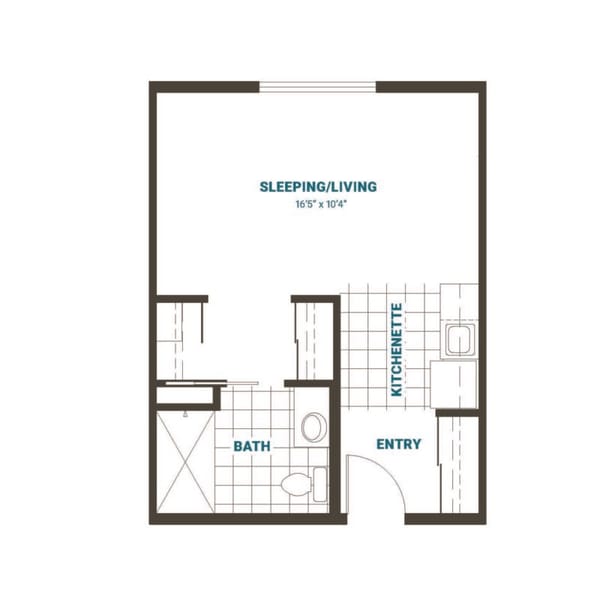

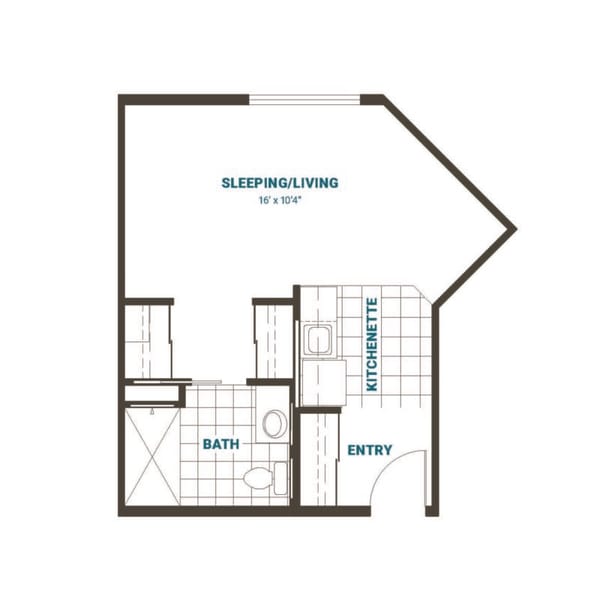

Room Sizes: 226-228 / 296 /334 / 347 / 424 / 454 / 475 / 562 / 724 sq. ft

Housing Options: Studio / 1 Bed / 2 Bed

Building Type: Two-story

Transportation Services

Fitness and Recreation

Types of Care at The Village at Mill Landing

Inspection History

In New York, the Department of Health, Office of Aging and Long Term Care performs unannounced onsite inspections to monitor compliance with state and federal healthcare regulations.

10 inspections

2 with violations, 8 without violations

8 complaint-related visits

New York average: 9 inspections, 56 complaint-related visits

Latest inspection

5 violations

Violations indicate regulatory issues. A higher number implies the facility had several areas requiring improvement.

New York average: 12 violations

5 deficiencies

Deficiencies indicate regulatory issues. A higher number implies the facility had several areas requiring improvement.

0 enforcement actions

Penalties or interventions imposed by state regulators when facilities do not comply with quality, safety or regulatory standards.

Compare Assisted Living around Monroe County

The information below is reported by the New York State Department of Health.Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Nursing Homes 24/7 care needed

Nursing Home 24/7 care needed

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Nursing Homes 24/7 care needed

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Nursing Homes 24/7 care needed

Assisted Living For seniors needing help with daily tasks but not full-time nursing.

Independent Living For self-sufficient seniors seeking community and minimal assistance.

Memory Care Specialized care for those with Memory Loss, Alzheimer's, or dementia, ensuring safety and support.

Places of interest near The Village at Mill Landing

8.6 miles from city center

45 Mill Rd, Rochester, NY 14626

Calculate Travel Distance to The Village at Mill Landing

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Financial Aid for New York Seniors

Get financial aid guidanceContact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.