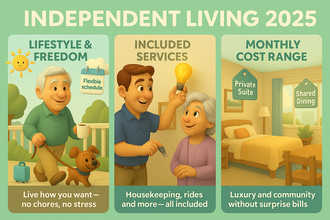

Older adults looking to live independently in retirement can enjoy an active, maintenance-free lifestyle with independent living. Independent living is an ideal retirement option that provides social opportunities and specially designed amenities for older adults who need little to no assistance in their golden years. Referencing trusted sources like the Genworth Cost of Care Survey, we provide a comprehensive guide to understanding independent living costs, services, and benefits.

What is Independent Living?

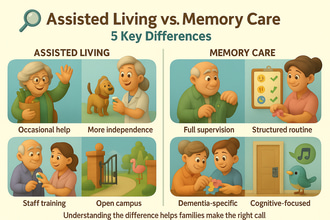

Independent living is a housing option for older adults, usually 55+, who do not need assistance with activities of daily living (ADLs), but prefer to live in a community with people of the same age. There are different kinds of independent living communities, including active adult communities, senior apartments, or retirement homes, which provide purposely designed living spaces, alongside shared amenities and services. However, independent living only focuses on convenience and recreation, and usually does not provide medical care.

With independent living, older adults maintain freedom without the burdens of housekeeping and maintenance, as per the U.S. Department of Health and Human Services. Independent living can be part of a Continuing Care Retirement Community (CCRC) or a standalone community.

Independent Living Services

Promoting a stress-free and active lifestyle, independent living services often include:

- Housing – with variations of private apartments, cottages, townhomes, and single-family homes, which often includes grab bars and other accessible features.

- Maintenance-Free Lifestyle – handles chores like housekeeping, laundry, maintenance, and landscaping.

- Dining – flexible dining plans in communal dining rooms. Bistros, restaurants, and cafes are available in some communities.

- Amenities – amenities for recreation and wellness, like fitness centers, swimming pools, libraries, game rooms, theaters, golf courses, and walking trails. Upscale communities may also offer spa and concierge services.

- Social and Recreational Activities – The National Institute on Aging notes that loneliness is a risk factor for older adults; hence, group activities, hobby clubs, games, and outings are often conducted to promote camaraderie and social belongingness.

- Transportation – for residents’ convenience, scheduled transportation services for medical appointments and errands are provided.

- Safety and Security – on-site security and a 24/7 emergency response system are provided.

- Other Services – Other communities offer pet care, assistance with personal needs, and medication management.

Stand-alone independent living communities do not provide assistance with ADLs and medical care, however, residents in CCRCs can easily transition to a higher level of care if necessary, with their wide range of care options.

Costs of Independent Living in 2025

Location, housing type, amenities, and service influence the cost of independent living. Referencing Genworth’s Cost of Care Survey, we provide a range of independent living costs.

National Average

- Monthly Cost

- The national average for independent living in 2025 is around $3,145 monthly, accounting to $37,740 per year.

- Depending on location, luxury level, and services, cost ranges from $1,500 to $10,000 monthly.

- Projected Increase

- Median costs may reach up to $4,100 monthly by 2040, due to inflation and demand.

State-by-State Variations

The state’s real estate rates and cost of living affect independent living costs, providing significant variations.

- Maine has the most expensive rates with a median of $6,162 monthly, due to high demand and limited supply.

- Mississippi, on the other hand, has the lowest rates at $1,282 on average per month, which is significantly lower than the national average.

- California exhibits the cost difference between urban and rural areas, with San Francisco averaging $7,000 per month, which is higher than the state average of $4,500 to $6,000 monthly.

- North Carolina has an average of $2,000 to $5,000 per month, but rural areas like Asheville are more affordable.

- Texas has a median of $2,000 to $5,000 per month, with cities like San Antonio being more affordable.

Additional Fees

- Entrance Fees (CCRCs) – ranging from $50,000 to $1,000,000, CCRCs often require entrance fees for future care access.

- Second-Person Fee – spouses or roommates can save more with a median of $800 monthly offer for couples in some communities.

- Pet Fees – Pet-friendly communities offer an average of $50 monthly additional fees, alongside various pet policies.

- Parking Fees – Other communities may offer covered parking, but parking fees usually average $50 monthly.

- Optional Services – Household services, meal plans, and transportation often average from $150 to $500 monthly, as noted by TheSeniorList.com

In Comparison with,

- Homeownership

- Independent living provides an avenue for older adults to downsize in retirement, making it a more affordable option than owning or maintaining a home, which often costs $24,000 yearly, as per Brookdale.

- Assisted Living

- Since assisted living provides more services like assistance with ADLs, it costs significantly more with 40% more than independent living at $5,676 monthly.

- Nursing Homes

- Based on Genworth 2025, nursing homes cost around $9,197 to $10,326 monthly, due to the level of care they provide.

Funding Options

Medicare and Medicaid do not cover independent living costs due to their lack of medical services, as per NCOA.org. However, other options include:

- Personal Savings – usually supplemented by Social Security and pensions.

- Veterans Benefits – eligible veterans receive up to $2,300 monthly, while remaining spouses receive up to $1,478 monthly through VA Aid and Attendance benefits.

- Long-Term Care Insurance – other policies may cover independent living if necessary.

- Housing Assistance – low-income seniors may receive assistance from SSI and HUD’s Section 8 vouchers.

- Bridge Loans – Assisted Living Locators notes that short-term financing may cover the costs for entrance fees or rents.

- Home Sale or Rental Income – Selling a home or renting it out can help with independent living costs, especially those in high-value markets.

Notably, a 2.5% cost-of-living adjustment (COLA) in 2025 will provide more benefits for over 72.5 million Americans, as per the Social Security Administration.

Pros and Cons of Independent Living

Pros

- Maintenance-Free Living

- No need to worry about the burdens of homeownership, such as repairs and landscaping, and can focus more on recreation, as noted by Forbes Health.

- Social Engagement

- Group activities, games, social events, and outings promote a vibrant lifestyle, preventing the risk of loneliness.

- Convenient Amenities

- Easy access to amenities like communal dining, fitness centers, and transportation services.

- Scalability

- Independent living in CCRCs allows an easier transition to higher levels of care without having to move to a different place.

- Cost Savings

- Lower expenses, in terms of home maintenance and repairs.

Cons

- Care Needs

- Since independent living does not provide care of any form, including assistance with ADLS and medical care, moving into assisted living may be an option in the long run.

- Location

- Urban areas, especially those with high real estate values, tend to be more expensive, like that of Boston, at $5,000 to $7,000 monthly, compared to rural areas like Mississippi with $1,282 per month.

- Luxury Level

- Luxury communities with services like a spa and a concierge cost up to $10,000 monthly, in contrast to basic communities that start at $1,500 per month, according to AssistedLiving.org.

- Contracts

- Independent living in CCRCs may require entrance fees for more convenient access to higher levels of care, as noted by Cedarhurst Living.

- Accreditation

- Forbes Health recommends checking state licensing and staff training for safety.

Conclusion

Independent living allows those active older adults to enjoy a maintenance-free lifestyle with an average cost of $3,145 monthly, which costs less than assisted living and nursing homes. However, independent living communities do not assist with ADLs and medical care, and only focus on providing housing and recreational activities for older adults’ comfort and social wellness. Independent living in CCRCs may provide an easier transition to higher levels of care if needs arise. Costs differ by state due to several factors, like the real estate market and cost of living. Since Medicare and Medicaid cannot cover independent living costs, older adults can find other options, including VA benefits and housing assistance, to ease financial burdens. To create precise retirement plans, older adults may reach out to local advisors and other reputable sources.