Brookdale Monterey

Brookdale Monterey is a Memory Care Home in Texas

Brookdale Monterey is a Memory Care Home in Texas

Brookdale Monterey

Brookdale Monterey is a Memory Care Home in Texas

Brookdale Monterey is a Memory Care Home in Texas

Nestled in Lubbock, Texas, Brookdale Monterey is a senior living community that offers exceptional Alzheimer’s and dementia care, drawing on over 25 years of experience in caring for individuals with these conditions. The community provides a stable, comforting environment where residents can thrive, with a focus on the individual needs of each resident and family. Brookdale Monterey is committed to a person-centered approach, building relationships with residents based on trust, loving concern, and a sense of family.

The community offers the Clare Bridge program for mid to late stages of dementia, as well as the Solace program for the advanced stages, providing purposeful programs with compassionate staff. Residents at Brookdale Monterey live life well, with schedules full of dementia-friendly, life-enriching activities, including fitness classes, nature walks, gardening, art workshops, trivia games, music programs, and devotional services. The community’s warm and rewarding dining experience offers dementia-friendly menus with familiar and easy-to-manage selections, small dining rooms with consistent seating, and personal assistance as needed.

Capacity and availability

Smaller home

May offer a more intimate, personalized care environment.

How BBB ratings work

About this community

Additional licensing details

Ownership & operating entity

Brookdale Monterey is legally operated by ESC G.P. II, INC., and administrated by ALMA TORREZ.

Type Of Units

Staffing

Key information about the people who lead and staff this community.

Leadership

Care Services

What does this home offer?

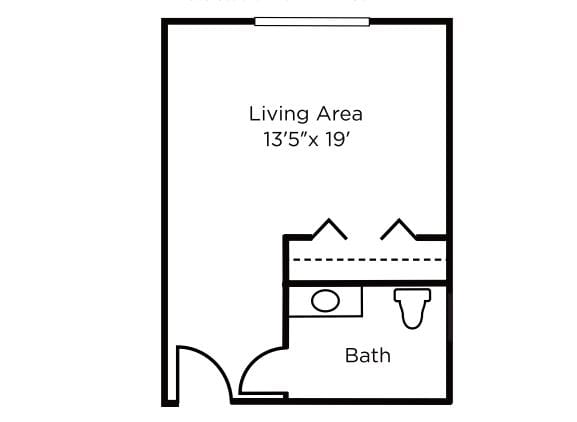

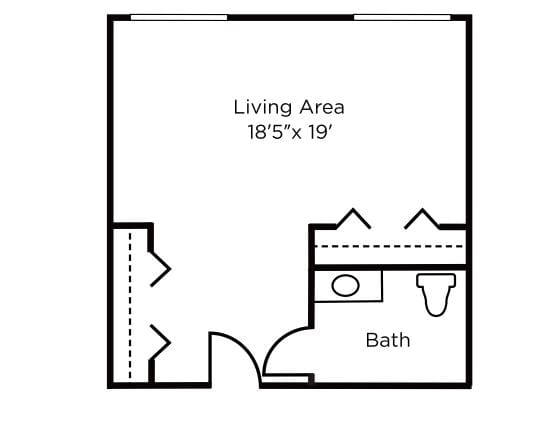

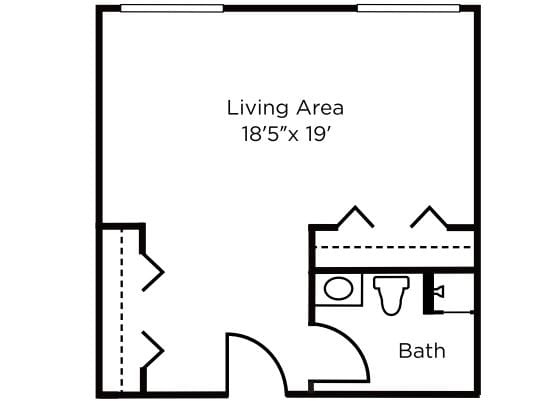

Housing Options: Studio

Building Type: Single-story

Transportation Services

Fitness and Recreation

Types of Care at Brookdale Monterey

Inspection History

In Texas, the Health and Human Services Commission (HHSC) is the primary regulatory body that conducts unannounced inspections and publishes quality reports for all long-term care homes.

0 enforcement actions

Penalties or interventions imposed by state regulators when facilities do not comply with quality, safety or regulatory standards.

Texas average: 1 enforcement action

Places of interest near Brookdale Monterey

3.5 miles from city center — 1.38 miles to nearest hospital (David Lewallen)

5204 Elgin Ave, Lubbock, TX 79413

Calculate Travel Distance to Brookdale Monterey

Add your location

Guides for Better Senior Living

Care Cost Calculator: See Prices in Your Area

Nursing Home Data Explorer

Don’t Wait Too Long: 7 Red Flag Signs Your Parent Needs Assisted Living Now

The True Cost of Assisted Living in 2025 – And How Families Are Paying For It

Understanding Senior Living Costs: Pricing Models, Discounts & Financial Assistance

Financial Aid for Texas Seniors

Get financial aid guidanceContact Us

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

More homes from the same owner

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.