Planning for long-term care requires comprehensive research on the costs of senior living, including different levels of care, types of communities, and locations. This article provides a comprehensive guide on senior living costs, in their various forms, including independent living, assisted living, memory care, nursing homes, and home care. Regional variations, factors that affect costs, and financial assistance are also discussed to provide further insights into senior living expenses.

Average Monthly Costs by Care Type

National average monthly costs for senior living in 2025 are as follows:

| Type of Senior Living | Median Monthly Cost (Nationwide) |

| Independent Living | Estimated at around – $3,145 per month, with Maine as the most expensive at $6,162 per month and Mississippi as the least expensive at $1,282 per month. For a better understanding of independent living costs, you may also refer to Independent Living: Services, Costs, Benefits in 2025. |

| Assisted Living | ~$6,077 per month. Hawaii is the most expensive with an estimated cost of $11,650 per month, and South Dakota is the least expensive at $4,481 per month. (Assisted Living Costs in the United States) |

| Memory Care | An average of $7,908 per month for a private room, with state costs ranging from $5,200 to $9,200 per month. (Memory Care: Services, Costs, and Benefits in 2025) |

| Skilled Nursing Facility (Semi-private room) | Estimated at around $9,197 per month. Texas is the least expensive with $5,125 per month, and Alaska is the most expensive at $31,512 per month. (Nursing Home Costs: A State-by-State Guide) |

| Skilled Nursing Facility (Private room) | A national median of $10,326 per month. Alaska is the most expensive, with $36,378 per month, while Oklahoma and Louisiana are the least expensive, both at $6,083 per month. (Nursing Home Costs: A State-by-State Guide) |

| In-Home Care (Home Health Aide) | Around $34 to $35 per hour, which ranges from $59,000 to $100,000 annually, based on the 44 hours per week per year standard. |

The figures listed are based on trusted industry providers and Genworth Financial’s Cost of Care Survey 2025. Noticeably, among these senior living options, independent living is the least expensive, while a private room in a nursing home is the most expensive.

- Independent living

- Independent living, also known as retirement communities, is a type of senior living option that provides housing, utilities, and a variety of amenities for older adults who are looking to live actively in retirement. With an estimated average cost of $3,125 per month, it is the most affordable senior living option.

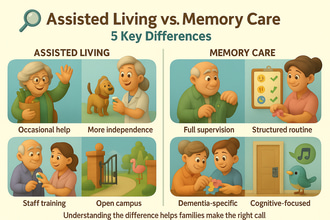

- Assisted Living

- Typically offers housing and assistance with daily living activities, including bathing, dressing, meals, and grooming. It costs around $6,077 per month, and depending on the community, this fee may be all-inclusive, while others may charge for additional care services.

- Memory Care

- Specializes in care for cognitive conditions, like Alzheimer’s and dementia, providing a secure environment to ensure their safety. It costs around $7,908 per month, which is 28% higher than assisted living.

- Nursing Homes

- Considered the most expensive option due to the variety of care options provided. It ranges from $9,197 to $10,326 per month for a semi-private or private room.

- In-Home Care

- Care provided at home is usually calculated by the hour, which is $34 to $35 per hour. Hence, costs may increase depending on the number of hours needed, with 24/7 care usually amounting to more costs than those of nursing homes. The cost is also affected by the service provided, with personal care assistance of home health aides and skilled nursing care at home costing more than basic companionship or homemaker services.

Regional Cost Variation

Geographical location is one of the major factors that affect senior living costs. Places with high real estate costs, higher wages, and higher cost of living tend to have more expensive senior living options. Costs vary depending on the location, including by state, the cost of living in each state, and urban and rural areas.

- High-Cost vs Low-Cost States

- Northeast and West Coast states typically cost more, while the South and Midwest are considered more affordable.

- Maine is a state in the Northeast and usually has a higher cost of senior living, with assisted living costs at $8,288 per month, independent living at $6,162 per month, and nursing homes ranging from $12,000 to $12,000 per month. Senior living costs in this state are usually among the most expensive in each category. The high cost of senior living in this state is driven by its higher-than-average cost of living and a huge demand for services due to its high older adult population.

- Similarly, states like New York, New Jersey, and Hawaii tend to have more expensive senior living costs due to their higher cost of living.

- On the other hand, Mississippi, which is a state in the South, is usually one of the least expensive in every type of care. Assisted living costs $4,578 per month, independent living costs around $1,282 per month, and nursing homes at $7,123 to $7,452 per month. With its lower cost of living, the expenses of senior living tend to be cheaper.

- Northeast and West Coast states typically cost more, while the South and Midwest are considered more affordable.

- Urban vs Rural Areas

- Urban areas, like Manhattan, San Francisco, Miami, and Seattle, tend to have a higher cost of living and concentrated services, driving the increase in senior living costs.

- In comparison, rural areas like Avery County, NC, and Hardeman County, TX, have a relatively lower cost of living, which also lessens senior living costs.

- Intrastate Differences

- Cities within states also have varying costs. For example, in New York, the state average of assisted living is $6,300; however, Manhattan has a higher than state average with an estimated $9,334 monthly.

- Locations with a pleasant climate and proximity to top hospitals and services tend to have higher prices due to higher demand.

Factors Influencing Pricing

Aside from geographical location, there are also other factors that affect senior living costs, including:

- Level of Care Needed

- The more complex the level of care needed, the more expensive it is. As discussed, nursing homes are more expensive due to their wide range of care services. Independent living, in comparison, costs less because it usually does not require additional care. For in-home care, the more hours and the more complex the care is, the higher the costs. The increase in costs is influenced by the number of caregivers necessary and the hours of care they provide.

- Most assisted living communities utilize tiered care levels of a la carte fees, which offer older adults additional rates depending on the care they need.

- Type of Accommodation

- Costs differ depending on the size of the accommodation, whether private or shared. Essentially, a private room in any senior living community is more expensive than a shared room.

- Amenities and Services

- The level of luxury of a community affects its rates, like resort-style communities with a variety of amenities like restaurant-style dining, pools, spas, and concierge services. Most communities offer these services at additional costs and can be optional.

- In contrast, communities that provide basic housing and care without various amenities will cost less.

- Pricing Structure

- Different pricing models are utilized by different communities, with some offering all-inclusive rates, which typically include rent, basic care, and all amenities. While others offer tiered pricing, which means that older adults have to pay higher fees for higher levels of care, and a la carte pricing, which includes the base rent but has additional fees for services used.

- For other communities, while the base rate may be lower, additional services may hike the costs. Hence, research the community’s pricing models or reach out to them to ensure that you get the right services for the amount you pay.

- Staffing and Staff Qualifications

- Communities with higher caregiver-to-residents ratios or specially trained caregivers, like on-site licensed nurses, memory care specialists, and therapists, tend to charge more for labor costs. In contrast, communities with lower caregiver-to-resident ratios are expected to cost more due to higher labor costs. Additionally, places with higher wages will cost more.

- Regulations and Insurance

- Senior living communities adhere to state regulations, hence, states that require higher staffing or caregivers may cost more.

The combination of all these factors affects the senior living experience and the costs. Essentially, older adults pay for housing, hospitality, and healthcare. Hence, communities with more amenities, higher levels of care, and more caregivers, and are located in urban areas, may come at a premium price. In planning for long-term care, ensure that you have an in-depth understanding of what is included and the possible additional charges.

Comparative Cost Analysis

Across Options

Noticeably, independent living is significantly lower than nursing homes due to the wide gap in terms of care provided.

- Independent vs Assisted Living

- Assisted living costs more than independent living because it provides personal care support and supervision, which independent living does not offer.

- Assisted Living vs Memory Care

- Assisted living costs 28% less than memory care due to the specialized care and safety features provided. For instance, assisted living in California costs around $7,571 per month, while memory care costs $8,500 per month. The additional costs usually cover safety features like alarms and locked units, specialized care, and therapeutic activities.

- Assisted Living vs Skilled Nursing

- Nursing homes cost 62% to 82% higher than assisted living, but provide higher levels of care for more complicated needs. The higher rates of nursing homes usually cover medical care, skilled nursing, and rehabilitation services. For example, assisted living in Mississippi costs around $4,578 per month, while nursing homes range from $7,123 to $7,452.

- Assisted Living vs Home Care

- Comparing the costs of assisted living and home care depends on the level of care needed. For instance, older adults in California who only need part-time care, like 20 hours per week, will be able to save more, with $3,440 per month, compared to assisted living, which costs $7,571 per month.

- However, for those needing extensive care, like 44 hours per week, assisted living might be a better option since personal care at home may cost around $7,946 per month.

- Older adults and families, especially those needing 24/7 care, should take into consideration the cost of homeownership, rental expenses, utilities, food, and other living expenses. Assisted living already covers these costs, hence, it might be a better option and can be more cost-effective.

Changes in Costs Over Time

Over the years, the cost of long-term care has continuously increased due to a combination of factors like inflation, rising healthcare costs, and increasing demand. According to the 2023 Genworth Cost of Care Survey, assisted living and home care have been outpacing general inflation.

- From 2012 to 2023, assisted living has seen a 60% increase. Notably, from 2023 to 2024, assisted living has increased by 10%, from $5,350 to $5,900 per month.

- Nursing homes also gradually increased over the years, with an annual rate of $81,000 in 2014 to around $127,000 in 2024. The increase in nursing home costs is also consistently above general inflation.

- Homemaker services have also seen a 10% increase from 2023 to 2024. Home care has consistently seen a cost hike, mirroring the high demand for in-home caregivers that is not met by its shortage.

Considering the consistent increase in costs and comparison of options, independent living remains the most affordable, followed by assisted living, memory care, and nursing homes, which are the most expensive. As for in-home care, costs depend widely on the number of hours needed and the level of care. With inflation and other factors, senior living costs would continue to increase. Hence, families should plan for long-term care with at least a two to four percent allowance to avoid financial deficit.

Additional Costs to Consider

Aside from base rent and care fee, communities may also offer one-time fees or additional charges for other services, including:

- Move-In Fees / Community Fees

- Covering administrative processes, apartment preparation, and community maintenance, most assisted living and memory care communities charge a one-time move-in or community fee, which usually ranges from a hundred to a few thousand dollars.

- Security Deposits

- In rent-based communities, usually independent living, a security deposit is often required. This deposit is refundable and can be returned to the owners when they move out, as long as there is no damage to the property and a proper notice is given. Assisted living communities, on the other hand, charge non-refundable community fees.

- Level of Care Surcharges

- If residents require a higher level of care, the community may charge additional monthly fees, depending on the services needed. These fees may begin after an assessment by the care team and will be reflected in the monthly bill.

- Some assisted living communities that offer memory care charge higher rates for memory care units or have an additional memory care fee for those in the standard residences.

- Second Occupant Fees

- For couples or those choosing to live with roommates, some communities offer a second-person fee of $800 to $1200, which can cover additional food, facility use, and basic care for the second person. While the housing cost is shared, the second resident still partakes in meals, utilities, and services. This fee can lower the total cost.

- Healthcare and Medical Expenses

- Monthly fees in assisted living and independent living do not include medical care, aside from first aid and wellness checks. Medicare or private insurance can cover the costs of on-site therapies in such communities.

- For therapies or personal aides in assisted living, residents shoulder the costs, as it may be provided by an outside agency or aide.

- In a nursing home, medical care is part of the service, but specialized medical equipment for complex wound dressing has additional fees, if not covered by insurance.

- Entrance Fees (CCRCs)

- Continuing Care Retirement Communities, which include all levels of care that allow older adults to age in place, usually require a one-time entrance fee, ranging from $50,000 to $1,000,000 to cover future care costs. However, the monthly rent can be lower.

- Optional Services and Amenities

- Services such as telephone, cable, and internet, alongside laundry, salon services, private transportation, and guest meals for visiting loved ones, are also charged separately. For special trips and events, other communities may add charges.

- Miscellaneous

- Miscellaneous fees include costs for hiring movers, first-month deposit, home modifications for safety features, and supplies, which are often paid out of pocket.

- Communities may also have an annual rate increase of 3 to 5% to cover increasing costs.

For precise quotations, reach out to your desired community or ask for a breakdown of fees. Assisted living communities are also required to outline the included services and additional charges to avoid mishaps.

Financial Assistance and Payment Options

There are several ways to pay for senior living expenses, including various government assistance, private insurance, and a combination of these:

- Private Pay

- These include savings, pensions, retirement accounts, Social Security income, and home sale proceeds. Usually, older adults use their finances to cover the gaps in financial assistance and services that cannot be covered. Cost calculators and precise quotes may help optimize resources and estimate their coverage.

- Long-Term Care Insurance

- Depending on the plan, some policies cover assisted living, memory care, or board and care homes. Usually, after the waiting period, the policy will cover a specific amount per day or month up to a lifetime maximum. Only 3 to 4% of Americans aged 50 and above have long-term care insurance in 2023, but if a family member does have one, it is better to understand the coverage and file claims accordingly. Documentation and assessment of care needs, like personal care support, are often required before payout.

- Medicaid

- Medicaid is a joint federal-state program that covers long-term care for low-income beneficiaries. Nursing home costs are fully covered for those who qualify financially and medically. Additionally, home and community-based services (HCBS) or Medicaid waivers, depending on the state, can cover some services, though board and room for assisted living and memory care are rarely covered.

- Medicaid only provides full coverage for medical services, including nursing care. Hence, assisted living services have partial or no coverage, unless Medicaid waivers are applicable.

- Medicare

- Medicare is a federal health insurance program, specifically for those 65+, which covers short-term skilled nursing or rehabilitation after a hospital stay of up to 100 days. Medicare only covers medical services, such as doctor appointments, therapy, hospital care, and rehabilitation. Hospice care is also covered.

- However, assisted living, residential care, long-term care, or independent living are not covered by Medicare due to their lack of health care services.

- Veterans Benefits

- The Department of Veterans Affairs (VA) provides a maximum monthly benefit of $2,050 for single veterans, while surviving spouses receive $1,478 per month through VA Aid and Attendance, which may help partially cover the costs of senior living. According to CMS data, only 5% of assisted living residents depend on VA benefits and utilize funding from other sources, including private insurance.

- State and Community Programs

- States have special programs for older adults that may help offset senior living expenses. Additionally, a Medicare or Medicaid joint program known as Program of All-Inclusive Care for the Elderly (PACE) can cover comprehensive care while allowing older adults to remain at home or in the community. Some non-profit organizations and local agencies on aging also offer grants.

- Insurance Conversions and Other Funding

- Life insurance conversion is the selling of a life insurance policy to cover long-term care. Others also utilize reverse mortgages, or the income from home equity, to pay for care services, and annuities for additional income to pay for care.

- HUD Programs

- The U.S. Department of Housing and Urban Development offers subsidized housing options for low-income older adults for affordable housing and some independent living communities.

- Tax Deductions

- Medical expenses, like assistance with daily living activities, exceeding 7.5% of adjusted gross income, are deductible.

Senior living expenses, especially assisted living and independent living, are generally paid out of pocket. Financial assistance like Medicaid, VA benefits, Medicare, and long-term care insurance may help offset costs, specifically for healthcare services and medical expenses. A combination of these funding options will be a significant help to ease financial burdens. To optimize financial resources, it is crucial to research possible financial assistance, possible long-term care insurance, and plan accordingly. It would also be beneficial to reach out to tax advisors to provide a better understanding of taxes and their benefits.

Future Cost Trends and Projections

Alongside the aging population and increasing demand for long-term care, costs are expected to rise continuously.

- Continued Upward Pressure

- According to Genworth Financial’s Cost of Care Survey in 2023, various senior living options, including home care, nursing homes, assisted living, and independent living, consistently increase from 1% to 10% year over year. Additionally, the convergence of the aging population and general inflation further increases the demand for long-term care, increasing expenses.

- Shortages in caregivers and low wages are yet to be addressed, which further hikes the operational costs of senior living communities.

- Demand vs Supply

- In connection, the baby boomer generation is expected to turn 65+ by 2030, which will further increase the aging population. With the aging population, the problems in senior housing and care services should also be addressed to keep up with the increasing demand. If not, prices would further increase due to higher competition for available caregivers and rooms.

- On the contrary, occupancy data from 2024 shows a positive increase, which will allow communities to bounce back from the pandemic.

- Projected Costs in 5 to 10 Years

- The average annual cost of a nursing home is projected to increase from $81,000 in 2014 to $146,000 by 2030, as per the American Council of Life Insurers (ACLI). For relatively cheaper nursing homes, this would result in almost double the current rates.

- Assisted living, on the other hand, is expected to steadily increase, assuming a 3% increase per year, which would mean that a $6,077 monthly median will be around $8,000 per month. Notably, analysts stated that assisted living costs have rarely stabilized since 2004, and have consistently increased above general inflation.

- Independent living costs are projected to increase from around $3,100 to over $4,100 by 2040, amounting to an annual growth rate of about 1.5% to 2%. Since independent living is closely linked to senior housing, an increase in real estate and senior housing, especially in high-cost states, would further speed up the rate hike.

- Home care costs are most likely to be influenced by the healthcare labor market. The continuous shortage of caregivers due to low wages will further increase the wages of existing caregivers, resulting in higher hourly rates. Considering the 10% increase from 2023 to 2024, it’s possible that the average monthly cost for a full-time home health aide (40 hours per week) would reach $8,000 in the next 10 years. While technology such as care robots or remote monitoring may help reduce some needs, the demand for human caregivers and the genuine care they provide will remain strong.

- Healthcare Cost Inflation

- Since 2005, nursing home costs have had an estimated increase of 4.5% annually, which is almost double the general inflation of an estimated 2.5%. Inflation in the health sector generally affects long-term care, hence, if healthcare inflation continues to increase, senior living is expected to follow. Amendments in mandate, like higher caregiver ratios, will also hike rates due to increased operational costs.

- Planning for the Future

- Utilize cost calculators like Genworth’s Cost of Care calculator to see the projected increase in long-term care costs and plan accordingly. Older adults and family members are advised to provide an allowance of 2% to 5% to accommodate possible increases.

- Policy Changes

- With the growing demand for long-term care, some states have started to discuss public long-term care insurance, which may help older adults and families financially.

In conclusion, senior living costs are expected to continue increasing over the next few years. Although the increase may not be as significant as it was due to the high inflation, a slight increase would still translate to higher costs in 5 to 10 years. Hence, older adults and families are advised to adjust their care budget yearly and remain up-to-date about industry trends. To offset senior living expenses, research long-term care insurance policies, explore government assistance programs, and apply early, if possible. Planning for long-term care will help older adults and families explore options to ensure their loved ones receive the right care for their needs while adhering to their financial capabilities.