Senior living in the United States offers various housing and care options tailored to older adults’ unique needs, from independent living communities to skilled nursing facilities. Various factors continuously shape this complex industry, and understanding its structure can help operators and families make informed decisions. In this article, we’ll give you a breakdown of the characteristics of the key segments that define this important sector.

An Overview on Senior Living Options

| Senior Living Type | Description | Key Features | Typical Residents | Payment & Costs |

| Independent Living (IL) | Designed for active older adults who require little to no daily assistance. | Private accommodations with services like housekeeping, meals, and social activities No personal or medical care on-site | Younger and active older adults (55+ or 62+), often in their 70s | Private pay, some long-term care insurance |

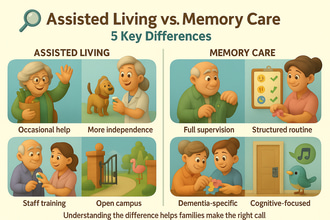

| Assisted Living (AL) | Offers housing, meals, and personal care services for older adults who need moderate assistance with daily living activities but not intensive medical care. | Assistance with daily activities (bathing, dressing, medication management), social activities, transportation Specialized memory care units in some communities for residents with memory conditions | Older adults in their late 70s to 80s with a majority being women | Private pay, some long-term care insurance, VA benefits |

| Memory Care | Specialized care for individuals with cognitive impairments like Alzheimer’s or dementia | Enhanced security features, specially-trained team members, structured cognitive programs, higher staff-to-resident ratio | Older adults (often late 70s-80s) with moderate to advanced dementia | Private pay, higher costs than standard AL |

| Skilled Nursing Facilities (SNFs) / Nursing Homes | Provides 24/7 medical care and rehabilitation services to disabled or chronically ill older adults with complex health needs | Highly regulated medical team, therapy services, short-term rehab & long-term care | Older adults (often 80s-90s) with complex medical needs or disabilities | Medicare (short-term), Medicaid (long-term), private pay |

| Continuing Care Retirement Communities (CCRCs) | Life plan communities offering IL, AL, and skilled nursing in one location | Campus-style model with multiple levels of care, on-site medical care, high-end amenities | Middle to high-income older adults entering their 70s or early 80s | Entry fees, monthly payments, private pay |

| Home & Community-Based Services | Provides medical and non-medical services to older adults aging in place at home | Personal care assistance, home health services, respite care, hospice/palliative care | Older adults who prefer aging in their residence with support | Private pay, Medicare (some skilled care), Medicaid (low-income seniors) |

Various senior living options are essential to ensuring older adults receive the care and support that matches their needs. The right choice depends on one’s health and financial situation. Understanding these options helps families make better judgments about their loved ones’ care and ensure they are well-cared for in a comfortable and supportive environment.

Ownership and Corporate Structure in Senior Living

Apart from variations in the type of care provided, the senior living industry also varies in ownership structures, from small independent operators to large corporations. It is a highly fragmented industry, with no single company dominating nationwide. Thousands of providers operate at local and regional levels, each with different business models and financial structures, including;

- Large For-Profit Operators

These operators pertain to corporations managing multiple senior living communities across the country. They provide independent living, assisted living, and memory care services under well-known brands. In the assisted living segment, around 56% of communities are part of a chain. Some examples include Brookdale Senior Living, Atria Senior Living, and Life Care Services. They offer standardized services and often have real estate investment partners or private equity backers. Despite being the largest operators, they hold only a small share of the total market.

- Real Estate Investment Trusts (REITs)

REIT companies own senior housing properties and typically lease them to operators. Two of the largest senior housing real estate owners are the Welltower and Ventas, which own 102,600 and 80,000 senior housing units, respectively. These companies separate property ownership from daily operations, allowing operators to focus on resident care. This structure made REITs a large capital provider for expansion and acquisitions that drove industry growth.

- Private Equity Firms & Investors

Private Equity Firms & Investors target senior living and long-term care and acquire companies and real estate portfolios. Great examples of these companies include Blackstone, Apollo, KKR, and others that facilitate buyouts. Between 2005 and 2015, PE-owned nursing facilities rose from 0% to 9% and will likely continue in the next few years. Typically, these companies use aggressive cost management and leveraged buyouts, leading to quality and transparency concerns. Still, PE companies continuously seek to consolidate the fragmented market and streamline operations for efficiency.

- Non-Profit Organizations

Non-profit entities typically include faith-based organizations and community foundations that run senior communities. These entities focus on reinvesting surplus funds into resident care and often cater to middle-to-upper-income older adults.

- Regional & Local Providers

These independently owned or small regional operators manage a few dozen communities within specific areas. Most of these companies are family-owned assisted living companies and local owners of nursing homes. They often specialize in services tailored to local market needs, such as memory care and luxury independent living.

Due to the fragmentation of the senior living industry, even the market share of top operators remains relatively lower than the overall market size. The largest companies like Brookdale still have single-digit percentages of the market, around 3 to 4%. Hence, the industry’s fragmentation leads to an interest for most for-profit companies to drive consolidation through acquisitions and mergers. But for now, the senior living market remains highly competitive, with no single entity holding a dominant share.

Financial Landscape of the Senior Living Industry

As a multi-billion-dollar industry, senior living features a diverse and segmented financial landscape influenced by cost structures, payer sources, and real estate considerations. On average, the U.S. senior living market size ranges from $120-$150 billion annually for private-pay senior housing to $923 billion when including all elder care services. Below is a breakdown of the costs, revenues, funding, and capital investment trends in the industry to help you better understand the financial landscape of senior living;

Revenue and Profitability by Segment

| Market segment | Revenue and Profitability Trends |

| Independent & Assisted Living | Revenue for these segments largely come from private-pay rents and service fees, with a monthly median rate of around $4,500. With the rising demand and rates, the U.S. assisted living market was valued around $92 billion in 2022 and expected to grow at 5.5% CAGR through 2030. The pandemic tightened the margins, leading to some operators suffering net losses of nearly 40%, cutting costs, and seeking government relief funds. To counter inflation, most AL/IL operators raised monthly rates by 5-8% in 2022. |

| Skilled Nursing Facilities | Nursing homes heavily rely on government reimbursements, including Medicaid (~60% of residents) and Medicare (~13%).This segment’s profitability is often tight due to Medicaid’s low reimbursement rates and Medicare’s higher rates but time-limited coverage.As a result of the pandemic, most nursing homes operate at break-even or losses.However, even before the pandemic most facilities were operating in the low single digit margins. |

| Continuing Care Retirement Communities | This segment derives its revenue from a mix of entrance fees, monthly rents, and Medicare/Medicaid reimbursements.CCRCs’ financial stability relies on maintaining high occupancy. |

| Home Care Providers | Home health agencies are funded by Medicare reimbursements (around $17-18B in recent years), and Medicaid personal care programs.This segment is also growing with more families paying out-of-pocket when hiring caregivers. |

Cost Structures and Expenses

Since senior living operations are labor-intensive, the largest expense comes from labor (around 50-70% of operating budgets), including caregivers, nurses, and support staff. Some states also mandate that nursing homes allocate 70% of their revenues to direct care costs.

Apart from labor, other major expenses in senior living include food and dining, insurance, maintenance, utilities, medical supplies, and REIT lease payments for those who lease their communities.

Factors like inflation, staffing shortages, and supply chain disruptions increase costs. During the pandemic, assisted living communities saw an increase in their operational costs of around 40% between 2021 and 2022. To conclude, the senior living cost structure has high fixed costs, which makes scaling occupancy essential for maintaining financial stability.

Funding Models and Payment Sources

Senior living costs vary by care level and are funded through a mix of private pay, insurance, and government programs:

- Independent & Assisted Living communities: They primarily derive their funding from private pay from long-term care (LTC) insurance, personal income, or savings. Another source of funding for these communities are VA Aid & Attendance benefits that assist eligible veterans with costs. Low-income older adults in some states can also use Medicaid waivers to cover care services but not room & board.

- Skilled Nursing Facilities: Most nursing homes receive funding from Medicaid with daily rates ranging from $150 to $300 per day, which is lower than the private-pay rate. On the other hand, Medicare offers higher payments for short-term skilled nursing up to 100 days post-hospitalization. Managed Care Plans are also increasingly influencing post-acute funding. Private pay is limited, as most transition to Medicaid once assets are depleted.

- Home & Community-Based Services: These communities often get their funding from private pay, Medicaid HCBS programs, and Medicare for short-term skilled care.

Capital Investment and Development Trends

- In the years leading up to 2020, senior housing saw rapid growth, which led to oversupply in some markets. The COVID-19 pandemic halted new development, and construction activity hit decade-lows by 2022.

- Developers also faced a sudden rise in construction costs and interest rates, further constraining new projects and leading to a 40% decrease in transaction volume for senior housing in 2023-2024.

- Current supply shortages may lead to targeted growth in high-demand areas.

- REITs and private equity firms are gradually resuming acquisitions, with Welltower investing $6.2B in 2024.

- Investors focus on upgrading existing facilities and developing affordable senior housing models.

Market Growth and Demographic Trends

Demographics are a crucial influencing factor for the senior living industry. With the rapidly aging U.S. population, driven by the aging baby boom generation, the senior living industry is expected to see changes in its market. In this section, we’ll help you understand the influence of demographic trends on market growth.

Aging Population and Demand

- The number of Americans aged 65 and above is projected to grow from 58 million in 2022 to 82 million by 2050.

- By 2030, all baby boomers will be 65 or older, expanding the 65 and above bracket to around 71 million, or about 20% of Americans.

- The 85 and older population, which drives demand for higher care levels, will increase from 6.5 million to 13.7 million by 2040.

- As the population ages, demand for senior living communities steadily increases, with occupancy rates exceeding pre-pandemic levels by late 2024.

- The U.S. would need 700,000 new senior housing units by 2029 to maintain current penetration rates.

Regional Demand Variations

- Key retirement hubs, such as the Sun Belt states (Florida, Arizona, Texas, and Carolinas), have strong senior housing development.

- Western states like Arizona, Colorado, and California account for 40.8% of assisted living communities, while the Northeast has the fewest at around 8.6%.

- Rural areas tend to have shortages of communities and rely on county-run nursing homes or personal care homes.

- Affluent areas with higher property values also saw an increase in the development of IL/AL communities.

- As of Q4 2023, secondary markets had higher occupancy rates by 87% compared to the primary markets, with an average of 85.6%.

- States with supportive policies tend to have higher capacity than states with stricter regulation and low Medicaid funding.

- Climate and disaster risk areas can deter investors from building or buying senior housing in the area.

Evolving Consumer Preferences

- Boomers who are more independent and tech-savvy prefer to age in place in their own homes, delaying their transition to senior living and boosting demand for home care.

- Boomers also value wellness and social engagement, which is why modern senior living communities offer wellness-focused amenities like fitness centers, pools, and spas.

- Senior living communities are starting to integrate smart home features, telehealth, and digital communication tools into their campus.

- More providers are offering in-home care services to attract older adults who are hesitant about moving into senior housing.

- Modern communities emphasize private apartments, flexible dining, and resident-driven schedules for boomers who enjoy their autonomy.

- Specialized senior housing options cater to LGBTQ+ seniors, ethnic groups, and lifelong learners.

- More communities are being developed as part of mixed-age communities or near town centers to maintain stronger connections and a sense of belonging to a broader community.

In sum, the numbers of older adults drive market growth in the senior living industry. However, success still depends on meeting the preferences and needs of the new generation of older adults. Hence, providers should learn to adapt to these changes and create communities that foster a vibrant atmosphere.

Navigating the Regulatory Landscape in Senior Living

Senior living providers need to follow a complex set of rules at the federal, state, and local levels. These regulations vary depending on the type of care provided, with skilled nursing facilities facing the strictest oversight and independent living with minimal healthcare-related regulations. Here’s an overview of key compliance factors for each senior living type:

Assisted Living Regulations (State Oversight)

Assisted living communities are regulated at the state level, which means requirements may vary widely across the country. State-by-state regulations regarding caregiver training, staffing levels, safety standards, medication management, and more can vary. Some examples include:

- Having specific staff-to-resident ratios for memory care units or mandate administrator licensing.

- Enforcement of fire safety codes, particularly for memory care units that require secured exits.

- Offering “aging in place” waivers allowing home health or hospice services within assisted living communities.

- Requiring disclosure forms to prospective residents outlining services, fees, and policies.

- Giving residents rights that protect them from unjust eviction.

Skilled Nursing Facility Regulations (Federal & State Oversight)

Nursing homes operate under strict federal and state regulations because they receive Medicare and Medicaid funding. They must comply with federal participation requirements under the Social Security Act. The Centers for Medicare & Medicaid Services (CMS) implements clear regulations that regulate nursing homes’ clinical care, resident rights, staffing, infection control, physical environment, and more.

Key federal requirements include:

- Having a registered nurse (RN) on-site at least eight hours a day and nursing staff available 24/7

- Providing individualized care plans to residents, with routine assessments using MDS

- Strict medication management with oversight by consulting pharmacists

- Limitations on physical restraints and requirements for social activities

- Maintaining nutrition and dietary standards.

Nursing homes also need to undergo annual surprise surveys by state survey agencies on behalf of the CMS. Deficiencies can result in fines, admission bans, or Medicare/Medicaid certification loss. States can impose additional regulations, such as higher staffing ratios or stricter patient protection rules. CMS can also require nursing homes to have comprehensive emergency preparedness plans for emergency situations.

Home Care and Other Senior Services

Home health agencies that bill Medicare must follow CMS’s Conditions of Participation, including care planning, mandatory patient assessments, physician oversight, and OASIS assessments. Like nursing homes, they also undergo compliance surveys.

Non-medical home care agencies, on the other hand, are licensed at the state level, and regulations vary widely. Some states require caregiver training and background checks, while others have minimal oversight. Adult day centers and hospice providers also operate under specific state and federal regulations, especially in senior living communities.

Labor and Workplace Regulations

Senior living providers also have to comply with general labor laws, including:

- OSHA regulations for workplace safety, including caregiver injury prevention

- Wage and hour laws under the Fair Labor Standards Act

- State-specific staffing mandates

- Immigration laws affecting foreign-born caregivers

COVID-19’s Impact on Regulations

The pandemic significantly affected regulations, leading to stricter infection policies, particularly in nursing homes. Emergency preparedness and disease prevention policies were also reconsidered by regulators across all senior living settings when over 160,000 nursing home residents passed away from COVID-19. As a result, increased oversight and quality standards are expected.

Legal & Compliance Considerations

Senior living providers should manage their legal risks, including lawsuits related to falls, medication errors, or wrongful death. To save themselves from liability costs, operators must

- Adhere to proper documentation and regulations

- Train their team members on policies and resident rights

- Comply with the Fair Housing Act and Americans with Disabilities Act (ADA) to ensure non-discriminatory housing practices and reasonable accommodations for residents with disabilities

- Follow HIPAA laws to protect resident privacy

Regulations can vary in every senior living option, from minimal regulations in independent living to strict policies in skilled nursing. Though regulatory compliance can be challenging, planning for these requirements helps ensure better care outcomes, protect providers from legal risks, and improve their reputation.

Industry Consolidation and Mergers & Acquisitions in Senior Living

As larger companies, real estate investment trusts (REITs), and private equity companies continue acquiring smaller operators and properties, the senior living industry continuously undergoes consolidation. Although merger and acquisition (M&A) activity fluctuates along changing economic conditions, the overall trend leads to a more consolidated industry. Here’s an overview of recent M&A developments and their impact on the market.

Recent M&A Activity

Several major mergers have shaped the senior living landscape in the last decade, with Brookdale Senior Living’s 2014 acquisition of Emeritus Corp for $2.8 billion being the largest deal. Other notable transactions include:

- Atria Senior Living’s 2021 merger with Holiday Retirement which made it the second-largest independent living provider in the U.S. by unit count

- The 2023 acquisition of Integral Senior Living (ISL) by Discovery Senior Living, adding 9,000 units and boosting Discovery’s ranking from 5th to 2nd largest operators

- Private equity and REIT takeovers, such as HCR ManorCare’s acquisition by Welltower and ProMedica in 2018 and the 2017 acquisition of Holiday Retirement’s properties by Fortress Investment and Blackstone

More recently, economic conditions in 2022–2023 slowed M&A activity, but deals picked up in late 2023, leading to further consolidation in 2025 as market conditions stabilized.

REIT and Private Equity Strategies

REITs and private equity firms have played a major role in industry consolidation. They often target high-end private-pay communities with ideal demographics, acquiring large portfolios or partnering with operators.

Sometimes, private equity firms utilize a “buy and build” approach, which involves acquiring a senior living company, expanding its communities, optimizing operations, and eventually selling at a profit. Some examples of this include;

- Holiday Retirement’s ownership shifts from Fortress Investment to a REIT, then to Atria.

- The private transfer of Sunrise Senior Living to KKR, which sold it to Welltower, and later transferred it to a new private equity-backed group.

Impact on Pricing and Competition

Although consolidation can lead to fewer independent operators and competitors, senior living remains a localized industry that allows communities to compete regionally, removing the possibility of oligopoly in local markets.

However, consolidated companies may gain pricing power in some markets, setting standardized rates across their locations. Larger companies can also benefit from bulk purchasing discounts and lower their costs.

Impact on Quality of Care

Consolidation pros argue that it can lead to better quality of care as larger organizations may implement system-wide best practices, invest in staff training, and use advanced technologies for health monitoring and safety, which small operators might not afford.

However, critics also note that profit-driven consolidations led by private companies can result in aggressive cost-cutting measures that negatively affect care quality. Studies demonstrated that private equity-owned nursing homes tend to reduce frontline staffing and cut costs on direct resident care, which often result in poorer health outcomes. Most PE-owned communities also tend to have higher charges.

Staffing and Workforce Considerations

Consolidation can also affect staffing as larger entities can offer more career growth opportunities and benefits or implement standardized labor usage to keep their staffing at required levels. Unions have gained traction in certain nursing home chains, influencing wages and staffing policies. In some cases, large chains set the prevailing wage rates in their markets, impacting overall caregiver compensation.

Consumer Choice and Market Competition

Despite consolidation, most cities still have a mix of large operators, regional providers, and small independent communities, keeping competition relatively healthy. New entrants also continue to appear and keep the market dynamic.

Hospitals, insurers, and senior living communities also partner or merge to provide seamless healthcare services. While this consolidation can improve care coordination, it may also limit residents’ options and tie them to specific networks.

Future M&A Outlook

The senior living sector is expected to see continued consolidation due to increasing demand, aging demographics, and the need for financial stability among smaller operators. Some key trends to watch include:

- REITs and private investors will continue to acquire high-performing senior living properties.

- Non-profit senior living organizations may see an increase in consolidation to remain financially stable.

- Private equity-owned facilities may face stricter regulatory scrutiny.

- Highly leveraged operators may be forced to sell assets if they fail to gain funding under higher interest rates.

Challenges and Opportunities in Senior Living

At present, the senior living industry faces significant challenges and exciting opportunities. Senior living providers must navigate staffing shortages and rising costs while also preparing for an increase in demand as the aging population grows. In this section, we’ll tackle the challenges and emerging opportunities that will shape the industry’s future.

Workforce Shortages and Staffing Issues

One of the biggest challenges in senior living today is the labor shortage. This challenge was further intensified by the COVID-19 pandemic, which led plenty of workers to quit due to burnout, health concerns, or low wages. As of 2023, the sector is still short by about 245,000 workers from the pre-pandemic levels. Nursing homes suffered the most, with staffing shortages forcing some communities to limit admissions.

Key positions remain in high demand, but competition from hospitals and other industries offering higher wages makes hiring difficult. Providers provide higher wages, bonuses, and better benefits to address this, while some communities invest in career development programs. However, workforce shortages are still expected to persist, and long-term solutions will be necessary.

Rising Operational Costs

Senior living operators also have to deal with rising operational costs as inflation in recent years has driven the cost of food, utilities, and supplies. Liability insurance costs also increased due to increased claims, particularly COVID-related lawsuits. Issues in the supply chain also made essential medical and safety supplies more expensive.

Even as occupancy rates improve, profit margins remain tight, and many communities have raised resident fees to compensate. However, the continuous increase in rates can make senior living unaffordable for middle-income older adults, leading to a delay in transitioning to senior living. Moving forward, finding ways to manage costs without compromising care will be a key challenge for operators.

Post-COVID Occupancy Challenges

The pandemic had a significant impact on senior living occupancy rates. Occupancy plummeted as a result of slowed move-ins and high mortality rates in 2020-2021. While occupancy has gradually recovered, it remains slightly below pre-pandemic levels in many sectors.

Senior living providers have been offering incentives and emphasizing improved infection control and safety protocols to recover occupancy rates. Encouragingly, demand is rebounding, with the National Investment Center for Seniors Housing & Care (NIC) reporting 13 consecutive quarters of occupancy growth through late 2024. Operators can expect financial improvements if this trend continues, as higher occupancy helps cover fixed costs.

Regulatory and Legal Pressures

Regulatory compliance remains a major challenge for senior living operators. New federal staffing mandates for nursing homes, increased documentation requirements, and evolving infection control regulations all add to the administrative burden. While these policies aim to improve care quality, they also raise costs and require careful navigation.

Opportunities on the Horizon

Despite these challenges, senior living providers are bound for growth with exciting opportunities on the horizon, including:

- There is rising demand for senior living due to the aging baby boomer population. By 2030, over 20% of Americans will be 65 or older, and by 2040, the 75-and-older segment, which is most closely linked to senior housing demand, will skyrocket.

- Another major opportunity lies in developing affordable housing options for middle-income older adults. Research indicates that more than half of them will struggle to afford current private-pay senior living rates.

- Technology is also helping providers improve their care quality and efficiency. Some notable innovations include:

- Telemedicine

- AI-driven analytics

- Robotics

- Electronic health records (EHRs)

- Smart home technology

- Providers are expanding their services and care models to create new revenue sources. Some of their strategies include:

- Offering in-home care or adult day programs as alternatives to full-time residency

- Expanding memory care services

- Exploring partnerships with Medicare and Medicaid programs like PACE (Program of All-Inclusive Care for the Elderly) to deliver cost-effective care

- Increasing post-acute care services in assisted living communities

- Many older senior living communities are being redeveloped to meet modern preferences.

Bottomline

The future of senior living is looking strong despite its short-term challenges. As the older population grows, occupancy rates are expected to increase. More investors are also interested in supporting the expansion and modernization efforts of the senior living industry. Although factors like staffing shortages and regulatory hurdles post challenges, senior living providers that embrace innovation and adapt quickly to changing preferences will be well-positioned for success. As senior living continues to evolve, utilizing technology, diversifying service options, and focusing on affordability becomes crucial to meeting the needs of the next generation of older adults.