Holiday Simi Hills

Holiday Simi Hills is an Independent Living Home in California

Holiday Simi Hills is an Independent Living Home in California

Holiday Simi Hills

Holiday Simi Hills is an Independent Living Home in California

Holiday Simi Hills is an Independent Living Home in California

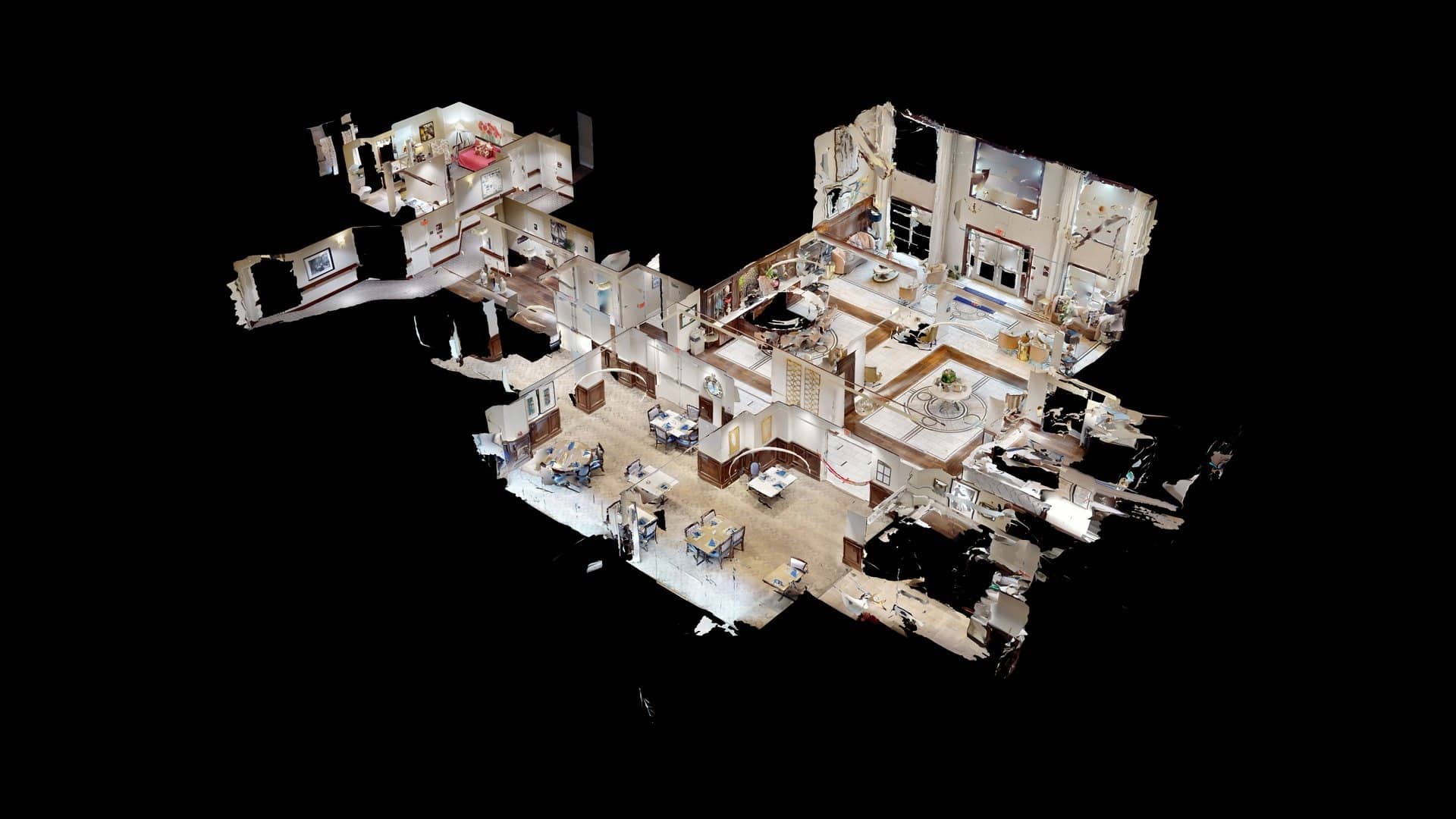

An Atria senior living community, Holiday Simi Hills has built one of the finest independent living homes in Simi Valley– prioritizing its inclusive amenities for the welfare of its residents. Their commitment to ensuring an individual’s independence while being engaged is their utmost priority for a balanced lifestyle, keeping their residents healthy and active. Holiday Hills has provided a diverse and inclusive environment, offering a strong sense of family.

The premier community boasts an elevated lifestyle through the high-quality services provided for seniors with independent living. Their all-inclusive amenities include daily delicious, nutritious meals prepared by a chef, weekly housekeeping and laundry, and everyday fitness activities with their finest gym equipment. They also equip every independent living apartment with an emergency call system.

What does this home offer?

Pets Allowed: Yes, Pets Allowed

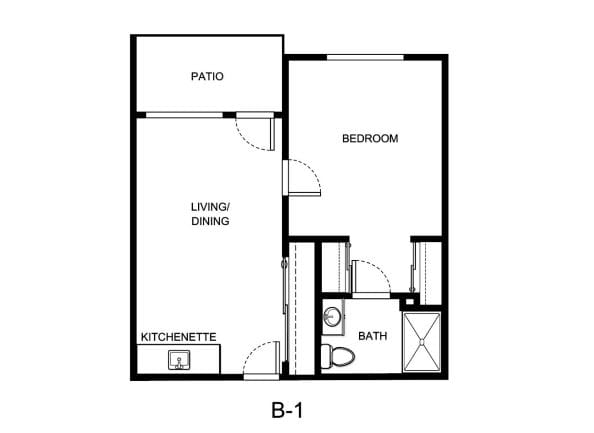

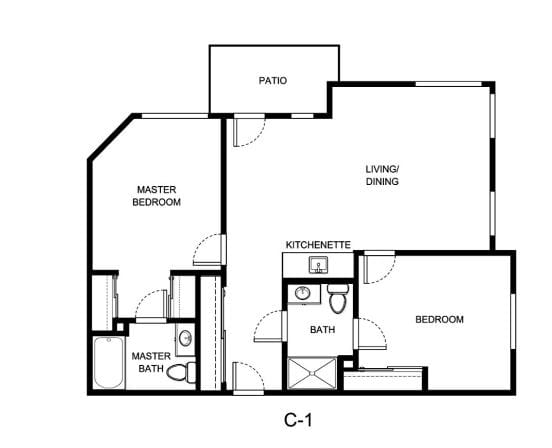

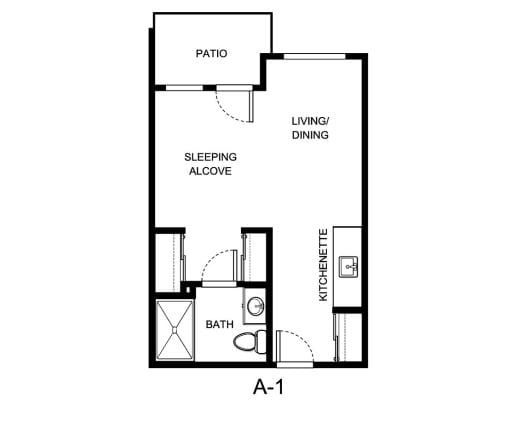

Room Sizes: 370 - 404 / 533 - 725 / 958 - 1,095 sq. ft

Housing Options: Studio / 1 Bed / 2 Bed

Building Type: Two-story

Transportation Services

Fitness and Recreation

Touring Checklist for Senior Living

Touring a community? Use this expert-backed checklist to stay organized, ask the right questions, and find the perfect fit.

Location

Community Spaces and Overall Environment

Services

Staffing

Accommodations

Finances

Other Notes

Send Checklist to Your Email

We'll send you a PDF version of the touring checklist.

Types of Care at Holiday Simi Hills

Type of Rooms Available

Places of interest near Holiday Simi Hills

2.5 miles from city center

950 Sunset Garden Ln, Simi Valley, CA 93065

[email protected]

805-520-3474

Calculate Travel Distance to Holiday Simi Hills

Add your location

Guides for Better Senior Living

From costs to care, explore the most important topics to make informed decisions about your future.

Claim What’s Yours: Financial Aid for California Seniors

- General: Age 65+, California resident, Medi-Cal eligible, nursing home risk.

- Income Limits (2025): ~$2,829/month (300% FBR, individual).

- Asset Limits: $2,000 (individual), $3,000 (couple).

- CA Specifics: County-managed; waitlists possible.

- Services: In-home support (4-6 hours/day), respite care (14 days/year), meals (~$6/meal), transportation (8 trips/month), care management.

- General: Age 65+, California resident, Medicaid-eligible or low-income.

- Income Limits: ~$1,732/month (individual, Medi-Cal threshold).

- Asset Limits: $2,000 (individual).

- CA Specifics: Can hire family as caregivers.

- Services: Personal care (up to 283 hours/month), homemaker services, respite (varies).

- General: Age 65+, California resident, Medi-Cal-eligible, nursing home-eligible but community-capable.

- Income Limits: ~$2,829/month (300% FBR, individual).

- Asset Limits: $2,000 (individual).

- CA Specifics: Available in 38 counties; waitlists common.

- Services: Case management, respite care (up to 10 days/year), minor home mods (avg. $500), adult day care (~$50/day).

- General: Age 62+, California resident, own and live in home, 40% equity.

- Income Limits (2025): ~$51,500/year (household, adjusted annually).

- Asset Limits: Equity-based; no strict asset cap.

- CA Specifics: Deferred taxes accrue interest (5% as of 2024); repaid upon sale/death.

- Services: Property tax deferral (avg. $1,000-$3,000/year, varies by county).

- General: Age 65+ or disabled, California resident, Medi-Cal-eligible, nursing home-eligible.

- Income Limits: ~$2,829/month (300% FBR, individual).

- Asset Limits: $2,000 (individual).

- CA Specifics: Available in 15 counties (e.g., LA, Sacramento); waitlists common.

- Services: Personal care in ALFs (5-7 hours/day), medication management, social services.

- General: Caregivers of California residents 60+ needing help with 3+ daily activities; no caregiver age limit.

- Income Limits: No strict limit; cost-sharing above ~$2,500/month threshold.

- Asset Limits: Not applicable; need-based.

- CA Specifics: High demand in urban areas; complements IHSS respite.

- Services: Respite care (up to 10 days/year), counseling (4-6 sessions/year), training (2-3 workshops/year), supplies (~$200/year).

- General: Age 60+ priority, California resident, low-income, utility/heating need.

- Income Limits (2025): ~$2,510/month (200% of poverty level, individual).

- Asset Limits: Not applicable; income-focused.

- CA Specifics: High demand in inland/coastal extremes; weatherization capped at $5,000/home.

- Services: Utility payments (avg. $500-$1,000/year), weatherization (e.g., insulation, avg. $1,000-$3,000 savings).

Contact Us

What questions do you have about Holiday Simi Hills?

We’ll help you with pricing, availability, and anything else you need.

Your Senior Care Partner, Every Step of the Way

We help families find affordable senior communities and unlock same day discounts, Medicaid, and Medicare options tailored to your needs.

Contact us Today

Homes near Simi Valley, CA