Retirement planning isn’t just about saving for travel and hobbies – it’s also about preparing for the cost of care as you age. One often overlooked tool to fund future care needs is long-term care (LTC) insurance. Think of LTC insurance as a secret weapon in your retirement strategy: it can help pay for home care, assisted living, memory care, or nursing home costs without draining your life savings. This article breaks down how retirees can leverage long-term care insurance as a savings tool to fund their care needs, and how to get started with a plan that fits any financial situation.

Why Planning for Long-Term Care Is Critical

If you’re nearing retirement, it’s important to recognize the high likelihood that you’ll need some form of long-term care. In fact, roughly 70% of people turning 65 will require long-term care services at some point in their lives. Yet many people underestimate this risk or assume Medicare will cover it – a dangerous misconception. Medicare does not cover ongoing long-term care beyond very short stints in rehab or nursing facilities, and private health insurance generally doesn’t cover it either. That means without planning, you’d be paying for extended care out-of-pocket until perhaps you qualify for Medicaid (which only kicks in after you’ve spent down most of your assets).

The costs of care can be staggering. According to the Genworth Cost of Care Survey, the national median cost for an assisted living facility is about $64,000 per year, a home health aide runs around $75,000 per year, and a semi-private nursing home room costs over $100,000 per year. These expenses, which continue to rise with inflation, can wipe out retirement savings in a matter of years. It’s no surprise that long-term care costs are considered “one of the biggest threats to older Americans’ financial security in retirement”.This is where long-term care insurance shines. By paying premiums over time, you essentially build a dedicated fund that will cover these hefty care bills later on – sparing your personal savings and giving you peace of mind. Long-term care insurance can help protect your assets and give you more choices in how and where you receive care when you need it. In other words, it’s a way to insure your retirement nest egg against the high cost of aging.

What Is Long-Term Care Insurance and What Does It Cover?

Long-term care insurance (LTC insurance) is a specialized insurance policy designed to pay for assistance with daily living activities and personal care needs over an extended period. If at some point you can’t perform routine tasks like bathing, dressing, eating, or you develop severe cognitive impairment, an LTC policy will kick in to cover the help you require. Unlike standard health insurance, which pays for doctors and hospital bills, LTC insurance covers custodial care – things like an in-home aide, an assisted living residence, memory care for dementia, or a nursing home stay.

Put simply, LTC insurance helps fill the gap for services not covered by Medicare or regular health insurance, acting as supplemental coverage for long-term support. A good policy typically covers care in a variety of settings, offering flexibility as your needs change. For example, a traditional LTC policy might pay for a home health aide or homemaker services (help with cooking, cleaning, errands) so you can remain at home, and also cover a portion of costs if you later transition into an assisted living facility or nursing home. Modern LTC insurance really isn’t just “nursing home insurance” – it’s just as much about helping you stay at home or in the community with paid caregivers. In fact, nearly half of all long-term care insurance claims pay for in-home care, and roughly one-third of claims pay for assisted living, while only about one-quarter fund nursing home care.

By using insurance benefits to pay for services like home health aides, adult day care, or an assisted living apartment in a senior community, you gain the freedom to choose the care setting that best suits your quality of life. Without insurance, many seniors are forced to rely on unpaid family care or settle for whatever limited options Medicaid covers. Long-term care insurance essentially gives you financial independence and dignity in deciding how you receive care as you age.

Starting Early: How and When to Obtain Coverage

Timing is key when it comes to long-term care insurance. Premiums are significantly cheaper and approval is easier when you’re younger and healthier. While you don’t want to buy coverage too early and pay premiums for decades before use, experts often suggest shopping for a policy in your early 60s. In fact, looking into a policy between ages 60 and 65 tends to offer the best balance of affordable monthly premiums and fewer total dollars spent over your lifetime. (Some advisors even recommend couples start in their mid-50s for optimal pricing.) If you wait until your late 60s or 70s, not only will the premiums be much higher, but you also risk developing health conditions that could make you ineligible for coverage. Most insurers require a health screening, so serious pre-existing conditions – like advanced diabetes, recent strokes, dementia, etc. – can disqualify you. The takeaway: plan ahead and apply while you’re still in relatively good health.

When you apply, you’ll choose a policy with certain parameters, such as a daily or monthly benefit amount (how much the insurance will pay for your care), a benefit period (how long it will pay, e.g. 3 years, 5 years, or even lifetime), and an elimination period (a waiting period like 90 days before benefits start). It’s wise to select benefit amounts that reflect the cost of care in your area and to include an inflation protection rider so that your coverage amount increases over time. For example, a 3% compound inflation rider will help your $200 per day benefit keep pace with rising care costs. These choices affect the premium, so you’ll need to balance what you can afford in premiums now with the coverage you might need 20+ years from now.

Don’t be afraid to shop around and get quotes from multiple insurers. Premiums can vary and each company has different discounts (for example, discounts for spouses who apply together) and underwriting criteria. If you find the cost of a full-featured long-term care policy daunting, consider alternatives like short-term care insurance. Short-term care policies provide benefits for shorter durations (often 3 to 12 months) and are generally more affordable and easier to qualify for than traditional LTC policies. While they won’t cover a prolonged 3-5 year care need, they could be a budget-friendly way to insure against some long-term care expenses or to cover a waiting period before other resources (like Medicaid) kick in.

LTC Insurance as a Retirement “Secret Weapon”

You might wonder, why not just save money instead of paying insurance premiums? The reality is that long-term care costs are unpredictable – you could stay perfectly healthy and need $0, or you could face a multi-year decline requiring intensive care that costs hundreds of thousands of dollars. Long-term care insurance is a tool to manage that uncertainty. By paying a known premium, you transfer much of the financial risk to the insurer. In essence, you’re leveraging relatively small planned expenses (your premiums) to secure a much larger pool of money for care if and when you need it. It’s not unlike homeowners or auto insurance: you hope you never need to use it, but you’re protected if disaster strikes. As one industry association put it, LTC insurance lets you “pay an affordable premium to protect an unaffordable catastrophic event.”

Using LTC insurance as a savings strategy means you don’t have to earmark your own retirement savings exclusively for future care. For example, rather than keeping an extra $200,000 in the bank “just in case” for nursing home expenses, you could pay a fraction of that in premiums to buy an insurance policy that would cover those costs. Your other retirement assets are then free to spend on enjoying retirement, or left invested to grow, or even passed on to heirs – rather than being depleted by care bills. This is why LTC insurance can be a secret weapon: it safeguards your nest egg and can prevent a scenario where a need for care derails your entire financial plan.

It’s important to note that policies have evolved to address the common worry, “What if I pay all these premiums and never use the care benefit?” Newer hybrid long-term care policies combine LTC coverage with life insurance or annuities. With a hybrid policy, if you end up never needing long-term care, your family will receive a life insurance payout or you can recover some unused funds – either way, the money isn’t “lost”. These policies do tend to cost more or require a larger upfront payment, but they offer a guaranteed outcome (care benefits if you need them, or a death benefit/return of premium if you don’t). For many, this peace of mind is worth the higher price tag. Hybrid policies have grown popular as a way to leverage existing savings (for example, using part of a 401(k) rollover or a lump sum) into a flexible fund that covers long-term care or turns into an inheritance.

Using LTC Insurance to Cover the Full Continuum of Care

An LTC insurance policy gives you the flexibility to receive care in the setting you prefer – whether that’s help from a home health aide in your own house or a stay in an assisted living community when home is no longer an option. One of the greatest advantages of long-term care insurance is that it can be used to pay for care in various settings as your needs change over time. Here’s how a typical retiree might leverage their policy across the continuum of care:

- Home Care: Most people prefer to stay at home as long as possible. LTC insurance will pay for in-home services like a certified home health aide to help with bathing, dressing, medication management, and other personal care. It can also cover homemaker services if you just need help with housekeeping or meal preparation. By using your policy for home care, you may delay or even avoid moving into a facility, maintaining independence in familiar surroundings.

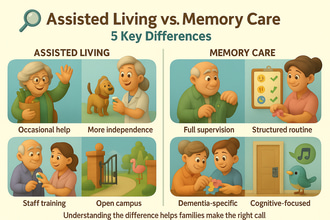

- Independent or Assisted Living: If living entirely on your own becomes difficult, you might consider moving into a senior living community. Since independent living communities don’t typically provide personal care, LTC insurance does not cover the rent. However, if you live in an independent or retirement community and later need caregiving services brought in, and as people transition into an assisted living facility, which provides help with daily activities in addition to housing, LTC policy could cover care services. Long-term care insurance policies cover the costs of caregivers and personal care in assisted living facilities, up to the limits of your policy. In practical terms, your policy might pay a daily or monthly benefit toward the assisted living fees related to personal care.

- Memory Care: For those with cognitive conditions like Alzheimer’s or other dementias, memory care units (usually in a stand-alone memory care community or specialized units in an assisted living or nursing home) provide a safe environment and specialized care. If you have a long-term care policy, coverage is typically included for memory care. LTC insurance typically covers cognitive impairments, even when a person can still function basic routine tasks. This can relieve a huge financial burden from families, as memory care can be as expensive as nursing care.

- Skilled Nursing Facilities: If medical needs become complex or a 24-hour supervision is required, a nursing home (skilled nursing facility) might be the best option. This is often the most expensive care setting, with around $100k per year or more for a semi-private room on average. Long-term care insurance will cover nursing home costs as well, typically up to a daily limit. For instance, if the policy has a $200 daily limit, and the nursing home costs $300, you’d have to pay the remaining $100. Having LTC insurance means you can afford a quality nursing facility of your choice, rather than having to rely on whichever facility accepts Medicaid patients once you’ve run out of funds. It gives you options at a challenging time, ensuring you get adequate care without completely emptying your family’s pockets.

Across all these settings, the goal of LTC insurance is to pay for the help you need so that you don’t have to sacrifice your entire life savings or depend solely on family caregivers. By having insurance to cover professional care, you can ease the burden on your loved ones and preserve your family relationships, and allow your spouse or children to spend quality time with you instead of being full-time caregivers.

Picking the Right Policy for Your Budget and Needs

Long-term care insurance is not a one-size-fits-all proposition. The “best” policy and strategy will differ depending on your financial situation and goals. Here are some considerations for different scenarios:

- If you have limited savings or income: Affording any insurance policy might seem challenging, but there are tailored options to consider. Look into special policies, like Partnership long-term care insurance policies, which collaborates with state Medicaid programs, allowing you to protect an amount of your assets equal to the benefits the policy paid out. For example, if your policy paid $150,000 toward your care, you would be allowed to keep $150,000 of your assets and still qualify for Medicaid if you need it, rather than having to spend down to poverty levels. Partnership policies were designed as a safety net for those of moderate means; they often include inflation protection to keep coverage growing, and they cost no more than a standard policy of the same benefits. This can be a smart choice if you aren’t wealthy, as it ensures you get a period of quality care paid by insurance without losing everything should you later rely on Medicaid. Even a smaller LTC policy is better than none; some coverage for a year or two of care can delay or reduce out-of-pocket spending. Also, remember that one primary reason people buy LTC insurance is to receive care at home, since Medicaid’s long-term care coverage varies by state and usually favor nursing home care over home care. If staying at home is important to you, an LTC policy could be invaluable.

- If you’re middle-class with a moderate nest egg: You’re in the group that arguably benefits most from LTC insurance. You likely have too many assets to qualify for Medicaid initially, but not enough to comfortably fund yourself for expensive care. A traditional LTC insurance policy with a 3-5 year benefit period can protect most of your assets. You might aim to cover the average duration of care (many need about 2-3 years of care, though some need longer). By doing so, you shield your spouse from impoverishment, especially if you’re married, and preserve an inheritance or remaining savings. Shop for a policy that fits your budget – perhaps by adjusting features like the elimination period or daily benefit. Also consider shared benefit riders for couples: these allow spouses to pool their coverage, so if one spouse needs more care, they can tap into the other’s benefit pool. This can be cost-effective protection for couples.

- If you’re affluent with substantial assets: Higher net-worth individuals might technically be able to self-insure (pay for care out-of-pocket), but many still choose to leverage long-term care insurance as a wise financial move. If you can comfortably pay the premiums, an LTC policy (especially a hybrid policy) can essentially ring-fence your portfolio. It ensures that even if you need, say, $500,000 of care, your investment accounts or property don’t have to be liquidated under duress. Many affluent folks like hybrid life+LTC policies because of the dual benefit: it doubles as a wealth transfer or estate planning tool (via the life insurance component) while also covering long-term care if needed. In addition, premiums for tax-qualified LTC policies may be partially tax-deductible at higher ages, which can take a bit of the sting out of the cost. The bottom line is, wealth doesn’t make the risk of needing care go away – it just means you have more ways to pay. But an insurance policy can often pay for care in a leveraged way (you pay a dollar to get several dollars of benefit) and preserve the intent of your other savings (such as maintaining your lifestyle or leaving a legacy).

Finally, everyone should carefully review the policy details before buying. Make sure you understand the triggers benefits, which is usually the inability to perform 2 out of 6 Activities of Daily Living, or severe cognitive impairment; the elimination period; and types of care covered or excluded. Work with a knowledgeable agent or financial planner if you can – they can explain differences between policies and help find one that fits your needs and budget. Also, consider the insurance company’s stability and history of rate increases; you want an insurer likely to be around decades from now when you file a claim.

Conclusion: Planning Today for Peace of Mind Tomorrow

Long-term care insurance may not be the first thing that comes to mind when plotting out your retirement, but it deserves a serious look as a powerful financial planning tool. It is essentially “asset protection” insurance and “quality-of-life” insurance rolled into one, protecting your hard-earned savings and giving you the means to access quality care on your terms. Whether you have substantial savings or very little, there are ways to adapt LTC coverage to your situation, from partnership policies for those with limited assets to hybrid policies for those who can afford more. By starting early and leveraging long-term care insurance as your retirement secret weapon, you can face the future with greater confidence. You’ll know that if the day comes when you need extra help – be it a few hours a day at home or full-time care in a facility – you’ve planned for it and you have a financial safety net in place.

Incorporating long-term care insurance into your retirement strategy can mean the difference between scrambling to cover care costs versus having a secure plan to fund your needs. It’s about maintaining control, dignity, and independence in your later years. No one likes to imagine themselves needing help with basic activities, but by confronting that possibility now and using tools like LTC insurance, you’re doing something truly empowering: you’re taking care of your future self. And that’s perhaps the best gift you can give yourself and your family as you all grow older.