Medicare is a government-funded insurance program for older adults 65+ and those with disabilities and life-limiting conditions. Home health care, on the other hand, allows older adults to receive care in the comforts of their homes. Medicare does not cover all types of services; however, Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) can cover medically necessary home health care services for eligible beneficiaries.

Services Covered

- Skilled Nursing Care (part-time or intermittent)

- Includes wound care, injections, catheter management, or monitoring of medical conditions.

- Medicare.gov notes that care must be provided by a licensed nurse.

- Physical Therapy

- Exercises to improve mobility, strength, and balance. Commonly utilized for post-surgery recovery.

- Occupational Therapy

- Focuses on recovering functionality of activities of daily living (ADLs), including bathing, grooming, and cooking.

- Speech-Language Pathology Services

- Aims to help with swallowing difficulties and communication issues, usually post-stroke recovery.

- Medical Social Services

- Social workers help optimize resources, including counseling services and community resources.

- Home Health Aide Services (limited)

- Supplementary ADL support for beneficiaries who receive skilled nursing and therapy services. CMS notes that aides cannot provide full-time caregiving.

Notably, Medicare can only cover services ordered by a physician or a doctor and provided by a Medicare-certified home health agency. The coverage is only up to 28 hours per week or 35 hours for up to 60 days per episode of care; hence, full-time care is not an option. However, Medicare fully covers these services without a deductible and copay.

Services Medicare Does NOT Cover

- 24/7 or full-time in-home care.

- Non-medical services, including housekeeping and personal care without skilled nursing or therapy.

- Meal delivery

- Transportation, except for medical appointments, if necessary.

- Medical equipment, such as hospital beds or wheelchairs. However, these are covered by Medicare Part B, which provides a $240 deductible and a 20% copay.

- Medications are only covered by Medicare Part D, and not home health.

Eligibility Requirements for Medicare Home Health Care

Beneficiaries must meet ALL criteria to qualify for Medicare home health care.

- Medicare Enrollment – Enrolled in Medicare Part A and/ or Part B.

- Doctor’s Order – Medicare only covers physician-ordered home health care, hence, the attending physician or a nurse practitioner must certify the need for home health care and provide a care plan every 60 days.

- Homebound Status

- Leaving is limited only to medical appointments and brief errands, and requires assistance, like a walker, wheelchair, or a caregiver’s help.

- This criterion is strictly enforced, so if the older adult is able to leave home for non-medical reasons, they can lose eligibility.

- Homebound does not mean bedridden.

- Need for Skilled Services – Intermittent skilled nursing is required, as well as physical and speech therapy, and ongoing occupational therapy.

- Medicare-Certified Agency – Care must be from a Medicare-certified home health agency.

Coverage of Medicare Home Health Care

- Covered Services – Medicare pays full or 100% for approved skilled nursing, therapy, and limited aid services, without deductibles and copays.

- Non-Covered Services – Beneficiaries are responsible for:

- Non-medical care, including homemaker services, costs $35 per hour in 2025, or full-time caregiving, which is around $21,823 to $24,006 per month.

- 20% of costs for medical equipment, like walkers and wheelchairs, after the Part B deductible of $240 in 2025.

- Private Pay – Older adults and families are expected to pay the following if eligibility is not met, like they are not homebound or no skilled nursing needed.

- Skilled nursing – $40 to $60 per hour

- Home health aide – $35 to $37 per hour

Duration and Limitations

- Duration

- Coverage is intermittent every 60 days, as long as beneficiaries meet the criteria and show progress to recovery. Care plans are reviewed every 60 days, and it can be recertified by a doctor, if necessary, according to CMS.

- Limitations

- Does not cover full-time care, typically up to 28 hours per week.

- Long-term custodial care, including ADL support without skilled nursing, is not covered.

- If skilled services end, such that therapy goals are met, aide services also stop.

- Appeals

- According to CMS, beneficiaries can appeal through Medicare’s Quality Improvement Organization if coverage is denied.

Funding Alternatives with Other Care Options

- Medicaid

- Covers home health aide services and other non-medical services for eligible older adults with assets less than $2,000 and income less than $2,523 in 2025, through Home and Community-Based Services (HCBS) waivers.

- Veterans Benefits

- Eligible veterans receive up to $2,300 per month, while surviving spouses receive up to $1,478 per month through the Aid and Attendance program.

- Long-Term Care Insurance

- Depending on the policy, long-term care insurance may cover non-medical and custodial care.

- Personal Savings

- Social Security with a 2025 COLA of 2.5%, and a home sale.

- Area Agencies on Aging

- According to the U.S. Administration on Aging, some agencies offer subsidized home care programs.

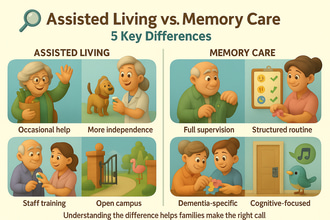

Comparison with Other Care Options

If care needs increase, other options include:

- Assisted Living – Not covered by Medicare, with an average cost of $5,676 per month.

- Nursing Homes – Cost range from $9,197 to $10,326 per month. Medicare can cover up to 100 days after hospitalization; full coverage for the first 20 days and a $240 per day copay for days 21 to 100.

- Memory Care – No Medicare coverage and costs around $7,908 per month.

Practical Considerations

- Finding a Provider: CMS suggests using Medicare.gov’s Home Health Compare tool to locate certified agencies and checking star ratings and services.

- Care Plan: Specify skilled services and homebound status in the doctor’s order for eligibility.

- Monitoring: Since coverage is limited, it is better to track services received.

- Supplementing Care: Family caregivers or private aides can fill gaps for non-covered ADL support.

- Appealing Denials: Reach out to Medicare via the Medicare hotline (1-800-MEDICARE) or a local State Health Insurance Assistance Program (SHIP) for help.

Conclusion

Medicare Part A and B can cover necessary doctor-ordered home health services for older adults who are homebound and in need of intermittent skilled nursing or therapy. Beneficiaries must receive care from Medicare-certified agencies to ensure coverage. Other funding options include Medicaid waivers, Veterans Benefits, and private insurance. To ensure a smooth transition, it is better to apply early and prepare the requirements.