The elderly population, specifically those 65+, constitutes over 50 million of the U.S. population, further increasing demands for senior care services. Alongside this continuous growth, the demand for 24/7 in-home care also increases, especially for those looking to age in place. Hence, it is better to understand 24/7 in-home care costs for long-term care planning. Utilizing government data and trusted industry surveys, this article aims to provide a comprehensive financial guide for the cost of 24/7 in-home care in 2025.

What is 24/7 In-Home Care?

24/7 in-home care is provided with a team of caregivers, ranging from eight to twelve-hour shifts, to satisfy older adults’ unique needs. In-home care includes non-medical services like assistance with activities of daily living (ADLs), including bathing, grooming, and meal preparation; and medical care from a team of qualified professionals, such as registered nurses and therapists. 24/7 in-home care costs are also heavily influenced by the level of care needed.

National Cost Estimates

The national median cost for non-medical home care in 2024 was around $30 per hour for homemaker services and $31 per hour for home health aide services, as reported by the Genworth Cost of Care Survey, referenced by the U.S. Department of Health and Human Services. Given that 24/7 care requires 168 hours per week, non-medical home care costs are around $21,823 per month and $22,568 for home health aide services, as shown:

- Non-medical home care: $30 × 168 hours = $5,040 per week, or approximately $21,823 per month.

- Home health aide services: $31 × 168 hours = $5,208 per week, or approximately $22,568 per month.

Notably, the U.S. Bureau of Labor Statistics reported that home health aides and personal care aides often require a median hourly wage of around $16.57, which translates to $33,000 for full-time work annually, from independent providers. On the other hand, agency rates are higher due to additional costs for coordination, background checks, and backup caregivers, which are estimated to be $18,000 to $24,000 monthly, varying on location and level of care nationally.

Regional Variations

The cost of living, caregiver licensing requirements, labor markets, in each state and region, affect the cost of 24/7 in-home care, as exemplified:

- California

- In the greater Los Angeles area, 24/7 care costs around $27,030 monthly, with an average of $40.

- The state average ranges from $27,804 to $28,578 per month.

- Georgia

- The state average ranges from $20 to $27, estimated at $14,000 to $18,000 monthly, due to the lower cost of living.

- Massachusetts

- With a relatively higher cost of living, 24/7 care in the state costs around $27,000 to $30,000 per month.

Due to the increasing demand for in-home care, costs continuously change, hence, it is better to contact local agencies and providers for precise quotes.

Factors Influencing Costs

24/7 in-home care is widely affected by several factors, including:

- Level of Care

- As discussed, 24/7 in-home care has different levels of care, ranging from non-medical care (companionship, household assistance) to medical care (medication administration, wound care) to specialized care (dementia, chronic illness). Due to the qualifications needed, specialized care costs significantly more than medical and non-medical care. However, demand for a level may also affect the cost, with some states having higher costs for non-medical care than medical care.

- Caregiver Qualifications

- In connection with the level of care, medical aides, including licensed nurses or therapists, require higher wages than non-medical aides.

- Geographical Location

- Urban areas tend to have higher costs, especially those with higher living costs, like San Francisco ($27.70/ hour), in contrast with rural areas like Tulsa, Oklahoma ($17.29/hour).

- Type of Provider

- Agencies tend to have higher costs due to additional costs, including insurance and trained staff. Costs range around $30 to $40/ hour.

- Private caregivers cost less at $20 to $30 per hour, but families have to take care of taxes, insurance, and backup plans.

- Duration and Shift Structure

- Holiday rates are higher, alongside overnight rates. Other agencies may offer discounts for 24/7 care compared to hourly schedules.

Funding Options

Aside from out-of-pocket or private pay options, there are other ways to offset the financial burdens of 24/7 in-home care.

- Medicare

- Medicare does not cover non-medical care, like ADLs, and 24/7 care, unless part of a Medicare Advantage plan. However, home health care, like medical services, including skilled nursing and therapy, can be covered, as long as it is less than 7 days/ week and 8 hrs/ day.

- Medicaid

- Depending on the state, medicaid waivers can cover ADLs and other basic assistance, but 24/7 care may not be fully covered.

- Veterans Benefits

- Eligible veterans can receive cash payments or short-term care through programs like Veteran-directed HCBS, Aid and Attendance, and VA Respite care.

- Tax Deductions

- Medical expenses exceeding 7.5% of adjusted gross income, like ADL assistance, that were unreimbursed are eligible for tax deductions.

For other funding options and funding assistance programs, the U.S. Administration on Aging provides resources for care planning. Long-term care insurance and personal savings are additional options.

Alternatives

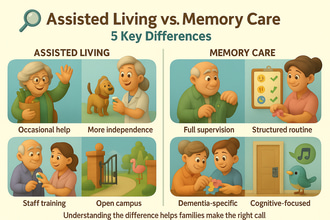

- Assisted Living

- The national average for assisted living in 2024 was $4,917, and is estimated at $5,900 in 2025, which may be a better option for those who need assistance in their senior years.

- Nursing Homes

- A semi-private room costs around $7,908, while private rooms cost around $9,034 per month in 2024. The estimated total cost of nursing homes can be lower than that of 24/7 in-home care.

- Live-in Care

- Those who need less intensive care may opt for a single caregiver, for a cheaper option, with $10,646 per month on average.

While in-home care can provide personalized support in the comforts of their homes, nursing homes may be more cost-effective, especially for those who need extensive medical care. LeadingAge studies suggest that the emotional benefits of aging in place can yield health and social benefits.

Planning for Costs

To optimize resources and ease financial challenges,

- It is better to get precise quotes from different agencies based on the care needed and compare them for better planning.

- Assess your needs to optimize services and determine whether 24/7 is necessary or a few hours is enough.

- Look into various funding options, including Medicare, Medicaid, VA benefits, and other state programs, to ensure your needs can be covered.

- To offset costs, you may combine part-time agency care with community services such as Meals on Wheels.

- Provide allowances when planning, since costs are projected to rise.

Conclusion

Through government data and trusted surveys, including the Genworth Cost of Care Survey, the U.S. Census Bureau, and the Bureau of Labor Statistics, comparisons between nursing home or assisted living costs and 24/7 care show higher expenses for the latter, with a national median of $21,823 to $24,006 in 2025. Medicare and Medicaid provide limited coverage for in-home care; however, VA benefits, tax deductions, and other funds may help ease financial burdens. In-home care is ideal for those prioritizing independence and familiarity; however, this care might be costly for some, hence planning early is crucial to optimize financial capabilities.

Contact local home care agencies or consult resources like the U.S. Administration on Aging (www.acl.gov) or Medicare’s website (www.medicare.gov) for precise quotes.